Protectionism: A brake on economic growth

Following decades of trade globalization, protectionism now seems to be more fashionable, particularly with the arrival of Donald Trump in the White House. Should we be worried about the new trend?

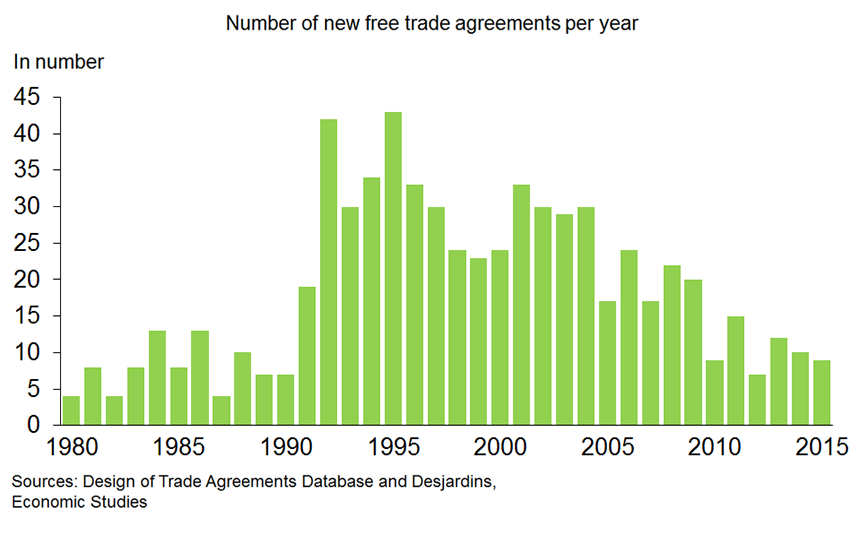

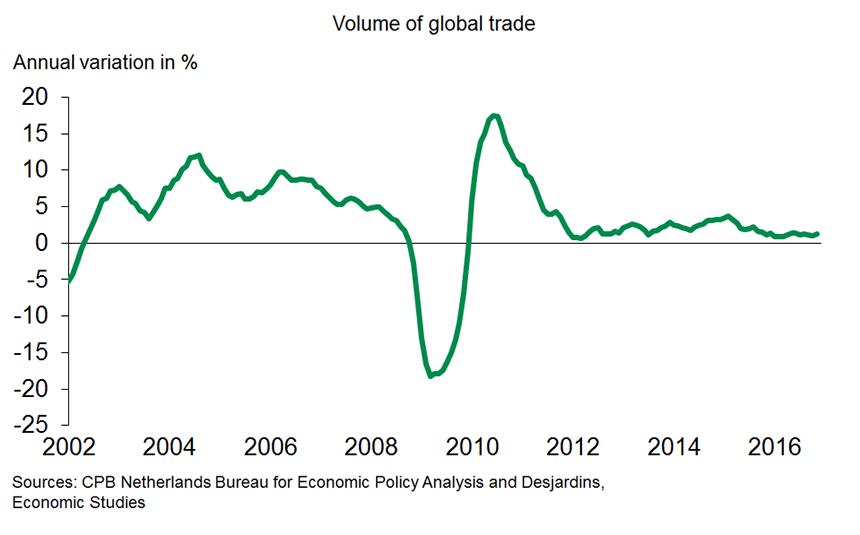

The surge in protectionism began in the aftermath of the financial crisis and is already damaging for growth by global trade. The trade in goods plunged during the crisis, of course, due to a drop in economic activity and tighter financial conditions, especially for export financing products. However, since the recovery, global trade growth has been fairly slow, both a symptom and cause of the international economy’s weak advance. According to OECD estimates, if trade liberalization had maintained its 1990s pace, global trade would have been boosted by 1% to 2% per year.

If the rise in protectionism continues, and particularly if it spreads, it would have a bigger impact on the global economy. According to the OECD, “trade, and the related expansion of global value chains, boosts growth through increased productivity by improving resource allocation, increasing scale and specialisation, encouraging innovation activities, facilitating knowledge transfer, fostering the expansion of more productive firms and the exit of the least productive ones.”

By curbing international trade and, in turn, limiting all of the positive factors global trade offers for growth, including productivity, protectionism has direct negative effects on global economic growth in the near term, and over the long range. According to the OECD’s estimates, one additional U.S. dollar in tariff revenue would trigger a US$2.16 loss in global exports and US$0.73 loss in global income. Better international economic growth would therefore require globalization to keep going rather than stop.

