The Bank of Canada Begins Monetary Firming and the Loonie Soars

The last few weeks have not been an easy ride for Canadian financial markets. The quick change in tone by the Bank of Canada (BoC), which began last April, culminated in the July 12 announcement of a 0.25% increase of its target for the overnight ratefootnote 1, the first since 2010. What is behind the BoC's action, and what should investors expect next?

The Canadian Economy Posts Impressive Results

There were no indicators at the start of 2017 that the BoC would follow the Federal Reserve and start raising its key rates. Recall that in reaction to the latest correction in oil prices, the BoC had lowered its overnight rate target twice in 2015, bringing it down to 0.50%, close to its historic low. Despite recovering oil prices and rebounding economic activity in Canada in the second half of 2016, BoC policymakers remained concerned, and last winter they were still keeping the door open to a further easing of Canada's monetary policy.

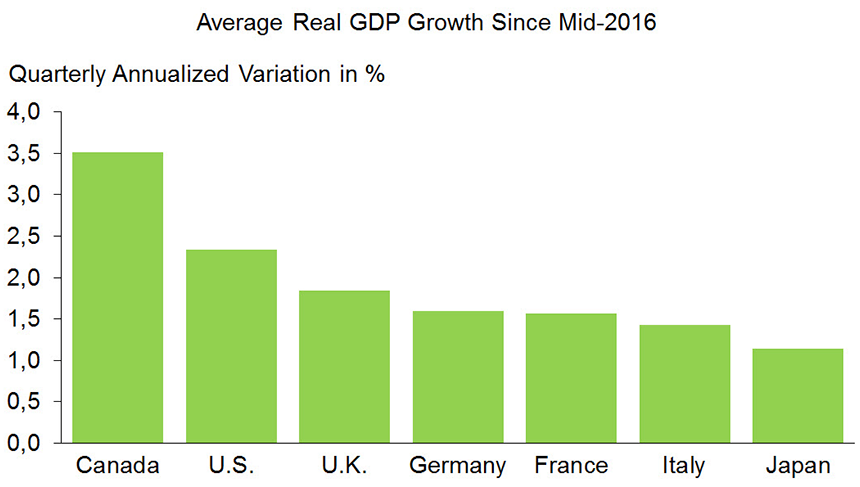

However, worries that the drop in oil prices would have a lasting negative impact on Canadian economic growth proved to be unfounded. Thanks to the labour market's solid performance and government stimulus efforts, household consumption has been very strong in the last few quarters, even in regions that are more dependent on commodities. Similarly, fears that tightened mortgage rules would disrupt the real estate market's momentum have not come to fruition. On the contrary, activity in the housing sector has remained very lively, even excluding the spectacular fluctuations seen in the Greater Toronto Area. With business investment and exports also exceeding expectations, the Canadian economy has posted the highest growth among G7 countries in the last few quarters (Graph 1).

The positive performance of the Canadian economy, despite a number of obstacles, likely indicates that its momentum is stronger than many observers had believed. With the excess capacity of the Canadian economy expected to be depleted by the end of 2017, the time is certainly appropriate to begin gradually normalizing monetary policy, even if inflation is still fairly low. A second key rate hike of 0.25% is expected in the fall, which would finish reversing the monetary easing measures applied in 2015. Monetary tightening should then proceed at a gradual pace of approximately one rate increase every six months.

The fact remains that for borrowers who are seeing their financing cost go up, and for exporters who are striving to remain competitive, monetary tightening is never good news. However, maintaining an extremely accommodating monetary policy when it is no longer necessary would needlessly increase the Canadian economy's vulnerabilities, such as those related to household debt, and risk a severe crisis in the medium term. In the current climate, a gradual normalization of the monetary policy appears to be the most appropriate option.

What Are the Consequences for the Financial Markets?

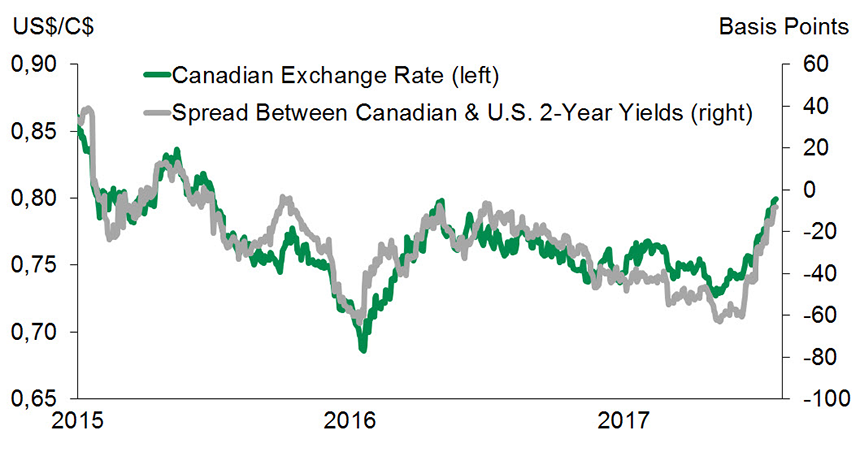

July's key rate hike has had a major impact on the Canadian bond market, as no one expected it a few months ago. For example, five-year Canadian federal bond yields have jumped about 70 basis points since the end of May. As a result, the gain for the FTSE TMX Canada Universe Bond Index since the start of 2017 went from 3.6% at the end of May to about 1.5% in mid-July. Shrinking spreads between Canadian and U.S. bond yields have also caused the loonie to soar (Graph 2), particularly as it has been coupled with speculators completely reversing their negative sentiment toward the Canadian currency. As a result, the loonie appreciated about 8%, reaching the symbolic threshold of US$0.80.

This surge in the Canadian dollar has boosted Canadians' buying power abroad. However, it has also lowered returns on investments denominated in other currencies. Although the U.S. stock market has continued to grow, the S&P 500's return in Canadian dollars since the start of 2017 fell from just over 10% at the beginning of June to about 5% in mid-July.

By impacting the performances of international investments and the bond market, the surprise start of monetary tightening in Canada put most investors at a disadvantage. However, an appropriate monetary policy is also favourable to financial markets in the medium and long term. Future Canadian key rate hikes should have a less dramatic impact, as most investors now anticipate them. As the U.S. dollar could recover slightly by the end of 2017, we expect the loonie to close the year at around US$0.79. As for the bond market, the start of monetary tightening reinforces our opinion that we should prepare ourselves for a few years of very limited returns for this asset class.

Sources: Datastream and Desjardins, Economic Studies

Sources: Datastream and Desjardins, Economic Studies Sources: Datastream and Desjardins, Economic Studies

Sources: Datastream and Desjardins, Economic StudiesNotes

- The overnight rate is the interest rate at which major financial institutions borrow and lend funds among themselves for one day; The Bank sets a target value for this rate, which is commonly referred to as the Bank's "key rate".