Economic and Financial Outlook

Growth Remains Widespread… but Watch Out for Risk of Protectionism

Global real GDP growth was fairly strong in 2017. The advance, at an estimated 3.6%, is faster than 2016's 3.1% increase. The global economy will remain strong in 2018, but the 0.5 percentage point jump from 2016's real GDP growth to 2017's will probably not be repeated this year. We are forecasting a more modest 0.2-point gain. What's more, the potential for a trade war increased following the initial shots fired by the Trump administration. Clearly, a widespread upswing in protectionism would hurt the global economy.

Our outlooks for European real GDP growth is 2.4% for 2018 and 2.1% for 2019, rates higher than the European Commission's estimate for potential GDP of 1.5%. Since the referendum on Brexit, the United Kingdom has been swimming upstream and is not getting as much out of the improved global economy as the other advanced economies. The political confusion over Brexit persists; it still is not clear what type of agreement will bind the United Kingdom and European Union after the divorce.

China's real GDP growth went from 6.7% in 2016 to 6.9% in 2017, the first improvement since 2010. As in 2017, the Chinese government is setting a growth target of 6.5% for 2018. However, there is less chance of seeing its performance exceed the target, as the government seems less ready to stimulate the economy. Moreover, the threat of U.S. protectionism looms over China's economy, one of President Donald Trump's favourite targets.

With growth of 2.3% for 2017 as a whole, U.S. real GDP improved substantially from the mere 1.5% recorded in 2016. Some data were disappointing at the start of 2018. Retail sales were down in each of the first two months of the year and real consumption fell 0.2% in January and stagnated in February, which is especially surprising as the economy could have responded to the tax cut stimulus. Nonetheless, we expect the positive effects of tax cuts to have more of an impact this spring. Moreover, tax reform, which includes dropping the tax rate from 35% to 21% and the opportunity to amortize new equipment investment automatically, has the potential to accelerate business investment. In addition to the potential impacts of tax reform, the economy could also get stimulus from the increase in federal government spending. How an economy that is already strong will deal with this much stimulus remains to be seen. Real GDP is expected to grow 2.8% this year, with 2.5% growth forecast for 2019. The job market should continue improving, while inflation should rise faster.

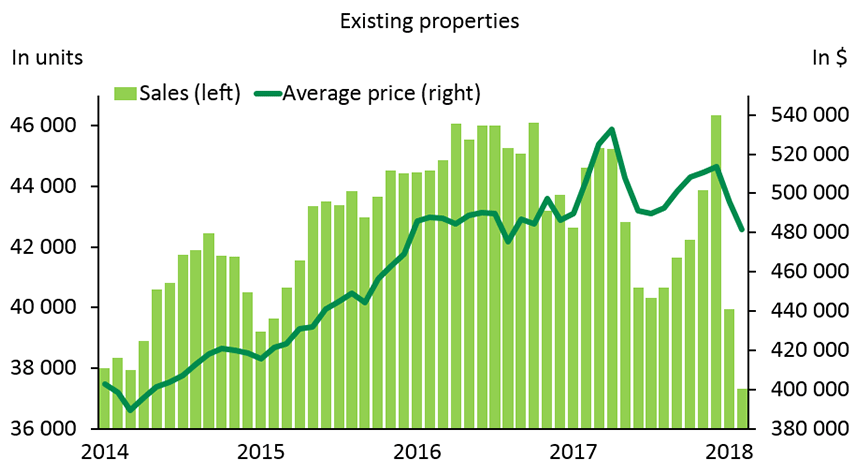

Canada's real GDP increased an annualized 1.7% in the fourth quarter of 2017, similar to the 1.5% gain recorded the previous quarter. Once again, the growth is largely based on robust domestic demand. Consumption spending by households continued to climb; moreover, investment spiked over the quarter. For a fourth consecutive quarter, however, real GDP growth was curbed last fall by a negative contribution from the trade balance. In general, the outlook for domestic demand growth remains fairly good for the quarters to come. As for the housing market however, the latest results confirm that new restrictions have had a major negative impact on existing home prices and sales since the start of 2018. After the 3.0% expansion in 2017, Canada's economy should slow to a more sustainable pace in 2018 and 2019, which should see growth of 2.1% and 1.9% respectively. Obviously, the uncertainty about the future of the North American Free Trade Agreement (NAFTA) and surge in U.S. protectionism persist.

Since the end of January, volatility has returned to the financial markets as investors are concerned about the potential for a steeper rise in bond yields, and by the U.S. government's protectionist intentions. Despite the concerns, favourable economic outlooks and slightly stronger inflationary pressure suggest that interest rates will keep rising gradually. Regarding US monetary policy, our scenario is similar to the Federal Reserve forecast in March and expects two more key interest rate increases in 2018 and three more in 2019. Key rates are also expected to rise gradually in Canada, but some signs of slowing in the housing market and household debt, and the heightened risks associated with U.S. protectionism could convince the Bank of Canada (BoC) to wait until the summer before tightening its monetary policy further. The BoC's slightly more cautious tone and fears of protectionism recently took the Canadian dollar to around US$0.77. These factors should curb the loonie's appreciation in the coming quarters, despite the fairly good outlook for commodity prices.

Sources: Canadian Real Estate Association and Desjardins, Economic Studies

Sources: Canadian Real Estate Association and Desjardins, Economic Studies