Writing Covered Calls to Set a Stock’s Selling Price

You own 300 shares of ABC Corp. (currently at $46) and plan to sell these shares when they reach $50. What should you do today to meet this investment objective?

Your first alternative is to place an open sell order for up to 30 days. This instructs your broker to sell your shares as soon as they hit $50. Your second possibility is to write covered call options.

An Example

Assume that the ABC 60-day 50 calls are trading at $1.00. You decide to write three of these calls at $1 each (remember, each call option covers 100 shares of stock) for which you will receive $300, less transaction fees. You have now obligated yourself to sell 300 shares of ABC at $50.

What can happen to your position?

The first possibility is that ABC never reaches $50 by the options' expiry date. In this scenario, the options you wrote will expire worthless, your obligation to sell ABC will be terminated, and you will get to keep the option premium you received when you initially sold the options - $1 per share. If you compare this outcome to placing an open sell order, you are $1 ahead of the game.

The second possibility is that ABC rises above $50 at option expiry. In this case, your calls will be assigned, you will be forced to sell your shares at $50, and you will keep the $1 premium, effectively selling your shares at $51. You are $1 ahead of where you would have been had you placed an open sell order to sell at $50.

Remember that under both scenarios, an open sell order and covered calls, you will have to sell at $50 even if ABC rises above that level.

The Other Side of the Coin

So far, all of the arguments favour writing covered calls over placing an open sell order. Where, you may ask, is the catch?

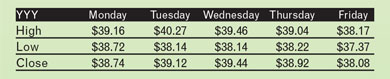

Assume that two investors have a selling target of $40 for YYY stock. The first has placed an open sell order at $40 and the second written the November 40 calls.

On Tuesday, the investor who placed the open sell order will sell his/her shares at $40, since the stock traded above this price (the high was $40.27). By the end of the week, the call writer will not have been assigned, the November 40 calls will expire worthless,and the investor will still hold his/her shares of YYY. And therein lies the difference between the open sell order and the covered calls: in virtually all scenarios, the investor who placed an open sell order will sell his/her shares before the investor who wrote covered calls. This is definitely an advantage of the open sell order, since investors prefer to sell a stock earlier rather than later (assuming the same selling price), and in some instances the open sell order will lead to the sale of the stock and the covered write will not, as in our example.