Strength of Advanced Economies Means Quick Absorption of Excess Capacity and Rising Interest Rates

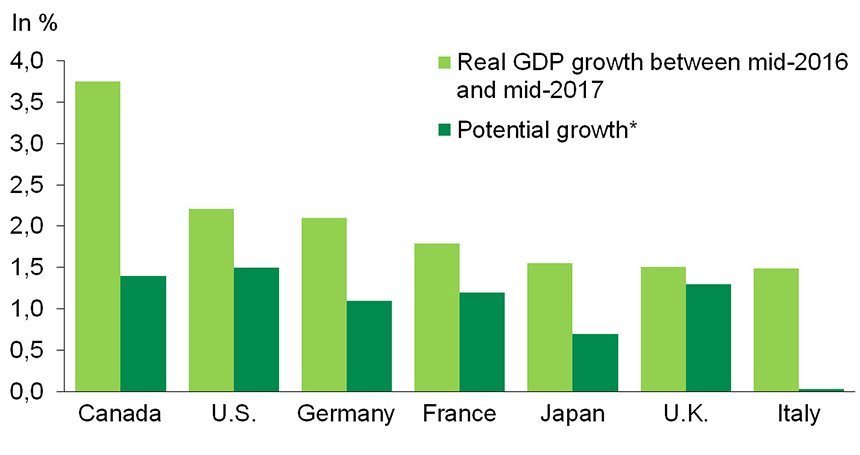

Growing geopolitical tensions over North Korea's nuclear program and the difficulties facing the U.S. administration raised some concerns over the summer. This is compounded by a particularly fierce hurricane season. Despite all of this, the global economy continues to send encouraging signals, with consumer and business confidence indexes remaining high and most advanced economies still posting growth well in excess of potential. While the global economy is doing better, overall inflation remains subdued, although the general decrease in surplus capacity suggests it will accelerate somewhat in the coming quarters.

Major advanced nations overseas posted good economic growth in the second quarter of 2017. For the first time since the winter of 2007, the euro zone posted three consecutive quarters with growth of more than 2%, and leading indicators suggest this positive trend will continue. Japan recorded its best GDP growth in more than two years, capitalizing on improvements in all components of final domestic demand. However, the United Kingdom continues to disappoint, with the uncertainty over Brexit now curbing the country's economic growth.

After another difficult start to the year, U.S. real GDP growth rebounded in the spring, going from 1.2% in Q1 to 3.1% in Q2 of 2017. This strength continued in the third quarter as the first estimate of the national accounts puts real GDP growth at 3%, although hurricanes have dampened some elements of domestic demand. The outlook is positive for the future in the United States as several household and business confidence indices have recently hit multi-year highs.

The Federal Reserve seems quite satisfied with the U.S. economy's performance. At its September meeting, it confirmed that it would start to let its balance sheet gradually deflate, and clearly signalled its intention to raise its key rates again by the end of 2017 and in subsequent years. In this environment, U.S. bond yields, which generally fell in July and August, recently started an uptrend that looks likely to persist.

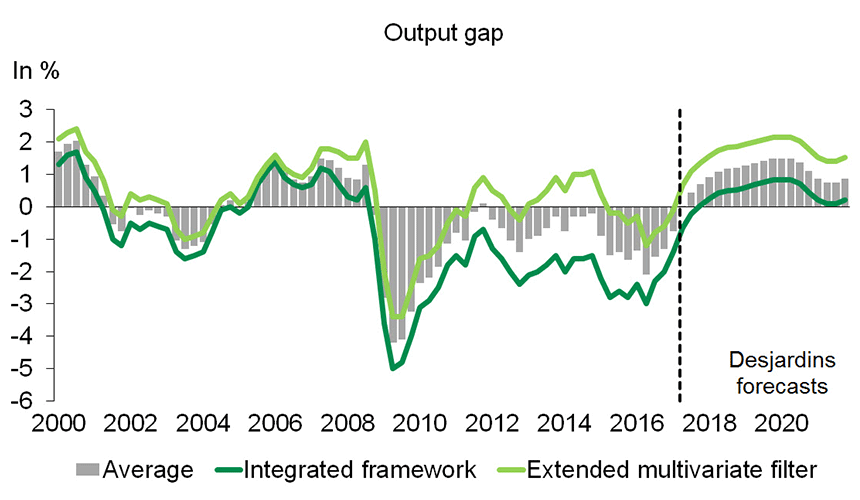

The Canadian economy accelerated once again, reaching 4.5% in the second quarter of 2017. Cumulative growth since the beginning of the year stands at 4.1% (annualized), a performance not seen since 2002. The Canadian economy's surge continued to be supported by very strong consumer spending, which has benefited from the labour market's solid performance. Canadian economic growth should decelerate in the coming quarters, slowing to a pace that is more sustainable over the medium term. The gradual increases in key interest rates and the slowing housing market should help curb domestic demand.Data for the months of July and August already point to significant moderation in growth in the third quarter.

The Canadian economy's second-quarter surge persuaded the Bank of Canada to move ahead with a second consecutive increase to its key rates on September 6. The target for the overnight rate has thus doubled in the span of seven weeks, going to 1.00% and putting substantial upside pressure on the loonie and all Canadian interest rates. However, the BoC opted for the status quo in October and adopted a more cautious tone. While Canada's monetary authorities are not sending very clear signals about what happens next, we can expect further key rate increases in the coming quarters, as Canada's economic growth should generally continue to outstrip its growth potential.

Quebec's economy also maintained its momentum, with real GDP increasing an annualized 2.5% in the second quarter of 2017. Real GDP growth has fluctuated between 2.5% and 3.0% for four quarters in a row, which is an excellent run for the province. Households are primarily responsible for the boom. They are benefiting from strong income growth, powered by the vibrant job market and a bit of tax relief. The economy's pace will nonetheless decelerate in 2018, as gradually rising interest rates should slow growth in consumption spending and activity in the real estate sector.

As in 2016, British Columbia should lead the way in Canadian growth for 2017 thanks to very brisk domestic demand. However, some of the oil-producing provinces, including Alberta, could be close behind; as they benefit from the major catching up that the energy sector has been doing since the start of the year. Ontario's growth could edge below the national average due to the impact of its slowing housing market. In Atlantic Canada, the energy sector could create some surprises in Newfoundland and Labrador, whereas the outlook remains subdued for the other provinces.

Sources: Datastream and Desjardins, Economic Studies

Sources: Datastream and Desjardins, Economic Studies Sources: Statistics Canada, Bank of Canada and Desjardins, Economic Studies

Sources: Statistics Canada, Bank of Canada and Desjardins, Economic StudiesNotes

- In 2017, according to the Organisation for Economic Co-operation and Development (OECD).