Options Strategies and the Four Classical Elements

When it comes to options, the basic positions are as follows: (a) opening purchase of call and put options, and (b) opening sale of call and put options. These four positions, combined with the opening buying and selling of the underlying security (stock or ETF), provide a fairly high number of combinations. To this, we add that each position can be entered into with different option maturities. In addition, there is a choice of options that are out of the money (OTM), at the money (ATM) and in the money (ITM). In short, a considerable number of possibilities can be envisioned using various option strategies.

Observing the different positions and variants can be compared to looking at the periodic table of chemical elements. Among the dozens of existing elements, it is difficult to determine the specific purpose of each of them at first glance. However, we know that by combining them in certain ways, we obtain the material of the reality around us.

At the time of the ancient Greeks, they were obviously unaware of the chemical elements, but they still declared the existence of fundamental elements. At the time they identified four of them: air, earth, fire and water. One can draw a parallel with the logical and concrete approach of the ancient Greeks by examining the four fundamental option strategies; the same strategies that justify their existence.

- Long deep ITM calls or puts

- Naked put writing

- Covered call writing

- Call or put credit spreads

In this article I limit myself to the first strategy listed; buying call options in the event of rising underlying security with an exercise price is so in the money (ITM) that theoretical value option calculators tell us that the delta is close to 1.

This strategy is part of the family of derivative strategies that fall are called "Delta One". This name evokes action movies in which the hero fights alone against a myriad of enemies and always wins, as in the Rambo movies.

Here, "Delta One" takes on a whole new meaning. The definition of "Delta One" is this: the sensitivity of the option to variations of a given value is exactly the same as the underlying security. So "Delta One" means that if the stock goes up or down $1, the option premium varies accordingly by $1. On the other hand, if the Delta was 0.40, the premium would vary by 40 cents for every $1 change in the underlying security.

The strategy that interests us is therefore the following: An investor, believing that a security will rise, buys a call option with a delta roughly equal to 1. The advantage is that the cost (premium) of such an option is significantly lower than the cost of the underlying security.

To find the delta of an option, it is possible to use the calculator offered by the Montreal Exchange: www.m-x.ca. The tool will be at the "options calculator" page.

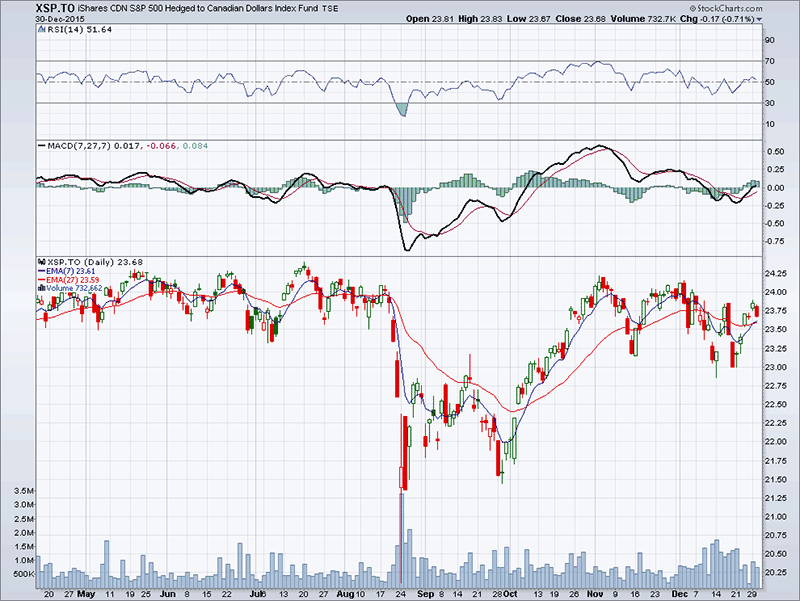

Suppose that the market is generally rising. Here we symbolize it by the XSP.TO (the US S&P 500 traded in Canadian dollars). However, the chart can perhaps make us doubt the assumption that the market is on the rise. Here is where this strategy proves most useful.

Source: Stockcharts

Source: StockchartsExample (as of the close of December 30, 2015):

- The underlying is the XSP.TO at $23.68

- The XSP.TO call option expires June 17, 2016

- The exercise price is $20.00

- The option premium is $4.00

- Implied volatility is 26.1%

- Short-term interest rate is 0.715%

Entering this data into the option calculator (and ignoring the section about dividends), we get the following results:

- Premium: $4.08

- Delta: 0.8582

- Theta: -0.0032

We can therefore say that:

- This option is selling at a price very close to the theoretical price ($4.00 vs $4.08)

- The Delta is not 1, but it is still high at 0.86;

- The Theta (which represents the erosion of premium for each day) is negligible.

Specifically, if an investor buys five options, he will pay $4.00 x 5 x 100 = $2,000 (before commissions). In exchange, he will obtain a product that responds to 86% of the movements of XSP.TO.

However, a daily loss of $ 1.60 should be considered due to the natural erosion of the premium (= 0.0032 x 500) on the amount invested. This suggests that the position should be liquidated by selling the five options once the desired gain has been made, without too much wait.

Ideally delta would be equal to 1, but to achieve this we would need a call option with a strike price of $18 or $19, and the lowest exercise price offered by the Exchange is $20.

If a purchase of 500 shares of XSP.TO had been done, the cost would have been $11,840 (= 500 x $23.68) (before commissions). In this case, a delta equal to 1 would have been achieved.

We now see the benefit of the call option strategy. With an investment of $2,000, it is possible to gain (or lose) 86% of the movement upward or downward of the XSP.TO price. By owning the shares instead of the call options, the delta would be 1, but with an outlay of $11,840.

Note that the maximum loss with the option purchase is $2,000 while buying stocks has a theoretical maximum loss of $11,840.

What happens if (still using December 30, 2015) instead of choosing the call option that expires June 17, 2016 we choose another option that expires earlier, on March 18, 2016?

Keeping the date of December 30, 2015 we have:

- The underlying is the XSP.TO at $23.68

- The XSP.TO call option expires March 18, 2016

- The exercise price is $20.00

- The option premium is $3.80

- Implied volatility is 29.2%

- Short-term interest rate is 0.715%

Entering this data into the option calculator (and ignoring the section about dividends), we get the following results:

- Premium: $3.85

- Delta: 0.9119

- Theta: -0.0037

We can therefore say that:

- This option is selling at a price very close to the theoretical price ($3.85 vs $3.80)

- The delta is higher than in the case of the June 17, 2016 call: 0.91;

- The theta (which represents the erosion of premium for each day) was slightly higher than the previous option.

So if an investor buys five options, he will pay $3.80 x 500 = $1,900 (before commissions). In exchange, he will have a product that responds to 91% of the movements of XSP.TO.

However, a daily loss of $1.85 (= 0.0037 × 500) erosion should be considered on the amount invested. This suggests, as in our previous example, that the position should be liquidated by selling the five options once the desired gain has been made, without too much delay.

By comparing two options with a difference of three months in maturities, we note that there is no noticeable difference with regard to the delta and theta. The real difference is in the fact that the option maturing in March 2016 gives us 77 days to make a profit, whereas the option maturing in June 2016 gives us 168 days.

It is therefore a matter of perception of what will happen in the market and when.

For example, if technical signals clearly indicate that there is in an impending increase in the market, one can choose a call option maturing even earlier than March. In this case, with an identical exercise price, the delta is naturally higher and the premium is less than the previous two examples. However, as nothing is free with options and fewer days are then available to make a profit.