The Age of KISS

When investors think of "portfolio construction", they normally try to attain three goals:

- Reduce risk by not putting "all your eggs in one basket";

- Obtain a return in the form of capital gains;

- Obtain a return in the form of dividends and coupons.

In the past, the classic portfolio consisted of stocks and bonds, plus cash, to eventually take advantage of attractive buying opportunities.

To determine the proportion of equity and fixed income, we applied the following popular rule: 100 minus age = the percentage in stocks.

For example, a 30 year-old investor would place 70% of their money in equities and 30% bonds. And at 65, they should only invest 35% of their money in stocks and the rest in bonds, because stocks are riskier than bonds and as we age, we do not like to take risks.

A few years ago "alternative" portfolios were introduced. There are two types: "traditional" alternative portfolios with four components – equity, fixed income, real estate and commodities – and "modern" alternative portfolios, composed of stocks, bonds, hedge funds, futures funds and out-of-favour stocks (with, of course, the likelihood that they regain some value).

These portfolios, which are similar to those managed by financial institutions, ideally seek higher returns while being more diversified.

Independent investors pursue the same objectives, but often have neither the opportunity nor the time to research and spot the opportunity offered by a particular security. They often have to approach the market in the simplest way; that is to say, using the traditional approach.

To make life easier, today's independent investors have access to wonderful instruments called Exchange Traded Funds (ETFs). These funds offer low management costs, provide diversification – each fund represents several securities – and replicate well-known indices.

With these funds, it is easier to build and manage a diversified portfolio. In addition, investors are protected from the risks of owning an individual security, because the inefficiency of one security is offset by the success of another. Investors therefore take on the risk associated with the market in general or a sector if a particular sector ETFs is selected.

Before building an ETF portfolio, investors should answer the following questions:

- Can you use ETFs?

- What type of ETFs?

- Can you use leveraged ETFs and inverse ETFs?

- Do you prefer a specific ETF provider?

- What is your risk tolerance?

Investors can then choose their ETFs in light of their answers to these five questions.

Independent investors who do not know any technical analysis or options strategies, and are therefore more inclined to opt for a passive strategy, should answer this way: "Yes" to the first question. "Indexed only" – the simplest, safest and cheapest in terms of management fees – to the second question. "No" to questions 3 and 4, and "minimal" to question 5. When choosing ETFs (for income and capital appreciation), one may opt for ETFs listed on Toronto, but that replicate listed ETFs in the United States without exchange rate risk (CAD-Hedged). In fact, US ETFs with much interest and high trading volumes are often available in Canadian dollars, which allows us to take advantage of the US market without any exchange rate risk. Below are suggestions for simple and effective portfolios.

- Simple, traditional portfolios with Canadian underlying:

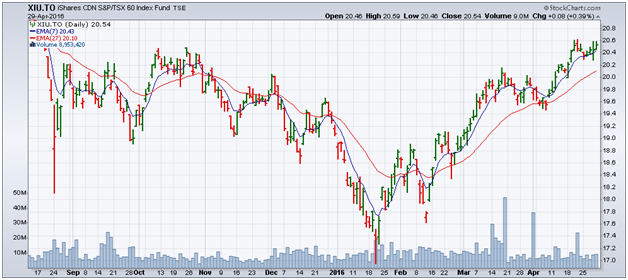

- XIU

- XQB

- Simple, traditional portfolios with American underlying (but in Canadian dollars):

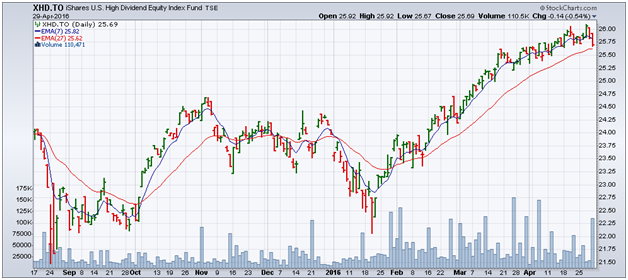

- XHD

- ZHY (or XHY)

- Simple, traditional portfolios with international exposure and American underlying (but in Canadian dollars):

- XIN

- XEB

These sample portfolios are based on the "law of parsimony" (from "Occam's Razor"). Stocks – and the ETFs that represent them – undergo a herd effect, much like ships that all behave the same way when a wave hits.

An investor once told me that ETFs are good, but not great. Individual stocks are more exciting. Buying XIN does not offer the same feeling as buying, for example, Alimentation Couche-Tard or Dollarama. Investors who like individual securities should set aside 10% of their capital to satisfy these emotions. And allow the largest part of their money to sail the calm sea of index ETFs.

The six ETFs within our three sample portfolios are illustrated in the charts below. We realize that they are in some cases very similar. In other words, these ETFs are highly correlated. This is the case for the XIU and XHD, ZHY and XEB.

This is not always the case, but in a world with economies that are more and more integrated, diversification is not as readily available as it was in the past.

In conclusion, the situation boils down to the recognized principle of KISS ("Keep It Small and Simple"), invented by an aeronautical engineer. (Note that Leonardo da Vinci once said, "Simplicity is the ultimate sophistication").

For investors who have no time to do research and who want to invest their money in a simple and cost-effective manner, these portfolios, individually or by combining the proposed ETFs, allow one to be autonomous and get what they want: a return that follows the market and a return on fixed income. What proportions should be established between bond ETFs and equity ETFs? Investors can simply use the equation we mentioned earlier and enter the age they feel rather than their actual age.

Source: StockCharts.com

Source: StockCharts.com

Source: StockCharts.com

Source: StockCharts.com

Source: StockCharts.com

Source: StockCharts.com

Source: StockCharts.com

Source: StockCharts.com

Source: StockCharts.com

Source: StockCharts.com

Source: StockCharts.com

Source: StockCharts.com

i "Duration" should not be confused with "maturity". Both are measured in years however duration indicates the sensitivity of a fixed-income security to fluctuations in interest rates. The higher this number, the more sensitive the ETF is to changes in interest rates.