Entry in bear market territory for U.S. stocks : fears are overblown

The beginning of the year has been a particularly turbulent time for financial markets, with the Japanese and European stock markets recently moving into bear market territory. The U.S. stock market has also been hit by a resurgence of global concerns, besides being troubled by falling profits and worries about the health of the U.S. industrial sector. Will the U.S. stock market suffer the same sad fate as some other markets?

What is Troubling the Markets?

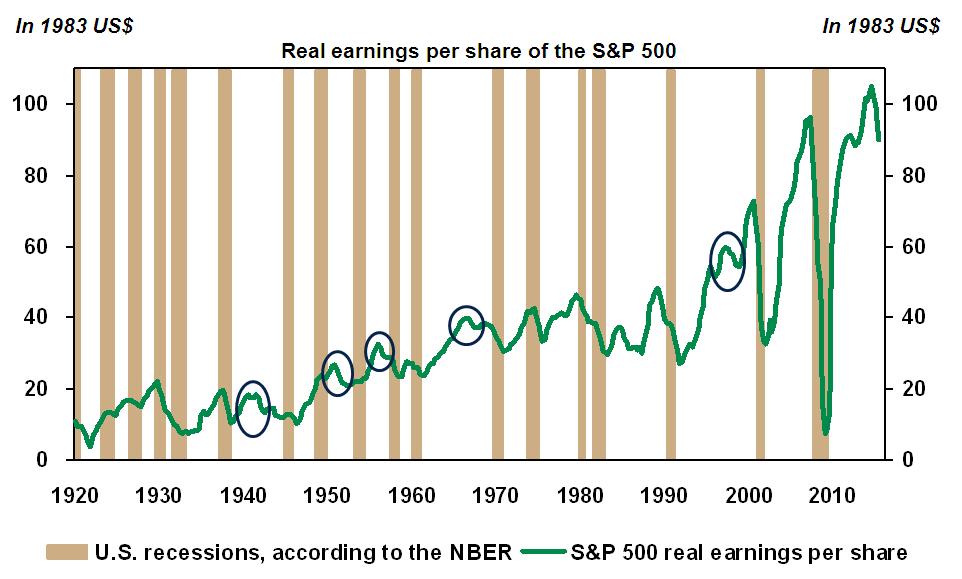

There are a number of factors behind the recent stock market meltdown. First, one of the most frequently cited factors is the peak that was reached in the U.S. earnings cycle last year. According to Bloomberg data, in the fourth quarter, S&P 500 earnings fell 6.5%, marking a third consecutive contraction. Profits in the U.S. equity market are thus in recession, prompting some to speculate that an outright recession might be around the corner. The large body of empirical research that has fleshed out the variables that reliably predict U.S. recessions has seldom come across company earnings. Turning points in profits are in fact a dime a dozen, and while recessions are almost invariably accompanied by profit contractions, the opposite is not necessarily true. There have been numerous instances of so-called real profit recessions, without macroeconomic recessions (Chart 1). We must also keep in mind that the recent downturn in profits is not widespread across all sectors: energy and materials are largely responsible for the contraction.

Sources: Robert J. Shiller, National Bureau of Economic Research and Desjardins, Economic Studies

Sources: Robert J. Shiller, National Bureau of Economic Research and Desjardins, Economic Studies

Secondly, rising labour costs represent another barrier to profits. In 2015, unit labour costs recorded their largest increase since the recession. But note that this situation also has a bright side: with salaries rising and job creation holding steady, U.S. consumers are enjoying renewed spending capacity.

Thirdly, the mess in China is another worrying factor for stock markets this year. The Shanghai equity market index has collapsed by nearly 45% since June 2015, and the Chinese authorities have been struggling to stabilize both the stock market and the currency. But just how important is this really for the United States? After all, the Chinese stock market is less than one tenth the size of the S&P 500, and foreign exposure to that market has been limited by restrictions on inflows of capital.

Finally, we must not overlook the enigmatic link between oil prices and the stock markets in recent months. The correlation with crude oil prices has approached the level of perfection, despite lower fuel prices providing a meaningful boost to economic activity. The United States just recorded its best year of vehicle sales since 2000, driven by a rekindled appetite for large, less fuel-efficient vehicles. Vehicle miles-driven, which were flat ever since 2009, are suddenly rising again. It is therefore hard to see why lower oil prices would constitute a negative factor for the U.S. economy, as the stock markets have seemed to indicate recently.

