Regional Disparities are Still Significant in Canada

- The Canadian economy is not done adjusting to the drop in commodity prices, despite improved economic conditions in the short term. Canadian real GDP should grow by 1.5% this year. For 2017 a gain of 2.3% is expected, with more sources of growth at work and a larger contribution from public spending.

- Regional disparities will remain significant in Canada in 2016 and 2017. Ontario and British Columbia will benefit from the diversified nature of their economies and the pick-up in the manufacturing sector due to the relatively strong demand from the United States and the weaker loonie, while downward adjustments in energy prices will continue to restrain economic growth in Alberta, Saskatchewan, and Newfoundland and Labrador.

- In Quebec, the sluggish economy should see some improvement starting in 2016. Private and public investment will begin to rise, while household spending should increase at a slightly faster pace thanks to tax relief measures. Real GDP should grow by 1.3% in 2016 and by 1.8% in 2017.

- In the United States, the main indicators have posted mixed signals, and real GDP growth should be under 2% in the first quarter. The U.S. economy will continue to be affected by the strong dollar, with additional negative contributions from net exports expected over the next few quarters. Starting in 2017, this impact is likely to subside. Some signs of recovery in the manufacturing sector have already started to show. U.S. real GDP should post growth of 2.2% in 2016 and 2.5% in 2017.

- The Chinese economy will likely continue to slow down in 2016. After posting 6.9% real GDP growth in 2015, the Chinese authorities are targeting 6.5–7.0% for 2016. The real GDP of the emerging economies should increase to 4.0% in 2016, following 3.9% growth in 2015.

- The very tough start to the year in the markets has given way to renewed optimism since mid-February, generating a remarkable rally in the stock market, commodity prices and the Canadian dollar. Still concerned, the Federal Reserve is now suggesting only two interest rate hikes of 0.25% between now and the end of 2016. In Canada, the latest news seems to confirm that no further cut in key interest rates is needed north of the border. The first hike in Canadian interest rates will likely not happen before the end of 2017.

- The inherent risks to economic and financial scenarios remain substantial. The weakness of emerging economies, notably China, remains a source of concern. Moreover, the pullback of the European economy and continued geopolitical risks could disrupt the global economy. Another source of uncertainty is the referendum on whether the United Kingdom should remain a member of the European Union. In the United States, growth could be further dampened by cautious households as well as by the negative impact from curtailed oil investment and the strong U.S. dollar. The scenarios could also be altered by the outcome of the U.S. presidential elections in the case of a significant change of governance. In Canada, economic hardship could intensify and continue due to the very low oil prices. In Quebec, the slight acceleration in economic growth could be compromised by softness in exports and business investment.

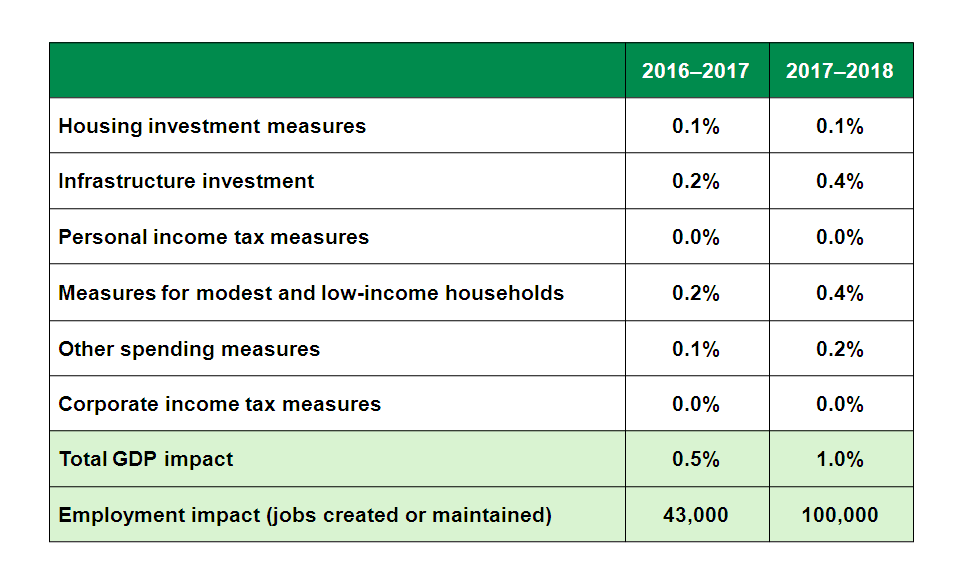

Note: Totals may not add due to rounding.

Note: Totals may not add due to rounding.Source: Department of Finance Canada