Asia: Challenges and Opportunities

Asia is one of the world's main drivers of economic growth. But with China at its core, doubts are starting to appear about outlook for the years ahead. It seems that many opportunities will continue to present themselves for investors who are interested in this region, provided that the major Asian economies and China in particular, offer decent performance and successfully carry out the reforms that are needed for them to continue developing.

One Continent, But Very Different Economies

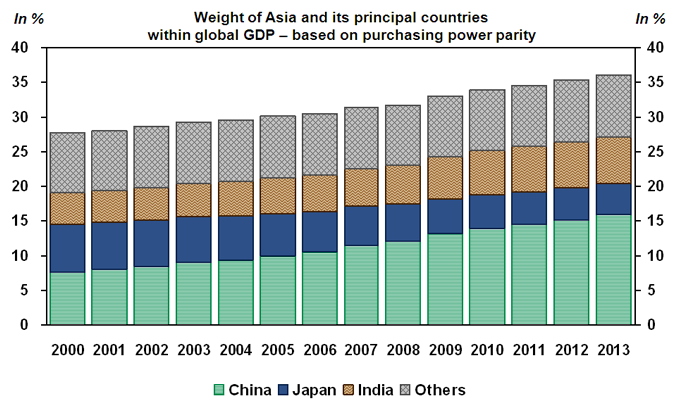

Perhaps to a greater degree than the other continents, Asia exhibits a wide range of very disparate types of economies. Some (like Japan) have been members of the advanced countries club for quite some time; others (like South Korea) joined that club more recently. In the centre of the continent, carrying tremendous weight, we find China, which exhibits some aspects of a modern economy and others of a developing economy. Finally, surrounding these larger economies, are countries with varying levels of development, like Vietnam, Thailand, Singapore and the Philippines. The growth achieved by the Asian economies (especially China) over the past 15 years means that they are carrying more and more weight within the global economy (based on purchasing power parity), from 27.7% at the beginning of the 2000s to 36.1% in 2013.

Potential for Economic Growth

Economic growth has generally slowed in Asia in recent quarters, but what about outlooks for the medium term? To get an idea, we would normally look at the change in potential GDP in the region's main countries. For China, the OECD is calling for a potential of 7.0% in 2016, versus 10.2% between 2000 and 2009. Even though they are not a precise measurement of real GDP growth potential, the IMF's medium-term forecasts offer a second opinion. In the case of China, the IMF is predicting average growth of 6.2% from next year to 2020. It is therefore clear that the Chinese economy will remain relatively slack compared with what we have been used to.

Sources: World Bank and Desjardins, Economic Studies

Sources: World Bank and Desjardins, Economic Studies

For India, the potential estimated by the OECD for 2016 is 7.1%. The medium-term forecasts are higher, though: 7.6% on average for the next five years. The Indian economy should benefit from two things: rapid population growth, and greater productivity through a new wave of investment and the liberalization of its economy.

Japan has had demographic issues for quite some time now, and these are likely to intensify in the years to come. This is reflected in an anaemic growth potential of 0.6% for 2016; the growth predicted by the IMF for the medium term is not much better at 0.7%. Fortunately, good labour productivity and strong competitiveness come to the rescue of this economy. The IMF is predicting medium-term growth of 3.5% in South Korea, a little higher than what has been recorded lately.

A Stock Market Undermined by Chinese Immaturity

Stock markets have been particularly volatile in Asia during the past year. This situation is mainly due to the Chinese market which, in the space of one year, managed to inflate a stock market bubble and then burst it. Even though the Chinese stock market is relatively modest in terms of capitalization (especially compared to the Japanese market, which is nearly 2.5 times larger), its abrupt movements shook all the markets of the world – including those in Asia, of course.

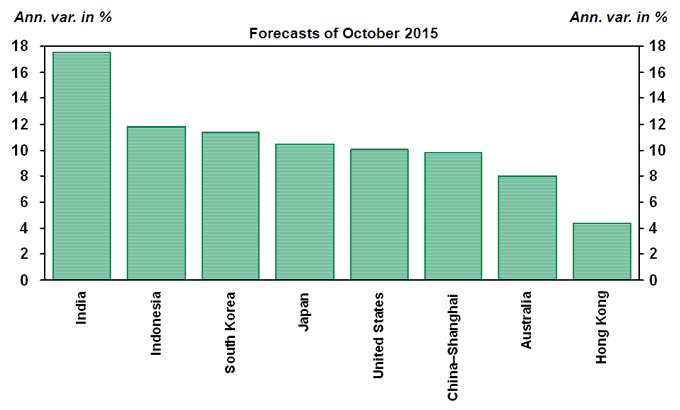

What happens next in the Asian market in general will depend to a large extent on the economic situation and on how well businesses perform. According to analysts surveyed by the I/B/E/S (Institutional Brokers' Estimate System) firm, the long-term average annual growth in earnings per share will be quite similar in the Asia-Pacific region (+9.9%) and in the United States (10.0%) and slightly less in Europe (11.6%). But the growth rates will be a bit higher in South Korea (11.4%), Japan (10.5%) and especially India (17.5%). But we do note a downward trend in forecasts of earnings per share in China. A long-term average annual gain of 15.8% was forecast in the spring, at the peak of the bubble; that growth rate has since dropped to less than 10% (one of the lowest recorded since 2004). Like the other stock markets of the world, the Asian markets could keep benefiting from very low interest rates.

Sources: Datastream, I/B/E/S and Desjardins, Economic Studies

Sources: Datastream, I/B/E/S and Desjardins, Economic Studies

Managing a Successful Turnaround

Its weight in the global economy and the outlooks that are offered by the ongoing development of emerging countries, in particular China and India, make Asia unavoidable. But Asia's success will depend on whether the reforms that are necessary in many countries go smoothly. China has already rolled up its sleeves. In the short term, reforms are likely to contribute to the slowdown of real GDP growth, but the emergence of a more robust domestic demand and more mature financial markets that are prerequisites for healthier and more sustained long-term growth. Success would inevitably lead to an improvement in return outlooks. In India, the reforms are still in their early stages and enormous challenges lie ahead, but the growth there is already more encouraging. Even in Japan, efforts must continue and growth must be supported by more solid solutions than a weak yen and an expansionist monetary policy.

For the region as a whole, the future establishment of the Trans-Pacific Partnership is a very positive prospect and offers attractive opportunities. Further liberalization of trade could give a new impetus to a globalization trend that seems to be stagnating. In order for Asian economies to make a real contribution to the global economy and provide a worthwhile return to investors, the entire region will have to keep advancing in terms of productivity and competitiveness, while continuing to develop its domestic market.

For more information, please see the full document NOTE - This link will open in a new tab..