The Markets Get the Year Off to a Rocky Start

The Canadian Dollar Is Still Under Pressure

Panic blew through the markets at the start of this year, generating substantial losses for numerous stock indexes. The key disruptive factors were another tumble by the Shanghai Stock Exchange and fears that several economies would slow sharply. Resource producers, including several emerging nations, seem especially vulnerable in a context of very low prices for oil and other commodities.

Stronger market risk aversion and weak crude prices had a direct impact on the value of the Canadian dollar (Chart 1), which hit a 13-year low on January 20, at US$0.6808. The loonie has recovered a little since then, but it is still too early for a lasting rise.

*West Texas Intermediate

*West Texas Intermediate Sources: Datastream and Desjardins, Economic Studies

Excessive Pessimism?

Given the weak correlation between the Shanghai Stock Exchange and the real state of China’s economy, investors seem to have overreacted. Chinese economic growth continues to trend down, of course, but it is nowhere near a disaster scenario. Over the next few years, it should continue the transition to a more mature economy that is more oriented towards consumption, and growth could slowly slide to settle around 6%. That being said, China’s greater global economic weight means that its total contribution to world growth is still comparable to where it was about 10 years ago.

As for the other emerging nations, there are certainly some places where fears are justified, as in Brazil and Russia amid low commodity prices. However, it would be hard for the difficulties there to spread to the entire world economy, especially as low resource prices are an advantage for several countries. As long as the U.S. economy holds up and the European economy keeps improving, even gradually, there is no reason for concern.

We can also count on the fact that the major central banks will not want to risk seeing the economy erode. The Bank of Japan recently announced that it will apply a negative interest rate of minus 0.1 percent to current accounts that financial institutions hold at the central bank. In the Eurozone, the European Central Bank clearly opened the door in January to further intervention to keep inflation expectations from falling. The Federal Reserve, for its part, seems ready to adopt a more cautious approach to key rate increases in order to reassure the markets.

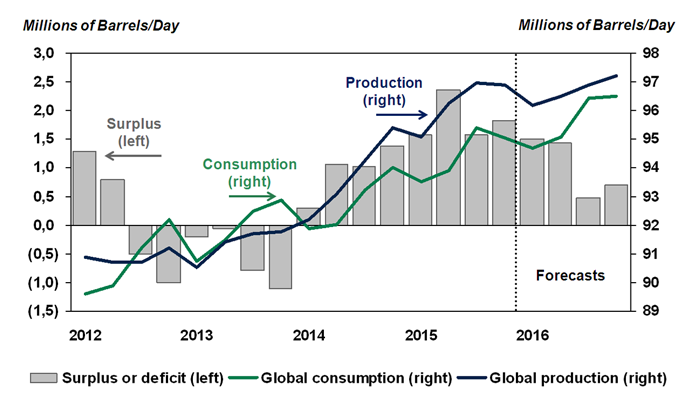

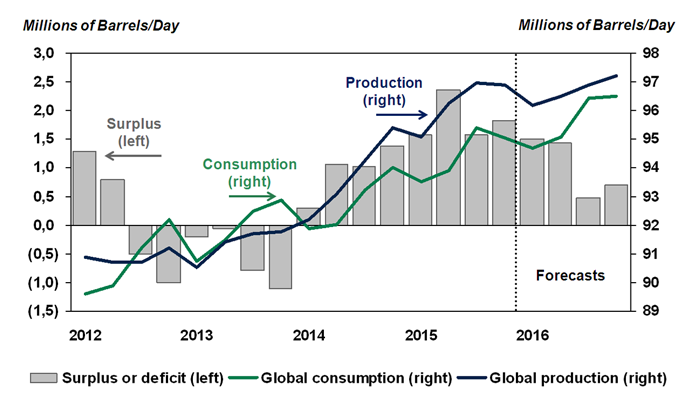

Oil Prices Should Rise Gradually

Oil prices remained weak throughout 2015 and hit new cyclical lows in January. This could perplex those who have been hoping for a rebound for several months. However, we find that the factors that allowed crude prices to drop so much will be difficult to sustain for all of 2016.

The lively surge in production by OPEC (Organization of the Petroleum Exporting Countries) nations was one of 2015’s surprises. Faced with low prices, several countries opted to produce more to try to maximize their oil revenues. Now, however, they have much less capacity to increase their output. Only Iran should substantially expand its output in 2016, when the international trade sanctions will be lifted. That being said, this influx of oil is already broadly anticipated and will not come as a surprise. Simultaneously, production should drop in non-OPEC nations, particularly the United States. Consumption should also be buoyed by the low prices. All in all, the current oil surplus should start to dwindle later in 2016 (Chart 2), and support a lasting rise by prices.

Sources: International Energy Agency and Desjardins, Economic Studies

Sources: International Energy Agency and Desjardins, Economic Studies

We anticipate that the benchmark WTI (West Texas Intermediate) could rise to between US$45 and US$50 per barrel by year’s end. This price is still low, but the trend would at least be heading upwards.

Better Days for the Loonie

A drop in risk aversion and a rise by crude prices would be good for the Canadian dollar. This is our preferred scenario for 2016. In the near term, however, the concern in the markets could remain tangible and oil prices could remain under pressure. The loonie could thus drop back below US$0.70 before starting to trend up again, to end the year at around US$0.73.

The Canadian dollar’s forecasted appreciation is proportionally less than the expected rise by oil prices. The fact is that other factors could rein in the loonie’s momentum.