Shareholders Pay the Price of SMEs!

Some self-employed professionals were amazed to learn in March and April that the taxes they will have will increase significantly starting in 2017. By how much, exactly?

Quebec Budget

On March 26, the Quebec Minister of Finance tabled a budget in which corporations used by many professionals and self-employed workers to operate their business will see their tax burden increase if they employ fewer than four full-time employees. If you find yourself in this situation, you can not use the small business deduction against your company’s taxes, increasing the tax burden on the business by 3.8%.

In addition, the Minister has not seen fit to increase the dividend tax credit for it to reflect this increase.

Federal Budget

For his part, on April 21, the federal Minister of Finance announced tax cuts for all companies, including those with fewer than four employees. The dividend tax credit will be therefore reduced starting in 2016.

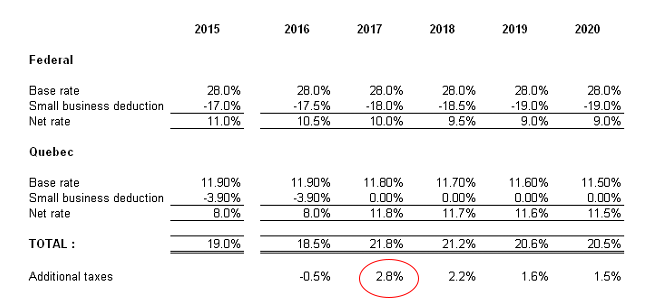

Table of tax rates

For the 2016 and going forward, the tax rates of companies with fewer than four employees are as follows:

We can see that the 2017 is when the shock will be the biggest.

The impact on shareholders

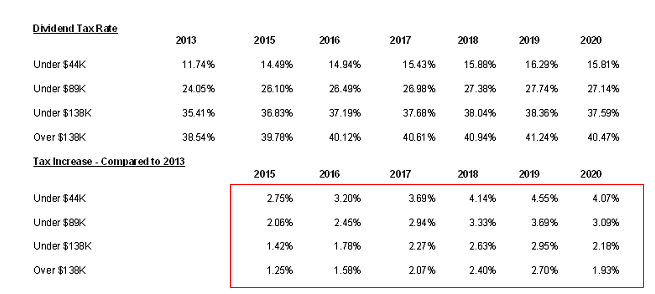

In relative terms, what is the cost of these changes for shareholders? The following table shows that according to income bracket, those who cash in dividends will see their tax burden increase in some cases by more than 4%!

What are the reasons for this increase?

This increase in tax rates is a result of two factors: the reduction of the federal tax credit and poor integration in Quebec.

Dividend Tax Credit

Our tax system promotes integration. Thus, a taxpayer who chooses to carry on business through a company should not be penalized compared to those who opt for a different method. To avoid this injustice, shareholders of a company are entitled to a credit that ideally is equal to the tax paid by the company. The corporate tax is a sort of interim accounting of the taxes shareholders must pay.

The table below shows that over time, the dividend tax credit has fluctuated. The changes made by various budgets have had the effect of reducing the rate.

We can see that the federal credit is now equal to the corporate income tax, which is good news. However, the shareholder has lost the advantage of 2.33% that was granted to him in years prior to 2014.

In Quebec, higher corporate tax rate results in a dividend tax credit which is insufficient. Overall, lower dividends may be paid to the shareholder because the tax burden of the company has increased, which indirectly increases that of the shareholder.

Thus, reduction of the tax credit at the federal level and poor integration in Quebec has the effect of increasing tax rates.

Reduction of Tax Rate

Earlier, I mentioned that corporate tax is a sort of interim accounting of the taxes shareholders must pay. Thus, if the tax paid by the company is lower, the lower fiscal burden will be carried over to the shareholder. As we have seen, this mechanism operates by reducing the tax credit rate for dividends in different years. Given that the federal tax credit will be reduced over the years, the shareholder must then bear a heavier tax burden.

Salary vs Dividend

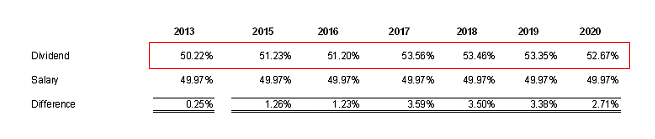

When analyzing the different changes proposed, we see that at the top marginal rates, the tax rate on dividends will be higher than that on a salary.

We realize that the tax rate on the dividend exceeds the psychological threshold of 50% for all years analyzed!

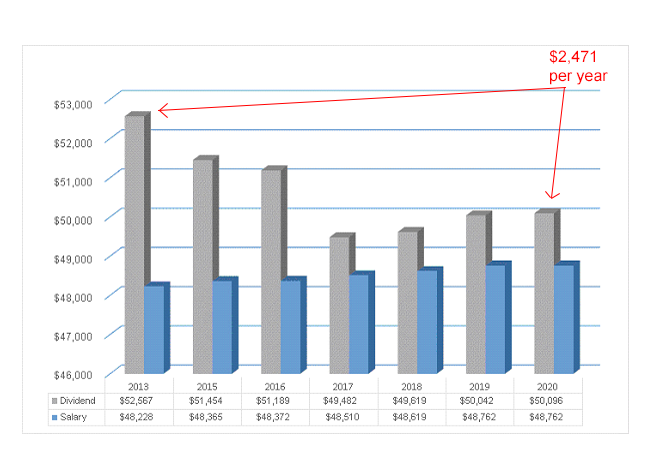

Comparison of a salary of $75,000 and dividends of $75,000

The chart below illustrates the situation of a shareholder of a company that makes $75 000 and shows that tax increases will deprive them of $2,471 annually once the money is all in hand.

Conclusion

Dividends may not be the remuneration of choice for the shareholder of a company with fewer than four employees. A more thorough analysis of their financial and fiscal situation is necessary to make an informed decision about the remuneration paid, because we must take into account many other factors.