Market Resilience Continues to Impress

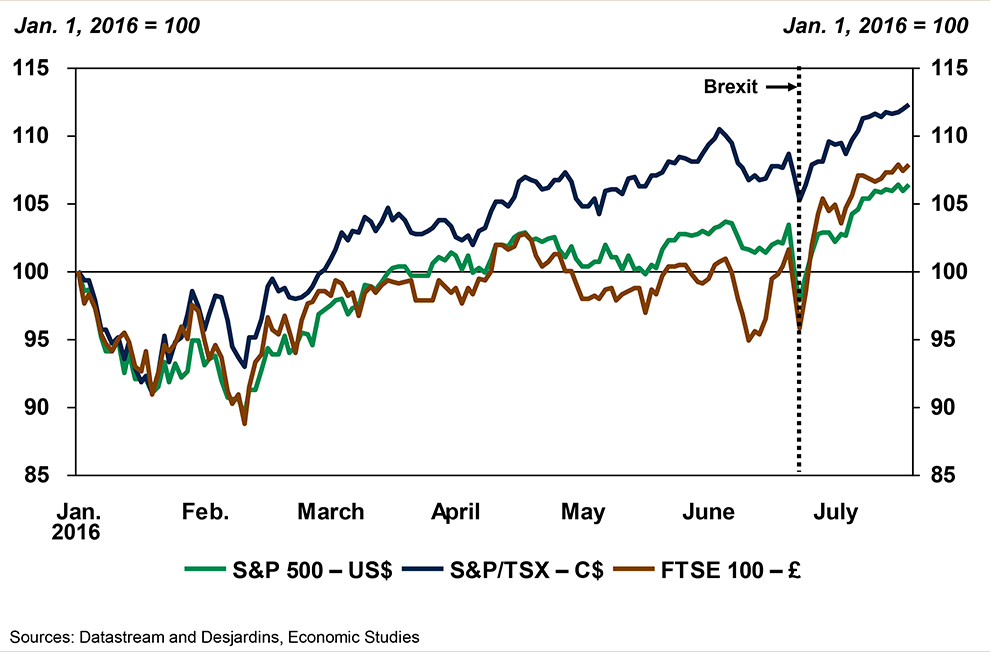

Financial markets had a good second quarter which ended on a bad note when the surprise vote of the British electorate in favor of leaving the European Union (Brexit) resulted in a surge of anxiety. It must be said that after being concerned about this possibility in early June, investors were finally convinced that the British would opt for continuity, which had increased the pound to around $1.49 USD prior to the June 23 referendum. The wakeup call was brutal as the British currency quickly dropped to around $1.30 USD and stock markets around the globe fell sharply.

Though the pound remains very weak, the panic that hit the markets was short-lived, and market indices quickly rebounded in the weeks that followed. The upward trend continued in July despite other stressful events, including increased concern about Italian banks, another attack in France and a coup attempt in Turkey. The S&P500 recently reached a new historic high and even the British stock market rose sharply compared to its level before the referendum. How to explain such a performance?

The fact that the immediate consequences of the Brexit victory seem much less catastrophic than what we had feared has certainly contributed to the positive performance of the markets. Let us remember that the referendum was only consultative and a negotiation period of two years, which should begin by the end of this year, is expected before a final exit from the European Union. The uncertainty resulting from this decision will still have serious consequences on European economies and international financial markets. Signs showing this appeared rapidly in the UK and Europe as some confidence indices declined, credit agencies downgraded British government bonds and some British investment funds experienced significant outflows.

A political crisis would certainly have aggravated the situation, as many had feared an explosion of the British Conservative Party. Finally, this crisis was avoided; Prime Minister David Cameron was quickly replaced by Theresa May, an experienced politician who seems to have succeeded by promising to achieve Brexit while trying to maintain good relations with the rest of Europe. The new government's openness to implementing a fiscal policy with more stimulus and positive first contacts with other European leaders has also helped to reassure investors. In addition, encouraging economic data in the US - where, among other things, job creation has rebounded strongly in June - seemed to confirm that the Brexit did not plunge the global economy into recession.

While the short-term negative impact of Brexit now seems to be fairly limited at the international level, it is much too early to conclude that this is a non-event. Despite the goodwill expressed by European leaders, negotiations between the United Kingdom and the European Union will not be easy, and financial pressures could resurface quickly in case of a deadlock, or if other countries want to leave the European Union. The uncertainty will also certainly limit economic growth in Europe over the coming quarters, particularly in the UK, where the Purchasing Managers' Index ("PMI") fell in July to levels indicating a contraction in activity. Global growth prospects therefore appear slightly lower following the Brexit, and downside risks have increased. In this context, it is expected that monetary policy remains highly accommodative and that further monetary easing may soon be announced in some countries. Major central banks have clearly indicated that they were ready to intervene if the Brexit threatened the stability of the financial system, which certainly contributed significantly to limiting the negative effects of this event on the markets.

This combination of more uncertain economic outlook and highly accommodative monetary policy strongly favored bonds. Despite a rebound in recent weeks, bond yields remain lower than before the Brexit, and there is nothing to indicate a sharp increase in the coming quarters. This extreme weakness in bond rates is certainly one more reason that explains the resilience of equity markets. While a growing proportion of government bonds from developed countries show negative returns and some companies are even beginning to be able to finance at negative rates, it is not surprising that the quest for yield by investors quickly returned to markets once the worst fears dissipate.

Beyond the question of Brexit, market resilience in recent years seems to be explained, in large part, by very accommodative monetary policies and by very low interest rates that result. As there is nothing to indicate an upcoming change in the coming quarters, the risk of a marked and durable market correction appears limited, although it is never zero. This important support for markets by monetary policy may, however, raise some concerns for the future. Among other issues, we can worry about the market reaction should accelerating inflation ever force central banks to normalize their monetary policy faster than currently planned. The impression that central banks will always be there to support the markets could also lead to the formation of financial bubbles, if investors become too careless.