Some Things to Consider When Preparing Your Tax Return

We are in April and if you haven’t already, now is the time to prepare your tax return. We take this opportunity to update you on some issues of concern to investors.

Admissible Spin-Offs

In our newsletter of March 2014, we discussed the benefits of applying section 86.1 of the Income Tax Act, which one can elect to use when certain foreign spin-offs occur. This section allows you to:

- Carry over the income generated by the spin-off;

- Divide the tax cost of shares between the original shares and those held following the spin-off;

- Generate a capital gain later on the sale of shares.

For a more complete explanation, we recommend you read our newsletter of March 2014.

For 2014, eligible transactions for this choice are as follows, according to the Canada Revenue Agency (CRA) website:

| Original Corporation | Spin-Off Corporation |

|---|---|

| Occidental Petroleum Corporation | California Resources Corporation |

| Kimberly-Clark Corporation | Halyard Health Inc |

| Agilent Technologies inc. | Keysight Technologies inc. |

| Chesapeake Energy Corporation | Seventy Seven Energy Corporation |

| Oil States International Inc. | Civeo Corporation |

| Automatic Data Processing, Inc. | CDK Global, Inc. |

| Simon Property Group, Inc. | Washington Prime Group Inc. |

| National Oilwell Varco Inc. | NOW Inc. |

| Dover Corporation | Knowles Corporation |

| Time Warner Inc. | Time inc. |

| ONEOK, Inc. | ONE Gas, Inc. |

| Sears Holdings Corporation | Lands' End, Inc. |

| Rayonier Inc. | Rayonier Advanced Materials Inc. |

We usually detect such a spin-off when preparing an investor's tax return, when unusually a large amount of income appears on the T5. Therefore, it is important to remain vigilant and to review one’s portfolio in the light of the above information, to avoid paying unnecessary income tax.

The Google Stock Dividend

In 2014, Google paid a stock dividend to its shareholders. Unfortunately, this transaction can not benefit from favourable treatment under Article 86.1 of the Tax Act on income. For each class "A" owned by an investor, a class "C" share was issued. Overall, the value of class "A" shares was split into two once the dividend paid. According to the financial statements of the company, an amount of $0.001 was credited to shareholders' capital.

For example, an investor who held 10 class "A" shares on the day of the transaction with a cost of US $9,000, the tax benefits can be described as follows:

- A dividend of $0.01 is deemed received by the investor (10 x $0.001). This amount will appear on the T5.

- The cost base of the class "A" shares remains $9,000. Considering that these shares were worth $5,698 after the transaction was completed, there is an unrealized loss of $3,302.

- The 10 class "C" shares will have a total cost of $0.01. On the date of the transaction, the price of these shares was $571.50. Therefore, their disposition could generate a capital gain of $5,715.

It is important to keep in mind the above rules for calculating the cost base of the shares, as the class "A" and class "C" will generate very different results in the future.

The Foreign Balance Sheet

In our newsletter of January 2015, we discussed the need to produce a foreign balance sheet on the T1135 form when an investor owns shares of a foreign company. We then pointed out that the form must be produced for foreign securities held by a current account, even if held at Desjardins Online Brokerage, a Canadian financial institution. For the CRA, what counts is the place of incorporation of the company in which you hold securities, not the ownership structure. Thus, holding securities that trade on the New York Stock Exchange could subject you to this rule if the cost of securities held exceeds $100,000 (after foreign currency conversion). Securities held in an RRSP, RRIF and TFSA do not have to be disclosed on this form.

Last year, it was possible to benefit from an exemption for certain securities in particular where the dividends were paid by the foreign company, and that they appeared on a T5 slip. This exemption was not renewed in 2014 as part of the fourth revision of the form and CRA requirements.

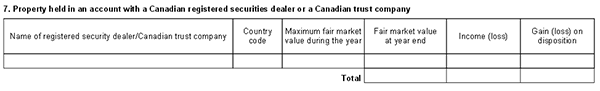

For 2014, here is the information that must be sent to the Canada Revenue Agency:

- You must complete the table in section 7 of the form regarding securities held in a current account.

- Information must be combined by country of incorporation of the companies in your portfolio.

- You must provide the total requested for each country on separate lines of the T1135.

- The maximum fair market value during the year must also be provided for each country. This may be based on the highest fair market value at the end of the month.

We continue to hope that legislative amendments will be proposed to exempt investments held in a Canadian financial institution, as we believe that completing this form is rather tedious and of questionable usefulness.

When preparing your tax return, make sure to take advantage of all the deductions and tax credits to which you are entitled. For 2014 you may consider splitting family income. You may be entitled to a credit of $2,000. The calculation of this credit is particularly complicated and it is easy to fall into the many traps that such an exercise entails. Feel free to ask questions and to consult an expert in order to avoid mistakes and paying too much tax.