Economic Prospects Are Very Good for 2018

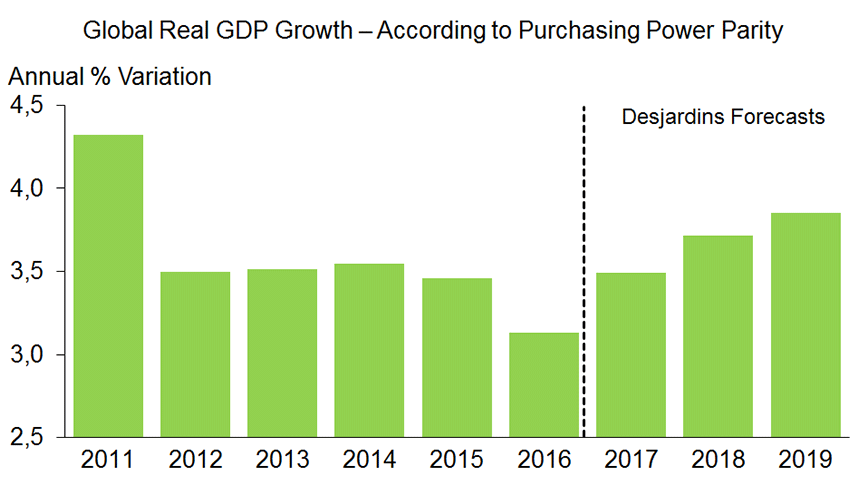

The economic situation has been improving almost everywhere in the past year, and more and more countries are contributing to global real GDP growth. The euro zone economy even seems to be on a fast track: the 2.4% growth forecast for 2017 will be the best since 2007 and it should attain 2.2% in 2018. Growth is slower in the United Kingdom, due to the palpable uncertainty surrounding Brexit. The most recent figures from Japan show progress, and the country's real GDP forecasts have been revised upward. Among emerging countries, growth is returning to Russia and Brazil, while the Chinese and Indian economies remain strong. After reaching about 3.5 % in 2017, global real GDP should accelerate to 3.7% in 2018.

The U.S. economy is continuing to perform very well. Real GDP growth surpassed 3% again last summer, in spite of hurricanes. Job creation remains strong while household and business confidence indexes remain high. The tax reform adopted in Washington at the end of 2017 should also support the US economy in the coming quarters. The outlook for 2018 thus looks very good and annual real GDP growth is expected to reach about 2.7% after achieving 2.3% in 2017.

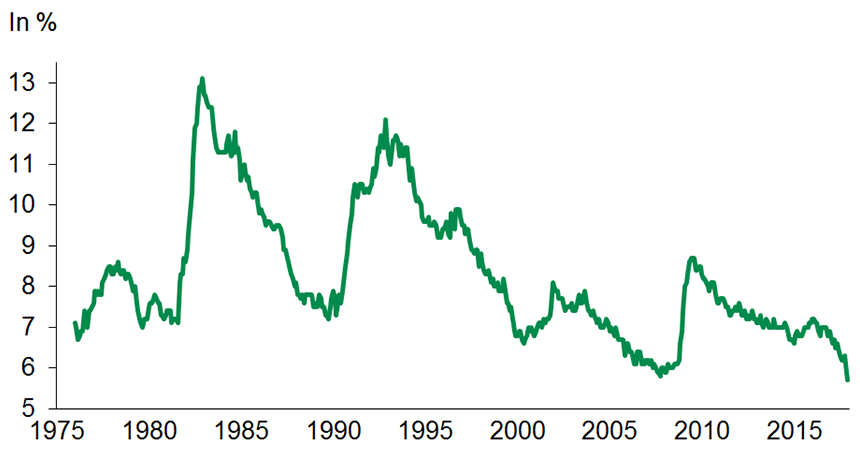

After an exceptional start to the year, the Canadian economy settled down to a more sustainable pace in Q3 of 2017 with growth falling to 1.7%. While weaker, this result is still higher than the Canadian economy's growth potential, which the Bank of Canada puts at about 1.3% for 2017. As the unemployment rate fell to a historic low of 5.7% in December, the labor market's remarkable performance confirms that excess capacity in the Canadian economy has declined significantly. Real GDP growth should remain around 2% in the coming quarters due to robust domestic demand and an upturn in international trade. Disparities among provinces should narrow in 2018. The recent growth leaders, Ontario and British Columbia, could be particularly hard hit by the expected slowdown in the housing market.

Quebec's economy is also growing nicely. Real GDP growth should be over 2.5% in 2017, the best result in 15 years. This surge is due to the very favorable environment for households which benefit from, among other things, wage acceleration and tax breaks. A probable slowdown in the residential sector and uncertainty about foreign trade dampen the outlook a bit, however. The economy's pace should thus slow a bit in 2018.

2017 has been very favourable for investors, with stock markets recording significant gains without unduly affecting the bond market. Economic outlooks are still encouraging for stock markets, but a clearer upswing in interest rates could limit the returns of major asset classes in 2018. As excess production capacity will continue to shrink in developed countries and the temporary factors limiting inflation should fade away, central banks will continue to gradually normalize their monetary policies. In the United States, the Federal Reserve hiked its key rates again in December, and its leaders are still signaling that a total increase of 0.75% will likely be appropriate next year. The Bank of Canada remains more circumspect in terms of its intentions, but it is expected that it will also continue to hike its key interest rates, as the two rate increases of last summer do not seem to have had a significant restrictive effect on Canadian household confidence and spending. The Canadian dollar might benefit slightly from the increase in commodity prices, but the outcome of negotiations on the North American Free Trade Agreement (NAFTA) could spark a strong reaction on Canadian financial markets.