Oil Prices Are Not Expected To Go Much Higher This Year

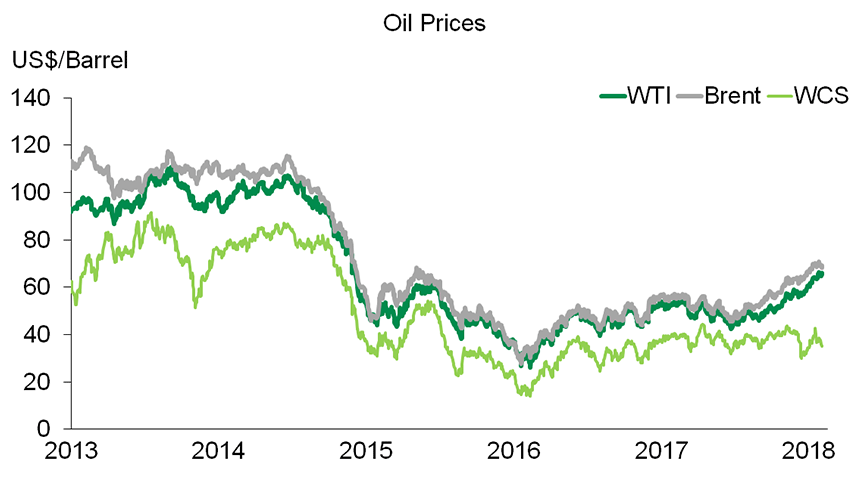

Like stock markets, commodity prices benefited from the improved global economic outlook and investor enthusiasm at the end of 2017 and beginning of 2018. Prices for Brent and West Texas Intermediate (WTI) oil thus jumped over US$70 and US$65 per barrel respectively in the last few weeks, levels we have not seen since 2014. However, the situation is less favourable for Western Canadian oil, as a rise in production combined with limited shipping capability has caused the price of Western Canadian Select (WCS) to be heavily discounted once again in comparison to that of WTI. This phenomenon has contributed to the recent underperformance of the Canadian stock market.

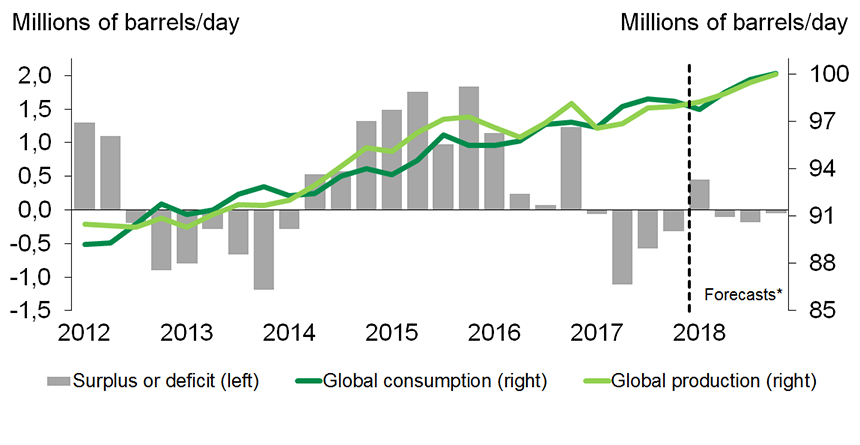

While demand for oil is underpinned by the global economy's acceleration, the recent surge in international oil prices is also based on other factors, including increased tensions in the Middle East and the depreciation of the U.S. dollar. However, the biggest change since the end of 2016 has been the discipline demonstrated by members of the Organization of Petroleum Exporting Countries (OPEC) and other major producers, including Russia. By limiting oil supply, these countries succeeded not only in eliminating the significant surplus on the global oil market, but even in creating a slight deficit throughout 2017. Because of this, global inventories of petroleum products shrunk last year for the first time since 2013. The drop is especially noticeable in the United States, where commercial petroleum stocks decreased by more than 10% over the last 12 months.

At first glance, one might think that the wager made by OPEC and its allies has paid off and that they might soon resume increased production while profiting from higher prices. The rapid decrease in inventories could even hint at the return of major deficits on global oil markets and prices exceeding US$100 a barrel. However, the reality is more complicated, as it appears that U.S. producers are currently the big winners. They began to massively reinvest over the last few quarters, leading to a dramatic increase in oil production in the U.S., which should soon reach a new all-time high. U.S. oil production has already caught up with that of Saudi Arabia, and it may reach that of Russia, the biggest producer in the world, before the end of 2018.

The latest forecasts by the International Energy Agency (IEA) suggest a surge of 1.5 million barrels per day (mbd) in America's crude output in 2018, which, on its own, would exceed the anticipated increase of 1.3 mbd in global demand. Far from growing, the 2017 deficit should thus be replaced by a balanced oil market in 2018. In this environment, if OPEC and Russia were to ease off their efforts, or if another jump in oil prices were to halt the rise in global oil demand, we could enter a new era of surpluses and lower oil prices.

In our opinion, the efforts of several oil-producing countries and the favourable economic outlook justify an increase in the price of WTI oil to about US$60 a barrel. With no risk of a shortage for the next few quarters, especially in an environment where OPEC's unused capacity is a significant cushion, we can however conclude that a price surge beyond this level would not be justified by fundamentals and would probably not be sustainable. Therefore, we are projecting an average price of US$59 a barrel for WTI throughout 2018. Although substantially lower than the peaks recorded prior to 2015, such oil prices point to a favourable situation for U.S. oil producers, which greatly reduced their production costs over the last few years. Commodity prices that are significantly higher than in the last three years are also good news for the Canadian stock market, but the issue of transporting oil will have to be resolved in order to truly benefit from it.

WTI: West Texas Intermediate; WCS: Western Canada Select

Sources: Datastream, Bloomberg and Desjardins, Economic Studies

Notes

- *International Energy Agency (IEA) outlook based on stable production by Organization of the Petroleum Exporting Countries (OPEC).

Sources: IEA and Desjardins, Economic Studies