2017: A Turning Point?

- Throughout 2016, major uncertainties persisted and numerous disruptive events occurred, such as the Brexit vote in the United Kingdom and Donald Trump’s election as U.S. President. The year should therefore wind up with fairly subdued economic growth in most parts of the world.

- 2017 will also have its share of uncertainty, from elections in several European countries, the process for the U.K.’s withdrawal from the European Union, and the implementation of Donald Trump's election platform. However, economic conditions should improve over the course of the year, particularly in the United States and Canada, and in most of the provinces.

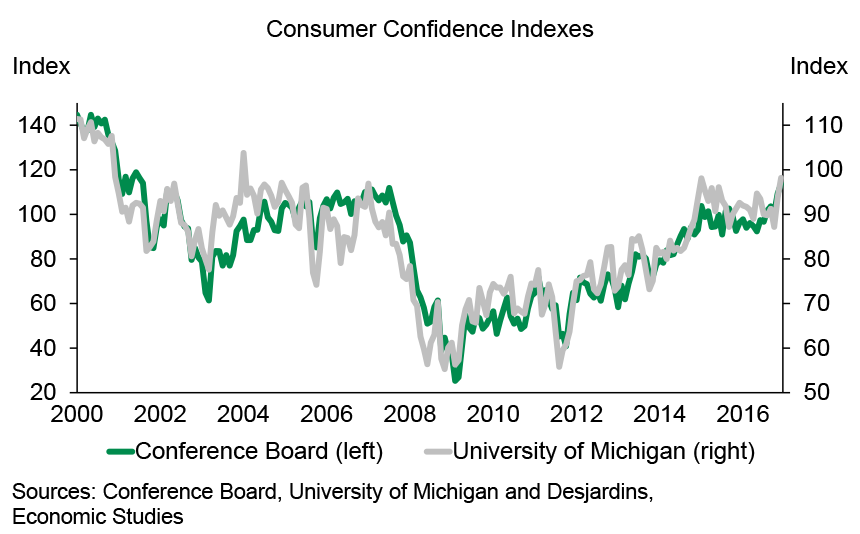

- In the United States, Donald Trump’s win does not seem to have hampered the upswing in U.S. confidence. On the contrary, the policies that the incoming administration will apparently implement should trigger faster economic growth in 2017, although the increase in interest rates and the greenback’s appreciation should limit the rebound. Further, the introduction of policies that are not so good for the economy, such as stronger protectionism, could curb real GDP growth in 2018.

- In Canada, the energy sector's stabilization and benefits of the federal government's stimulus program should pave the way for slightly stronger economic growth in 2017 and 2018. A number of headwinds will continue to hamper Canada’s economy, such as the housing market slowdown expected in several regions and uncertainties over NAFTA’s future.

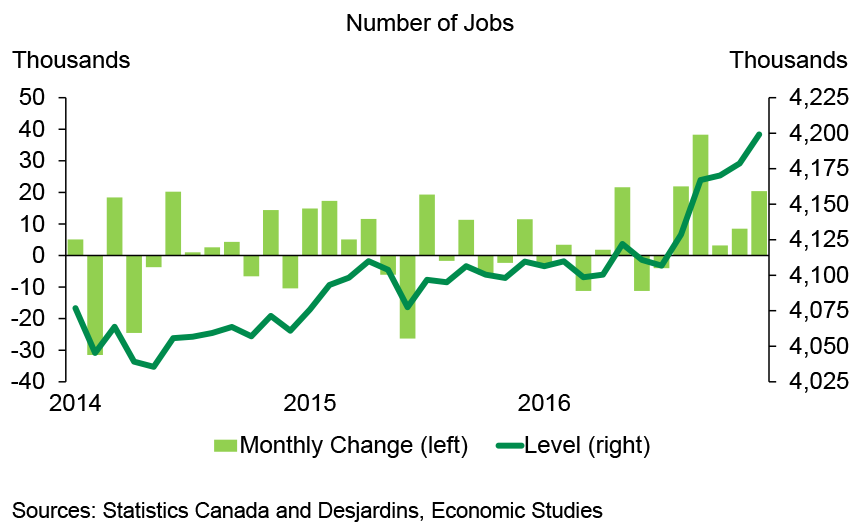

- In Quebec, economic conditions have improved recently with more positive results, particularly in the labour market. Under these conditions, economic growth for 2016 will be somewhat higher than originally forecast. On the other hand, caution is necessary as several hazards continue to impede the Quebec economy, such as an anemic growth of business investment. Therefore, the expected growth for the next few years is not much higher than we predict for 2016.

- In other provinces, the regional disparities seen in recent years could wane in 2017 and 2018. For one thing, Alberta, Saskatchewan and Newfoundland and Labrador will benefit from the energy sector's stabilization. For another, the growth leaders of recent years, Ontario and British Columbia, could be especially hard hit by the housing market’s forecasted slowdown.

- The U.S. Federal Reserve (Fed) should keep raising its key interest rates slowly in the quarters to come, which will open the door for an ongoing bond yield uptrend. In contrast, other central banks will want to maintain highly accommodative monetary policies. The loonie has been particularly robust since the U.S. election. It has gotten a hand from the rise in oil prices, but also from the fact that investors seem to be starting to think that the Bank of Canada could follow the Fed by raising its key rates in 2017. In our opinion, such expectations are premature and we continue to target a status quo for Canadian key rates until the fall of 2018, with the Canadian dollar trending down.

Household sentiment is improving

The labour market has performed well in the last few months