Better Outlook for 2016

Following a disappointing 2015, the outlook for 2016 is slightly better

Growth in advanced economies will continue to improve in the coming years, but will not accelerate sharply. We expect growth of 1.9% in 2015, 2.0% in 2016 and 2.1% in 2017. Euroland's economy should expand by 1.5% in 2015 and 2016, followed by 1.6% in 2017. The global economy should receive somewhat stronger support from emerging countries, even though the Chinese economy will slow again.

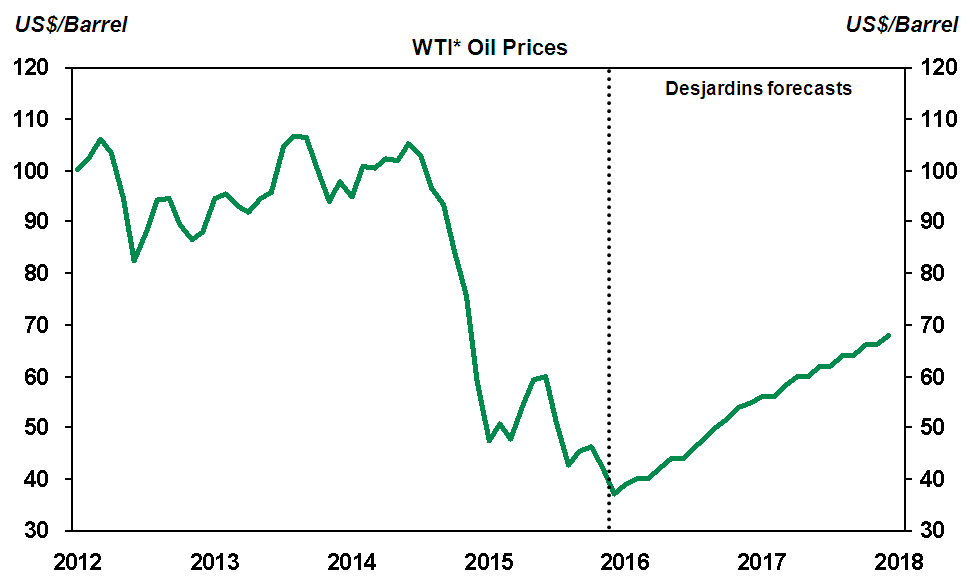

In the United States, economic growth slowed last summer and it should be less vigorous in the fourth quarter of 2015. Manufacturing, in particular, is struggling to shake off its sluggishness, a situation that could persist for part of 2016. Oil prices are expected to remain low in 2016, but the negative impacts on business investment caused by the drop in prices should dissipate by next summer. The decrease in oil prices does have one advantage, in that it is causing gas prices at the pump to diminish again. U.S. real GDP should grow by just 2.5% in 2015 and 2016. It should then expand by 2.7% in 2017, when the impacts of the stronger dollar and the tumble in oil prices dissipate.

* West Texas Intermediate

* West Texas Intermediate Source : Datastream and Desjardins, Economic Studies

In Canada, despite last summer’s upswing, growth is likely to be disappointing in the fourth quarter, given that weak oil prices dropped even lower on international markets. The growth outlook is better for 2016 and 2017, once the negative effects of the drop in energy prices slowly dissipate and the federal government's infrastructure investment increases. Following growth estimated at 1.2% in 2015, 2016 could end with real GDP growth of 1.7%. An increase of 2.2% is forecast for 2017.

In Quebec, the long-awaited acceleration of the economy—which failed to materialize in 2015 given estimated growth of 1.3%—should start to slowly emerge in 2016. Among other things, a solid performance by exports and an upswing in business investment will provide support, as will public infrastructure spending. However, consumers’ shaky financial position will keep a curb on their spending. Quebec’s real GDP could rise by 1.5% in 2016 and by 1.7% in 2017.

Major disparities persist in the economic outlook of other provinces. The provinces that are more focused on manufacturing, i.e. Ontario, British Columbia, Manitoba and most of the Atlantic Provinces, will continue to benefit from strong U.S. demand and a weaker loonie. In contrast, resource-dependent provinces, i.e. Alberta, Saskatchewan, and Newfoundland and Labrador, will continue to hurt as a result of the drop in energy prices.

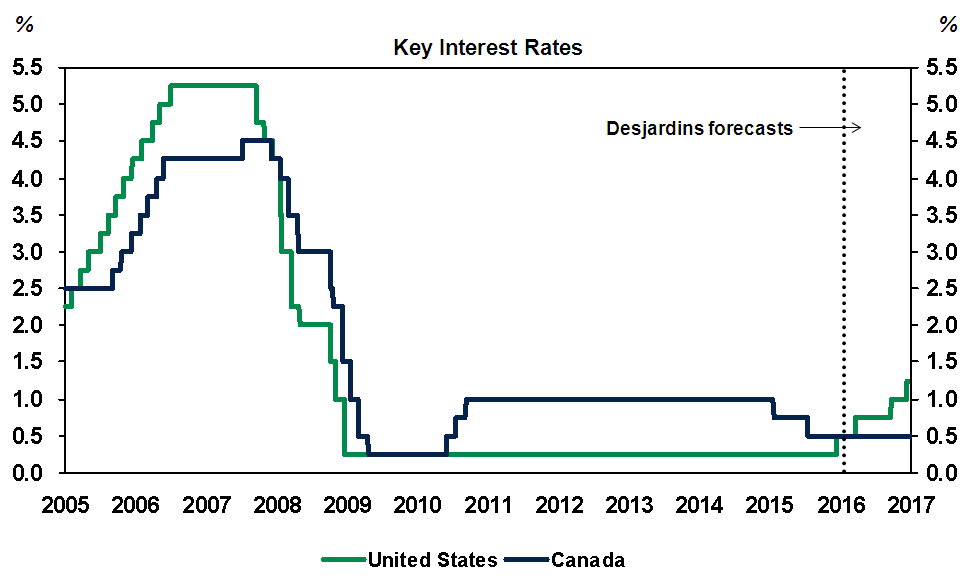

The solid performance posted by the U.S. job market finally convinced the Federal Reserve (Fed) at its December 16 meeting to launch monetary firming. However, the Fed clearly signalled that increases in key rates would be very gradual.

Oil prices and the loonie should stay very low in the coming months, but could start to edge up in the second half of 2016. The Bank of Canada will not likely contemplate raising its key rates before 2017.

Source: Datastream and Desjardins, Economic Studies

Source: Datastream and Desjardins, Economic Studies