What does the future hold for Bitcoins?

A new phenomenon is gaining traction in the world of money—digital money that is, with the Bitcoin at its forefront. Unlike national currencies, such as the Canadian dollar, the issuance of Bitcoins is not controlled by a government or central bank. Instead, the quantity of money to be issued is determined by a computer software that has been programmed to accomplish such a task. Bitcoins do not come in paper or mint form, and all transactions are done through computers, with users keeping track of money owned through the use of a virtual portfolio. The golden coins representing Bitcoins—as seen on TV or the Internet—are purely fictitious in nature.

This digital currency is an innovation which offers certain advantages. On the flip side, we note several drawbacks that should warrant caution on the part of users and investors.

Why hold Bitcoins?

As with any currency, Bitcoins can be used to purchase goods and services, particularly in online trading, but only a very small number of businesses will accept them currently. Their use remains marginal, although some believe they will become more widespread in the near future.

Confidentiality and low transaction costs are two characteristics highly prized by users. Bitcoins are also easily bought and sold around the world without intermediaries, which helps reduce costs.

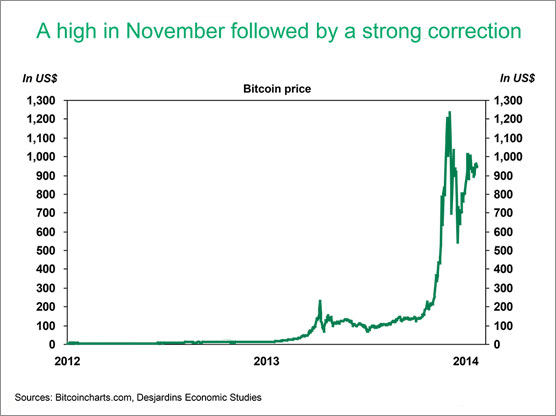

The impressive run-up in the value of Bitcoins over the past year highlights the great potential for gains, which has caught the interest of speculators and fuelled demand for Bitcoins. At only US$13 at the beginning of 2013, the unit value of the Bitcoin skyrocketed to more than US$1,200 last November. Nevertheless, its value remains highly volatile (see the graph provided), as we were reminded last December when it corrected and plummeted to US$500. The Bitcoin eventually made its way back up to US$1,000 recently.

Limited supply

The issuance of Bitcoins has been programmed on the premise that the value of a currency is enhanced by its scarcity. Currently, about 3,600 Bitcoins are created daily. Participants in the network who are ‘mining’ the currency can be rewarded with a few of these newly created Bitcoins (distributed in blocks of 25 Bitcoins currently). Bitcoin transactions are grouped into transaction blocks and processed every 10 minutes or so, as massive computing power is required for encrypted calculation and validation processes. With the help of a powerful computer, you could be granted 25 Bitcoins should you be the first to validate a block of transactions. Needless to say, competition to the finish line is fierce!

The rate of money creation is divided by two every four years, such that a maximum of 21 million Bitcoins will be issued in total. For purposes of comparison, there are more than one trillion dollars worth of U.S. bank notes outstanding, a quantity constantly adjusted based on demand.

The deflation problem

Given limited supply to support the value of Bitcoins, widespread use of this currency would eventually lead to deflation (negative inflation). The cast-iron economic laws are inevitable. In other words, if the quantity of goods and services exchanged daily grows at a faster pace than the money available to settle the transactions, the resulting scarcity at play would drive up the currency value. This very increase in currency value would in turn make the future cost of goods and services less expensive.

Broadly speaking, deflation is a serious threat to an economy, as it curtails consumption and investments. In both instances, the decision to buy or invest is postponed to take advantage of falling prices. Deflation is also known to bring down wages but increase the weight of debt (liabilities do not dwindle as prices fall). Just imagine having to repay a debt that is increasing in value!

No monetary policy mechanism

Unlike the Bitcoin, traditional monetary systems have mechanisms at their disposal to circumvent deflation. The control that central banks can exert on money supply and short-term interest rates allows them to target an acceptable inflation rate as well as to smooth out economic cycles and help maintain financial stability. Furthermore, central banks can temporarily lend funds to financial institutions facing difficulties to prevent a domino effect from rippling through the entire financial system and to avoid panics.

The lack of a central authority controlling the Bitcoin is often cited as an advantage by its proponents. However, we would argue that in the event of widespread use such a characteristic is more closely associated with an inconvenience, as opposed to an advantage.

No regulatory framework

Another major drawback to the Bitcoin is the lack of any regulatory framework. In modern economies, a number of rules and surveillance organizations are in place to protect citizens, but these structures do come at a cost.

One such example is deposit insurance. Bitcoin transaction fees are kept low not only on account of the limited number of intermediaries, but also because legal protection does not exist in case of loss, fraud or computer hacking. The absence of regulations and monitoring is an open invitation to those involved in illegal activities.

All in all, the need for regulation generally depends on how a currency is used. Given that the Bitcoin is used mainly for basic transactions, excessive regulation would probably not be suitable. On the other hand, the situation would certainly be different if the Bitcoin took the place of national currencies in a wider range of transactions, such as loans or more complex financial transactions.

The Bitcoin is headed for marginal use only

The Bitcoin has innovated to allow electronic exchanges of money without the intervention of a third party. That said, we believe the limited supply, absence of mechanisms of monetary policy and lack of protection for users are major hurdles preventing the Bitcoin from eventually competing head to head with national currencies.

In all likelihood, the value of the Bitcoin will remain very volatile, but it could still experience episodes of surging value. But for this to happen, an increasing number of people would need to buy Bitcoins despite the shortcomings highlighted. Moreover, a small shock could rapidly shake confidence, resulting in a drop in demand that could in turn bring about a significant correction in price. This is without a doubt a high-risk investment.

Please note that Bitcoin is not an accepted form of payment at Desjardins.

Important: This document is based on public information and may under no circumstances be used or construed as a commitment by Desjardins Group. While the information provided has been determined on the basis of data obtained from sources that are deemed to be reliable, Desjardins Group in no way warrants that the information is accurate or complete. The document is provided solely for information purposes and does not constitute an offer or solicitation for purchase or sale. Desjardins Group takes no responsibility for the consequences of any decision whatsoever made on the basis of the data contained herein and does not hereby undertake to provide any advice, notably in the area of investment services. The data on prices or margins are provided for information purposes and may be modified at any time, based on such factors as market conditions. The past performances and projections expressed herein are no guarantee of future performance. The opinions and forecasts contained herein are, unless otherwise indicated, those of the document’s authors and do not represent the opinions of any other person or the official position of Desjardins Group.