Confidence Makes a Comeback

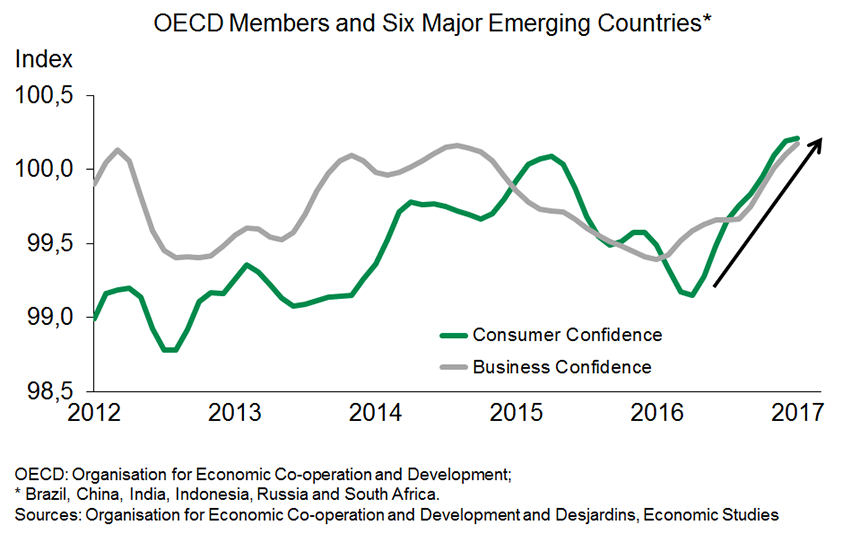

The global economic situation seems to be improving little by little. The Organisation for Economic Cooperation and Development’s (OECD) leading indicators for advanced nations and BRIC countries (Brazil, Russia, India and China) are clearly heading upward. Consumer and business confidence indexes are also rising fairly widely. What’s more, even global trade seems to have better momentum, showing faster growth in the final months of 2016 than it had early in the year. Paradoxically, all of these promising factors are materializing during a period of very high anxiety over economic policies.

In fact, several major elections are taking place this year in the euro zone, including in France this spring and in Germany this September. The rise of populism seen in 2016 in the United Kingdom and the United States could materialize in continental Europe as well, which could sap confidence in the sustainability of common institutions and even the euro. The financial markets are also becoming more nervous. For the moment, our growth forecasts for the euro zone call for real GDP gains of 1.6% in 2017.

In the United Kingdom, the economy’s resilience is what is most surprising. On the heels of the June 2016 referendum decision, expectations were slashed in the United Kingdom. But the main indicators did well all year long, pushing the projections up. Last fall’s annualized 2.9% real GDP growth is the strongest even among G7 nations. The growth forces us to raise our expectations for 2017. The pound’s depreciation is one of the main reasons for this resilience, supporting manufacturing and domestic consumption. However, its impact on prices is starting to affect households, which could have negative consequences for the economy. This will add to the uncertainties over Brexit, with the government having invoked Article 50 of the treaty with the European Union on March 29, thus triggering negotiations that should last about two years. We expect Britain’s real GDP to rise 1.9% in 2017 and slow to 1.4% in 2018.

In the United States, the good news keeps rolling in, especially with regard to jobs. Confidence has also improved substantially. The improvement in consumer confidence even suggests that real consumption will accelerate. Business confidence is also doing well; small-business confidence has hit its highest point since 2004. The ISM indexes, for their part, are signalling strengthening business investment. In addition, there’s the improvement to the outlook in the oil sector, where more drilling is taking place. However, there is a high probability that the results for the first quarter of 2017 will be disappointing. The fact is, beyond employment, the real data has rarely been up to expectations, which have been boosted by confidence surveys. The drop in real consumption in January and February stands out the most. Also, the new administration is taking its time in implementing the promises made during the election campaign. Tax cuts will apparently come in 2018 rather than in 2017. This change prompts us to downgrade our real GDP growth forecast for this year from 2.5% to 2.2%; faster growth of 2.4% is now expected in 2018.

After the second straight quarterly 0.25% increase to the Federal Reserve’s key rate on March 15, two additional 0.25% increases are expected by the end of 2017, with three increases to come next year.

The Canadian economy’s growth accelerated sharply in the second half of 2016 and the outlook is good for 2017. The 0.6% growth in real GDP by industry in January is another clear signal. Even if we consider the possibility of a temporary pullback in February, the first quarter could wrap up with more than 3% growth. Among the good signs for Canada’s economy, the positive impact of the federal government’s recovery plan is starting to be keenly felt. What’s more, tax measures introduced in the 2016 budget have boosted disposable income in Canadian households, which has posted faster growth since mid-2016. Canada’s labour market is advancing nicely and household confidence is also climbing. Lastly, the commodity price increases seen in the last few months are also good for Canada’s economy. Under these conditions, we have upgraded our forecast for 2017 from 1.9% to 2.2%. A gain of 2.0% is still expected for 2018.

This good news should prompt the Bank of Canada to take a less worried stance soon. The first Canadian key rate hike could be announced a little earlier than we previously anticipated, in July 2018. In the meantime, widening rate spreads between the United States and Canada should play against the loonie.