An increase in protectionism also has a direct negative impact on a country’s real GDP growth. According to an IMF estimate, a permanent 10-point increase in U.S. tariffs on imports from all regions would trigger a permanent 1% drop in real GDP. Tariffs and other protectionist measures can impact an economy negatively in several ways. Here are the key ones:

Increase in import costs

Tariffs increase the prices importers pay for equipment and intermediate products. In the short term, even prices for similar goods manufactured domestically should go up, due to a sudden surge in demand. The rise in input prices could trigger a drop in business investment or decline in corporate profits.

Increase in consumer prices

Higher import prices would, in the short term, lead to an increase in consumer prices, either directly or indirectly due to impact on input costs. The price increase would lower households’ real disposable income. We can therefore see an increase in tariffs or restriction on the supply of imported products as a consumption tax paid by the entire population. The impact on inflation also has repercussions for monetary policy, as it reduces the leeway of central banks that are grappling with an artificial price increase. Lastly, we can also be concerned about the effect of protectionist policy on income redistribution.

Reduced economic efficiency

Protectionism has a negative impact on an economy’s productivity by discouraging competition, specialization, innovation and knowledge transfer. The economy is therefore less able to adapt to technological change or cyclical downturns.

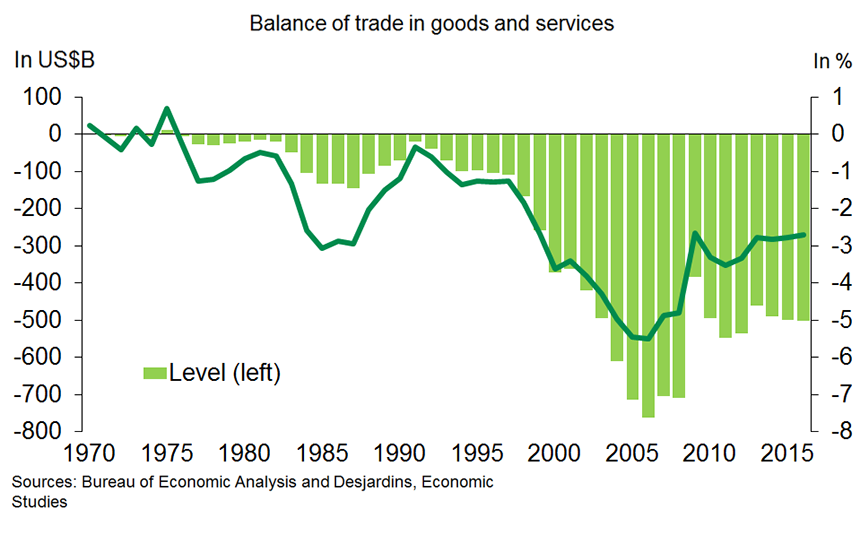

Currency impact

This is probably the most underestimated impact. By cutting real imports, the tariff increase triggers expectation of an improved trade balance. However, to balance this change with a fixed level of foreign investment, the currency will appreciate. The higher exchange rate will play against exports in foreign markets and support imports in the domestic market. In the end, it generally wipes out the initial goal: improving the trade balance.

Reprisals and trade wars

The negative effects listed so far affect the national economy, even without subsequent offences by the countries that are targeted by the new protectionist measures. The risk of payback is great, however. Given that globalization was a fairly widespread source of prosperity, a multilateral trade war can only be harmful to the global economy and would, of course, affect the country that fired the first round. A trade war touched off by the protectionist aims of the U.S. government or another country is currently one of the main risks to the global economy and financial markets.

In most cases, the costs of the protectionist measures described above are often fairly diffuse. The drop in disposable income created by higher prices is shared by a large proportion of the population. The decline in business competitiveness generally becomes evident over the longer term, and has a bigger effect on the economy’s potential than on near-term real GDP growth.

However, the problems caused by globalization or open trade are often more visible. The closing of a company that is unable to adapt, or the decline of an entire sector of industry can easily be represented by economic and social problems in one region, community, or category of workers.

It is therefore important to allow the sectors and communities affected by open markets to adapt. Globalization’s poor reputation and the comeback by protectionism could no doubt have been avoided if the authorities had paid more attention to potential problems and tried to resolve them. It would be good for the global economy to keep developing through more open markets, while supporting those who will inevitably be affected.