Would a Bear Market be Justified?

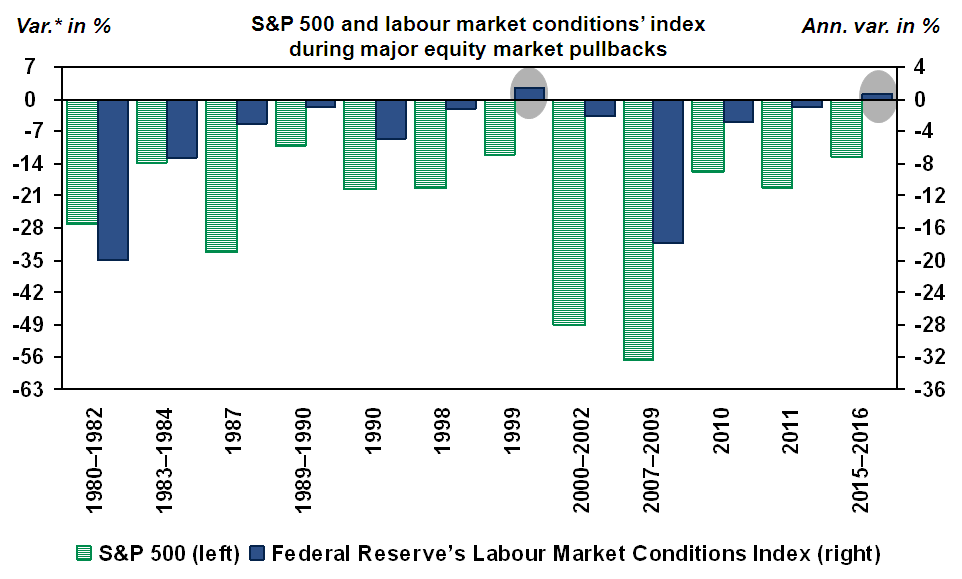

Despite the above arguments, the pessimists stand by their position. They point out that the U.S. industrial sector is struggling, predicting a major decline for the stock market. On that point, history tends to bear them out to some extent. When industrial production has been in contraction, as it is now, major stock market downturns have often taken the form of bear markets (i.e. contractions of more than 20% of the S&P) rather than mere corrections (between 10% and 20%). However, we must not forget the importance of the job market, which continues to improve. Historically, a stock market correction and job market improvement do not go hand in hand. If we look at the historical record of corrections and bear markets going back to 1976, on only one occasion did the job market continue to improve. This happened during the technology stock bubble at the turn of the millennium (Chart 2).

*Peak-to-bottom

*Peak-to-bottomSources: Bloomberg, Federal Reserve and Desjardins, Economic Studies

What should one make of these two conflicting signals? We tend to believe that the manufacturing cycle is a less compelling determinant of overall returns than in the past. This is simply because the manufacturing sector’s share of the U.S. economy is fundamentally smaller than it was a few decades ago. Only two of the ten largest companies by market capitalization on the S&P 500 are pure traditional manufacturers (Johnson & Johnson and General Electric). Real manufacturing profits have been growing at a slower pace than that of earnings in other sectors since the late 1990s (Chart 1), without preventing the S&P 500 from generating a total return of 7.1% on an annual basis since then. By contrast, the job market remains a central pillar, particularly in an economy for which personal consumption expenditures and residential investment account for a combined 71% of GDP. If we rely more on the job market to assess the fundamental context, there is little justification for a bear market for U.S. stocks.

Our Point of View

We currently estimate the chances of a U.S. recession at around 20%. Standing at 3.1% in 2015, growth in U.S. consumer spending is holding its own. The hiring rate is verging on its highest level since 2007. Consumer confidence has been resilient despite January's turbulent markets. The forward price/earnings ratio of the S&P 500 is currently around 15.4, only slightly above its 30 year average. As market volatility continues to recede, U.S. stocks will offer attractive opportunities. Our total return target stands at 7.0% for the S&P 500 in 2016.