The Markets Have Been Wary, but the Economy Continues to Send Encouraging Signals

The financial markets ended 2016 on a very positive note, with Donald Trump’s surprise victory viewed by investors as the dawn of a new period of strong economic growth. This quasi-euphoria gave way to hesitation in early 2017, and concerns started to become clearer as March and April rolled around. Has the time come to seek safe havens as we wait for a complete turnaround of the market trends observed in the second half of 2016?

A Tough Start for the Trump Administration

Donald Trump became the most powerful man on the planet after his inauguration on January 20, 2017. The limits of his power quickly became evident, however, with his first 100 days in office, which were beset with difficulties implementing the reforms promised during his campaign. Republicans may hold a majority in both Houses of Congress, but they do not have a supermajority in the Senate to prevent Democrats from using obstructionist means to block several legislative measures. For example, this has forced the Trump administration to give up its plan to immediately finance the construction of the border wall with Mexico and make a few compromises on funding Obamacare to prevent paralyzing the federal government at the end of April. The new president has also met with some resistance even among elected Republicans, when certain right-leaning members of Congress thwarted Trump’s efforts to reform the healthcare system in March. The failure of one of Donald Trump’s primary pledges has had a sobering effect on expectations for swift and far-reaching tax reforms.

Geopolitics Magnify Concerns

Amid rising doubts about the Trump administration, falling oil prices and signs of weak real activity in the United States, concerns rattled the markets in March. American intervention in Syria and a potential conflict with North Korea further fuelled these fears. Moreover, electoral uncertainties in France revived concerns about the political situation in Europe. In reaction, investors turned to safe havens, thereby exerting downward pressure on North American bond yields and stock markets.

Earnings and the Economy Should Take Priority Over Politics

Geopolitical concerns rarely have a lasting effect on the markets, however, and the encouraging outcome of the first round of the French presidential elections already seems to have brought back a sense of optimism. The general market trend for the next few quarters should mainly reflect the economy and business earnings. The biggest question for investors should be; can we remain optimistic about these things even if the U.S. administration does not deliver the level of support we may have expected at the end of 2016?

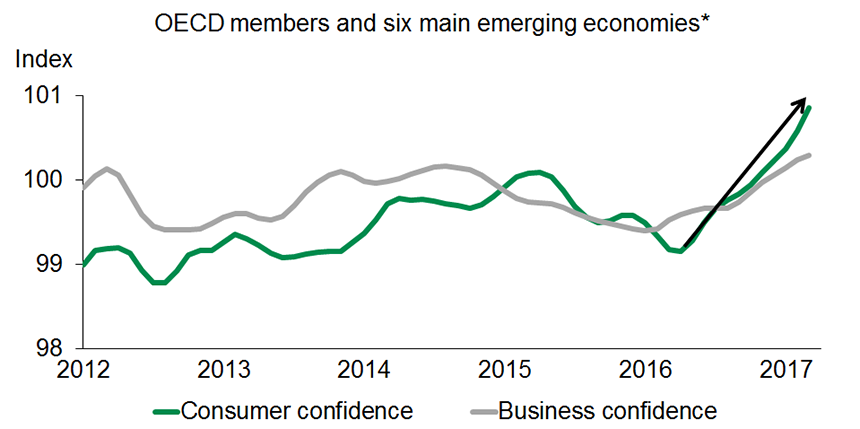

Overall, the news about the economy is encouraging. The U.S. economy may have recorded slow growth in the first quarter of 2017, but this largely reflects temporary factors, especially the weather that held back the consumption of services. In contrast, fixed, non-residential business investment was up 9.4%, the best result since autumn 2013. With confidence indexes in the United States still at high levels, economic growth should rebound closer to 3.0% in Q2. Climbing confidence indexes in several other economies are also very reassuring, a sign that other factors besides Donald Trump’s election are at play. Global expansion in 2017 is thus pegged to be stronger than in 2016.

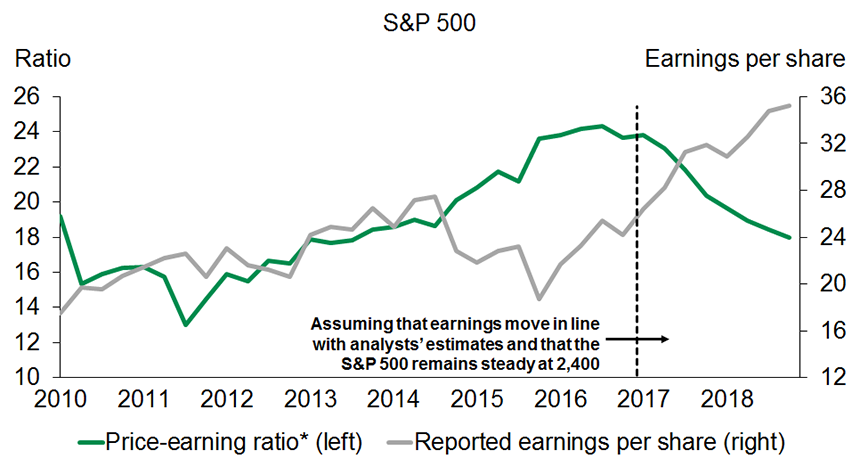

The news is also encouraging for earnings, which took a beating between the middle of 2014 and the end of 2015, driving up S&P 500 price/earnings ratios to worrisome levels. The drop in profits, which mainly reflected difficulties in the energy sector, gave way to a sharp rebound in the last few quarters, as oil prices have doubled since the low reached in early 2016. This favourable trend, which seems to have extended to the first quarter of 2017, suggests that price/earnings ratios could quickly return closer to normal levels if the S&P 500 stays around 2,400.

Concerns continue to cloud the economic and political environment; tensions could rise and the markets could fall at any given time. After the run-up at the end of 2016 and beginning of 2017, a period of consolidation was completely justified. The economic and profit outlooks remain favourable, however, and the risk of a major and lasting market correction appears weak, barring a genuine deterioration of the situation.

- * OECD: Organisation for Economic Co-operation and Development

- ** Brazil, China, India, Indonesia, Russia and South Africa.

- * based on earnings for the last 12 months.