Investors may come out all right in the end

The third quarter of 2015 was particularly difficult for investors. A surge in concern about emerging economies, triggered by a correction of the Chinese stock market and a devaluation of the yuan, among other things, led to another substantial slump in commodity prices and a generalized correction of stock market indexes at the end of the summer.

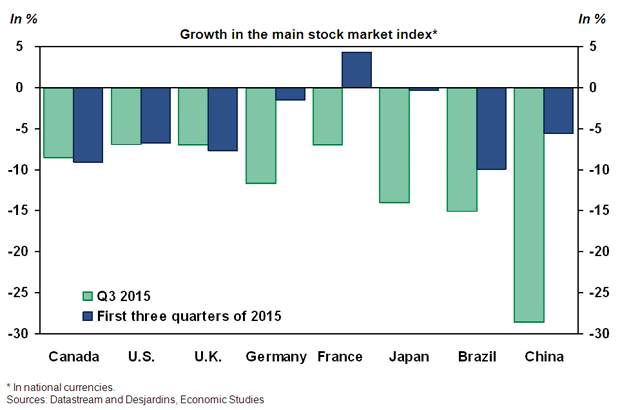

After holding fairly steady during the first half of 2015, the S&P 500 fell by 6.9% in the third quarter, its worst performance since the summer of 2011. Meanwhile, the S&P/TSX did worse, getting hard hit by the pullback in commodity prices; it lost 8.6%. The slumps in the European and Japanese stock markets were also dramatic, as were those in the emerging countries, which were the main focus of investors’ concerns. In particular, we note a slide of nearly 30% in the Chinese market (chart 1). These stock market difficulties have not been compensated by other asset classes as, for example, the FTSE TMX Canadian bond index was at a standstill in the third quarter.

The Canadian dollar saves the day

At first glance, the situation in the financial markets at the end of the first three quarters of 2015 was enough to give investors the blues. The vast majority of markets were posting a slump for which the modest gains of the bond market could not compensate. Does this mean that Canadian investors can expect to wind down 2015 with a loss to their investment portfolios?

Fortunately, a few factors could boost returns. First of all, investors who hold foreign investments are likely to have recorded significant gains during the past few quarters thanks to the sharp drop in the Canadian dollar. For example, an Apple share ended the third quarter of 2015 at US$110.30, quite close to where it stood at the end of 2014. The value of that same share in Canadian dollars rose from C$128 to C$147, a gain of nearly 15%. We should point out, though, that investors who chose investment funds or exchange-traded funds (ETFs) that are hedged against exchange rate fluctuations (a prudent option that is entirely appropriate for many investors) will not benefit from the sharp drop in the Canadian dollar.

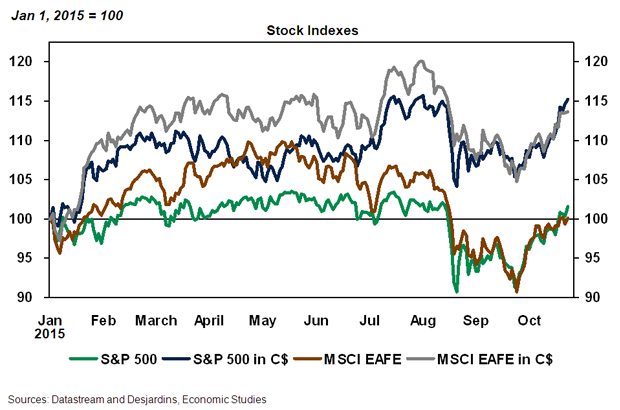

The performances of the S&P 500 and of the MSCI EAFE index (which reflects the performance of developed stock markets outside North America) are thus much more favourable when expressed in Canadian dollars (chart 2). This sizable return on assets denominated in US dollars should save the day for many Canadian investors this year. Thus, we calculate that a very simple Canadian portfolio (15% U.S. stocks, 25% Canadian stocks, 45% Canadian bonds and 5% Treasury bills) recorded a return of 0.7% over the first three quarters of 2015, despite the 7% loss on Canadian stocks. Without the currency effect, this portfolio would have dropped by 2%. A more aggressive portfolio consisting of 20% Canadian stocks, 20% U.S. stocks, 20% of the MSCI EAFE, 35% Canadian bonds and 5% Treasury bills would have posted growth of 3% at the end of the first three quarters of 2015, compare with a drop of 2.5% without the currency effect.

A year-end rally on the horizon?

Investors may also see the return of their portfolios boosted by a good fourth quarter. The markets have already performed much better in the early weeks of October. The S&P 500 recently moved back into positive territory for the year, and many European markets are once again showing over 10% growth compared with the beginning of 2015. Even the Canadian market has wiped out a considerable portion of its losses, despite commodity prices still being weak.

Of course, the performance seen in the early weeks of October offers no guarantee for the fourth quarter as a whole. A resurgence of worry in the markets could easily trigger another correction. But apart from this volatility, which is inherent to stock markets, some recent developments allow us to be fairly optimistic.

The sharp downturn in the markets during the third quarter mainly reflected two factors: fears of a collapse in emerging countries (especially China) and concerns about the beginning of monetary firming in the United States. The economies of many emerging countries (Russia and Brazil in particular) are still struggling, but the latest data from China is not consistent with the worst-case scenarios. For instance, Chinese GDP posted an annual growth of 6.9% in the third quarter. The new easing of Chinese monetary policy that was announced in October also indicates that authorities remain vigilant.

By choosing the status quo in September, and justifying that decision by pointing to international and financial turbulence, the Federal Reserve (Fed) also sent a reassuring message to investors. Some Fed leaders are keeping the door open to a key interest rate hike in December, but a growing number of members seem to want to wait for more signs of a pick-up in inflation before taking action. Given that some U.S. economic statistics (job creation in particular) have been flagging recently, we are now forecasting that the Fed will wait until March 2016 before initiating monetary firming. Furthermore, the European Central Bank has clearly indicated that it could soon announce new stimulus measures. Far from hindering market growth, it now appears that monetary policies will provide major support for stock indexes between now and the end of the year.

Beyond immediate monetary policy decisions, the recent reaction by the central banks confirms that they will be very reluctant to do anything that could be detrimental to economic growth. We must therefore expect interest rates to remain very low for several quarters, possibly even several years. This state of affairs would justify price/earnings ratios staying relatively high. In light of recent events, our year-end targets of 2,100 for the S&P 500 and 14,200 for the S&P/TSX—targets that seemed optimistic at the end of the third quarter—now look quite appropriate.