InterRent Real Estate Investment Trust (REIT)

Analysis by

Michael Markidis

CFA, Analyst

- Business model involves adding value to existing properties

- Best cash flow growth profile in our coverage universe

- Room for significant distribution hike

| Rating | Buy-Average Risk | |

| 12-month target | C$8.00 | |

| Symbol | IIP.UN, TSX | |

| Sector | Real Estate | |

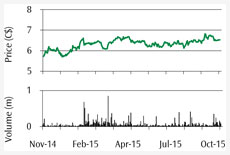

| Recent price | C$6.53 | |

| Total potential return | 26% | |

| 52-week range | C$5.50–6.91 | |

| Distribution per unit | C$0.22 | |

| Distribution yield | 3.4% | |

| Units outstanding | 70.7m | |

| Market capitalization | C$462m | |

| Net asset value (NAV) per unit | C$6.50 | |

| Premium/(discount) to NAV | 0% | |

| Utilized capitalization rate | 5.3% | |

| Implied capitalization rate | 5.2% | |

| Leverage (incl. convertible debentures) | 51.5% | |

| Year-end | Dec-31 | |

| FFO1 per unit | 2015E 2016E |

C$0.35 C$0.44 |

| Price/FFO | 2015E 2016E |

18.4x 14.9x |

| AFFO2 per unit | 2015E 2016E |

C$0.31 C$0.39 |

| Price/AFFO | 2015E 2016E |

21.2x 16.9x |

2 Adjusted funds from operations

Source: Desjardins Capital Markets, Cap IQ, Bloomberg, FactSet

InterRent is an Ottawa-based owner of multi-family residential rental properties with a geographic footprint that is concentrated in primary and secondary markets in Ontario and Québec. Including properties under development, the portfolio encompasses ~8,300 suites with a value exceeding C$1.1b based on International Financial Reporting Standards (IFRS). We believe that InterRent is an attractive investment opportunity that should appeal to growth-oriented income investors. It has the best near-term earnings growth profile in our REIT coverage universe, and we see the potential for a 5–10% distribution increase over the next several months.

Since taking over in late 2009, management has established InterRent as one of the leading value creators in Canadian REIT-land. The REIT’s external property manager, Ottawa-based CLV Group (helmed by InterRent’s CEO Mike McGahan), was instrumental in the turnaround of what was previously a moribund vehicle. Over the past three years, InterRent has developed a two-pronged growth strategy: (1) increasing its presence in three core markets (Greater Toronto Area, Ottawa and Montréal), and

(2) acquiring well-located but often poorly managed properties where returns can be substantially improved through active management and capital improvement programs.

An example of the REIT’s value-creation philosophy is evident in LIV Apartments, the C$100m redevelopment of a 440-suite property located in Ottawa that was acquired in early 2013. Management vacated the entire property and completely redeveloped the asset. The project is nearing completion, with lease-up progressing well and stabilization expected in the second half of 2016. Combined with ongoing repositioning of other properties acquired in 2014–15, we expect LIV to drive above-average cash flow and net asset value (NAV) growth over the next two years.

The REIT’s annual distribution of C$0.22 per unit (paid monthly) provides investors with a cash yield of 3.4%. Given an estimated 2016 adjusted funds from operations (AFFO) payout ratio of just 57%, we have a high degree of confidence in the sustainability of the distribution going forward and expect a 5–10% distribution hike in the near term.

InterRent trades at a 5.2% implied capitalization rate and in line with our C$6.50 net asset value. Our C$8.00 target is based on a ~20% premium to NAV and equates to 20.5–21x our 2016 AFFO. InterRent is rated Buy–Average Risk.