"Smart Beta" ETFs

We know that mutual funds are not publicly traded and that their official value is known only at the close of each trading day, when the issuer provides the price (the net asset value). This is true even if the mutual fund replicates a known stock index. Technological innovations of the 1980s made it possible to get continuous stock quotes on screens. (The first home computers were commercialized in the late 1970s with, among others, Commodore's PET with 8 Kb memory and the Apple 16K+, the commercial version of the telephone modem.)

In 1989, New York's American Stock Exchange launched a strange product for its time, called an "Exchange Traded Fund" (ETF). It was a fund that accurately replicated the S&P 500 Index. It was therefore not necessary to have a manager to select securities (hence, no management fees). Moreover, the value of this ETF could be monitored continuously throughout the trading session and, as a revolutionary new feature for a fund, it could be bought and sold repeatedly and at any time during the day.

Altogether, this was a historic innovation in the world of finance.

The product was so strangely new, simple and practical that a US judge classified it as a futures contract so it could no longer trade like a regular stock on an exchange. The judge's ruling drew its logic from the fact that a futures contract that replicated the S&P 500 index had already traded on the Chicago futures exchange – with considerable success – since 1982.

This first ETF was therefore taken off the market. A year later, in March 1990, the Toronto Stock Exchange launched a similar product that was based on the Canadian Index and called it "TIPs35".

In 1993, the legal impasse was finally lifted and the American Stock Exchange re-launched its product. This was the official creation of a new world for investors and the birth of a formidable competitor for the previously dominant mutual fund market, which had enjoyed a monopoly in the field of publically offered funds.

Year after year, the idea that a fund passively replicates an index has come a long way, winning the growing favor of investors, both institutional and private.

ETF issuers experienced a problem from the outset. Unlike mutual funds which – at least theoretically – can grow endlessly, the number of indices that can be replicated is limited and so the number of ETFs that can be launched is limited.

Issuers then began offering more specialized ETFs by replicating sub-indices (for example, dividing the S&P 500 Index into growth and income indices). Finally, in the 2000s, they launched ETFs with an underlying of futures contract on an index or a commodity rather than an index directly. This is how double and triple leverage ETFs (defined as 2X and 3X) were born and – why not – double and triple leverage inverse ETFs (-2X and -3X). The underlying may be a futures contract on a stock index, gold, oil, natural gas, wheat, and so on.

The introduction of futures and financial engineering increased the opportunities to create ETFs. Originally, an ETF replicated, for example, only the SPY (where the underlying was the S&P 500 Index). Today, the same index can be used to create five other ETFs, for a total of six: the traditional SPY plus double and triple leverage and three inverse ETFs: single, double and triple leverage.

Meanwhile, the appetite for ETFs is still growing. In spite of new existing indices and after having explored the possibilities offered by the futures market, issuers are beginning to offer "smart beta" ETFs to distinguish them from the passive replication of official indices or commodity futures contracts.

A "smart beta" ETF means that the issuer itself can create indeces and subsequently replicate them with an ETF. For example, in an existing index of growth stocks, it will select the most promising stocks based on multiple factors to create an index. It will then select securities with low volatility to create a low volatility ETF, as these may perform better than higher volatility securities. Or it will reduce the weight of one sector in one index and increase that of another sector, putting an upper limit on any sector within an index.

But what is "beta"? Beta is the sensitivity with which a security or a portfolio reacts when the overall market moves. A beta of 1 means that the portfolio moves in lockstep with the benchmark; if beta is less than 1, the portfolio is less reactive to the market, and if beta is greater than 1, it is more responsive. In the framework of smart beta ETFs, the word "beta" is a bit of a misnomer.

The word "smart" is probably borrowed from military jargon: a "smart" bomb is the one that, once released, strikes a specific target for which it was programmed. This term is also somewhat inappropriate. The market target moves, whereas a smart ETF needs, in most cases, a determined market behavior to generate profit. In other words, after putting together certain factors, the issuer delivers a corresponding ETF.

Applying the words "beta" and "smart" to an ETF is therefore a matter of marketing. It is sufficient to look at Table 1 to see that these US ETFs have the largest market capitalization in terms of assets under management (greater than US $12.5 billion each).

