India: Between Rapid Growth and Major Challenges

India is on track to become the fastest growing economy in the years to come. In six years, it should also dethrone China as the most populous country. Its role in the global and Canadian economy is not to be neglected. This country seems to offer good investment opportunities in the short and medium term, but some factors remain to be monitored to ensure long-term sustainable growth.

Abrupt but Long Awaited Reforms

The arrival of the Narendra Modi government in May 2014 changed India's political and economic path. Among its modernization efforts are the implementation of two major reforms: demonetization, which replaced 86% of the notes in circulation, and the new goods and services tax. These reforms were aimed mainly at reducing corruption and the weight of the informal sector, which accounts for more than 80% of jobs, as well as increasing the tax base. Although the economy has been temporarily affected, these reforms could improve competitiveness, productivity and the climate in the business world. In fact, India's ease of doing business index has risen from 130 in 2017 to 100 in 2018 (1 representing perfect facility), which is above the South Asian average, but remains 22 points behind China1.

Rapid Growth is Expected ... and Necessary!

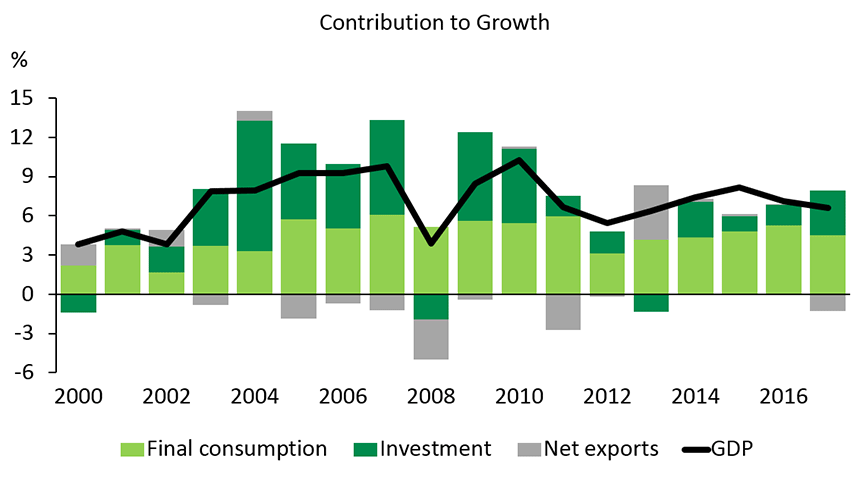

Industrial production in India has grown at an annual rate of about 6.3% in the first quarter of 2018, and consumption is still strong, which is the largest contributor to economic growth (Chart 1). The services sector accounted for 56% of GDP in 2017, making it the largest sector of the Indian economy. Private investment, however, experienced some difficulties as the balance sheets of public banks were weighed down by nonperforming loans, which accounted for 10.9% of gross loans in the first quarter of 2018, compared to 5.9% in 2015. According to the International Monetary Fund (IMF), real GDP growth was still 6.7% in 2017, one of the strongest in the world. The IMF forecasts an average growth of 7.9% by 2023, which would exceed that of China, which stands at 6.1%. Higher oil prices, however, drove up inflation, prompting the Reserve Bank of India (RBI) to tighten monetary policy. As it relies heavily on imports of raw materials, especially for industrial production and energy, the Indian economy is more vulnerable to a surge in prices. Despite this strong growth, poverty in India remains a problem. GDP per capita adjusted to the purchasing power parity (PPP) exchange rate is just over $7,100, while those of China and the United States are about $16,600 and $59,400 respectively. Moreover, this poverty varies greatly from one region to another. The poorest state, Bihar, has a GDP per capita nine times smaller than that of Delhi.

A Growing Population That Needs to be Educated

India had more than 1.34 billion people in 2017, making it the second largest population after China, which it is expected to surpass by 2024, according to the United Nations (UN). As Indians get richer, this market offers enormous growth potential and therefore becomes attractive for businesses, both in terms of consumption and labor supply. However, the low rate of graduate students is holding back this potential. Thus, according to the latest data published in 2016, the participation rate in secondary and post-secondary education was only 75% and 27% respectively, placing India last among the constituents of BRICS (Brazil, Russia, India, China, South Africa) in terms of education.

Protectionism Still Exists

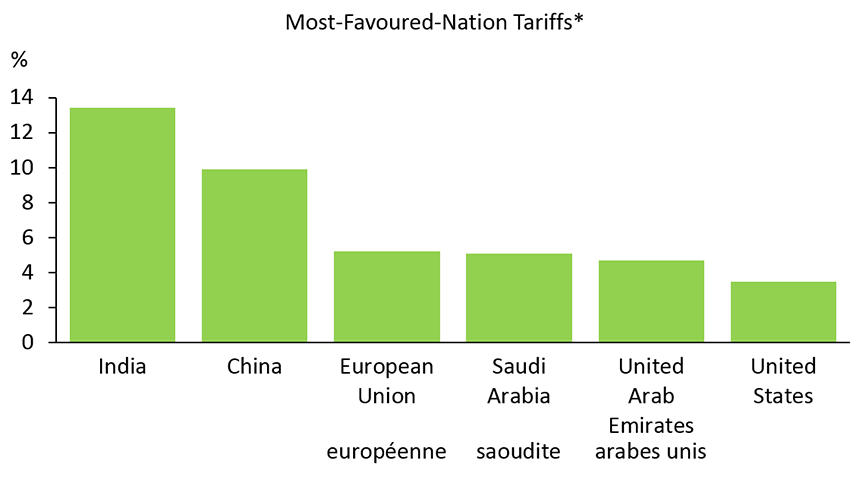

In total, trade accounted for 41% of India's GDP in 2017. Yet the country remains relatively closed. Tariffs applied under the World Trade Organization (WTO) averaged 13.4% (Chart 2) and no free trade agreement has yet been concluded between India and its main trading partners. The recent tariff increases enacted by the Indian government would even indicate a possible protectionist pullback. Fears of an international trade war have recently pushed Indian bond yields up and the Indian rupee to depreciate.

Stock Market in India Performs Well, but Less Than in Asia

After a few years of stability, the MSCI index of the Indian Stock Exchange has skyrocketed throughout 2017, gaining 30% for the year. This performance, however, remains below that of the continent in general. The price-earnings ratio has continued to rise and has exceeded 24, which is much higher than in China or Japan. Capital gains tax returns could penalize the market because many Indians had diverted their savings from real estate and gold into the stock markets.

An Encouraging Future, but Full of Challenges

The good global economic outlook and favorable economic conditions in India suggest that growth will remain strong over the next few years and should outpace other major economies. However, the country will face several persistent challenges if it is to maintain sustained growth in the longer term. Significant infrastructure gaps remain across the country, severely limiting economic growth and its potential. These include poor access to basic health services, a deficient electricity grid, an outdated and insufficient rail system, and a lack of highways and roads in good condition. Other issues also pose a potential risk for long-term economic growth in India. Several major social problems persist, conflicts with Pakistan and China are still unresolved and environmental risks are also to be considered. All of these elements create instability in the Indian economy and could hinder its development.

Sources: World Bank, International Monetary Fund and Desjardins, Economic Studies

Sources: World Bank, International Monetary Fund and Desjardins, Economic Studies Sources: World Trade Organization and Desjardins, Economic Studies

Sources: World Trade Organization and Desjardins, Economic Studies

* Latest available data for each country.

Notes

- The World Bank Group. Doing Business 2018: Reforming to Create Jobs, 15th edition, October 31, 2018, 312 p.