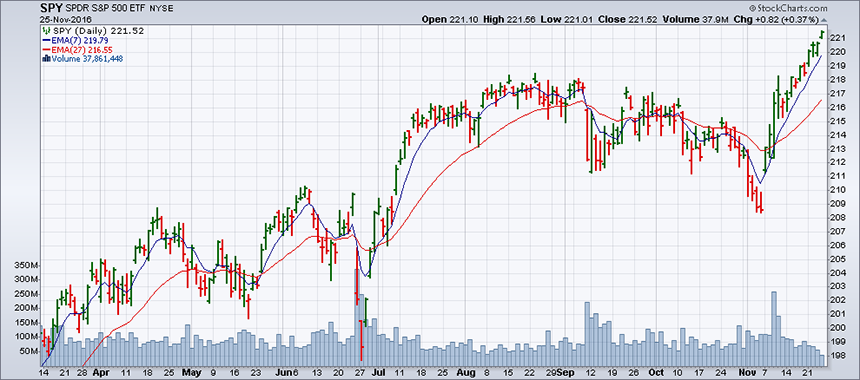

Note that the capital invested over the last twelve months has generated an attractive but not unusual yield compared to the SPY (the simple replica of the S&P 500 Index, in Canadian dollars, trading in Canada under the symbol XSP). The XSP realized a gain of 8.12% with a management expense ratio (MER) of only 0.10%, compared to more than double the MER and an average return of 9.87% for the smart beta ETFs in the table. To justify the "smart" label, one would have expected better...

In other words, to be "smart", the ETF should modify its strategy to dynamically adapt to market movements. But to do this, you would have to resort to a manager and the ETF would then operate increasingly like a traditional mutual fund with higher MERs. Of course, such a product exists as a subset of smart beta ETFs called "active ETFs" or "alternative ETFs".

In Canada, smart beta ETFs are available in large numbers and their performance, case-by-case, is similar to their US counterparts. Several are US smart beta ETFs quoted on Toronto in Canadian dollars (CAD-hedged), therefore offering the same performance.

Issuers publish lists of such ETFs on their respective websites.

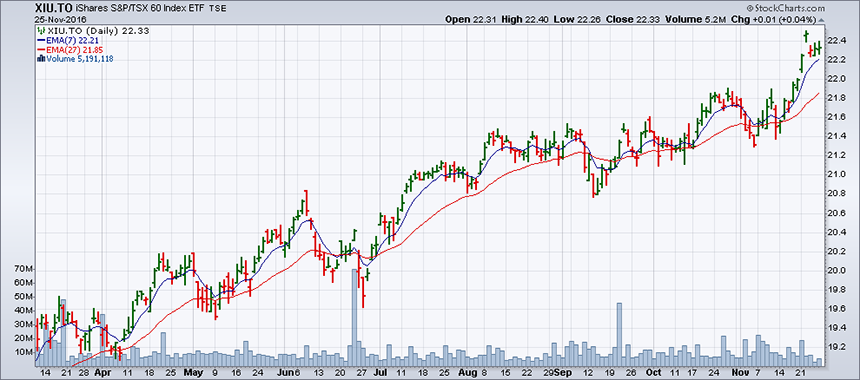

One of the highest capitalized of these Canadian funds is part of the iShares portfolio of funds: it is the XDV, an index of Canadian high-dividend stocks selected by Dow Jones, the performance of which doesn't do much to justify calling it a "smart beta" ETF, especially when compared to the traditional XIU (the passive replica of the S&P/TSX60 index). In this smart beta ETF, the securities were selected based on, among other things, their dividend growth and ratio of dividends to earnings per share.

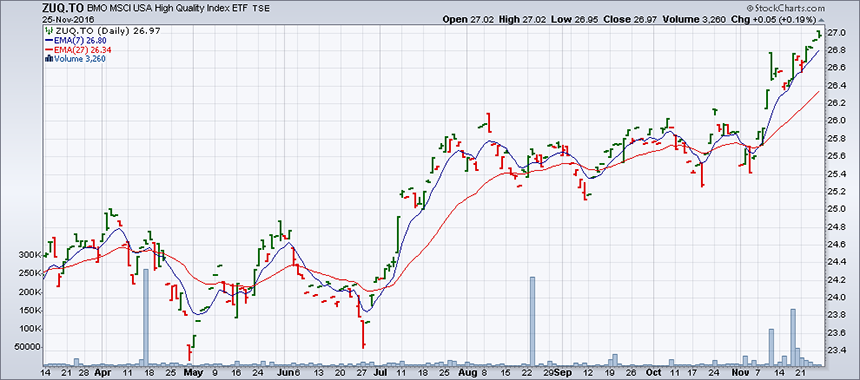

Over a one year period BMO's ZUQ outperformed the SPY in the three months prior to the latest jump, but its performance was weaker during the spring. This ETF replicates an American index comprised of securities with a high return on equity (ROE), stable earnings growth and a low effect of leverage on capitalization.

Conclusion

The main weakness of smart beta ETFs is that once they are issued on a specific index, they are fixed to that index, meaning that their performance is linked to its specific characteristics which, depending on market conditions, can sometimes limit performance rather than favor it.

However, if they are chosen well, their sheer numbers may offer a portfolio a more nuanced dynamic allocation, rather than simply selecting an ETF which passively replicates a traditional index.