The Collar: Everyone's Gem (or Almost)

The term "collar" refers to a risk hedging strategy but it is reminiscent, for those who know their history, of Queen Marie Antoinette's famous Affair of the Diamond Necklace of 1785 as the epitome of fraud and stupidity.

Fortunately, the collar in Finance is an excellent example of the opposite; an intelligent and effective strategy. It belongs to the family of strategies called "Delta 1", which means that this kind of strategy uses derivatives to try to replicate the behaviour of an investment, but in the opposite direction. This type of strategy aims to cover the risk of loss on a stock or ETF and not to make a profit. It is essentially a price hedging strategy. It would be a shame not to take advantage of it.

To implement the strategy, several conditions must apply. The first is to own the security that is to be protected, for example, 1,000 shares of XSP.to (Canadian dollar ETF which mimics the S&P500). The second condition is to be pessimistic about the rest of the market. Third is that we do not want to sell the security. Fourth is that we prefer to purchase a collar instead of HVU.to, which rises when the XSP declines.

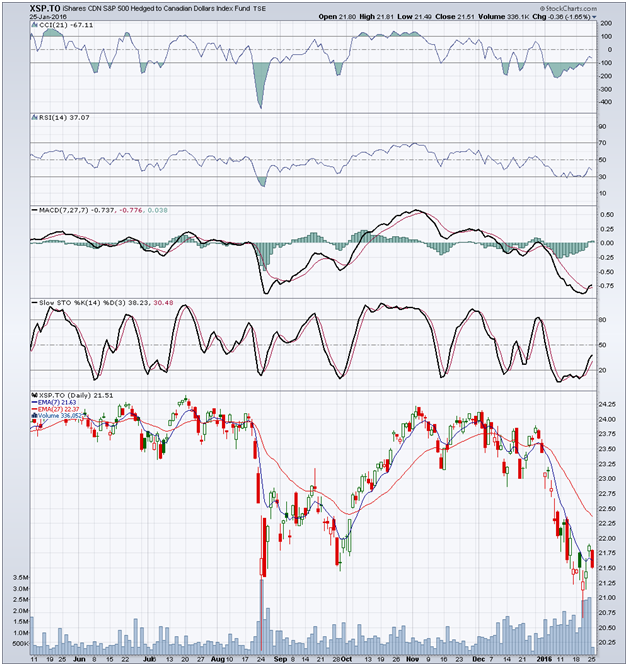

Since mid-December 2015, the North American market in general has shown signs of exhaustion, as if it was swimming against the tide and was out of breath. This is evident in the monthly XSP.to chart (Chart 1). After an impressive increase between 2009 and the start of 2015, any rise receded during 2015, to finally take a downward slope (see the daily Chart 2). Since January 2, 2016 the path down has been considerable. If the North American market continues this tumble, the trend will truly be downward.

Source: Stockcharts

Source: Stockcharts

We can see more clearly using these four indicators (the four musketeers of technical analysis: CCI, RSI, MACD, STO), which all give a pessimistic view of the future, especially over a long-term period (Chart 1).

Source: Stockcharts

Source: Stockcharts

An Example of a Collar

On 25 January 2016 the XSP.to closed at $21.51 (the following option premiums are from the close of market on the same date).

Fearing a decline, an investor buys a put option allowing them to limit their loss to $21.00.

To give this strategy long term protection they buy ten puts (each option represents 100 shares) which expire April 15, 2016 with an exercise price of $21.00. The price per contract on the Montreal Exchange is $0.85. For 1,000 shares this implies an outlay of $850 (plus commissions), a significant amount to risk losing if XSP.to moves up instead of down. In fact if the price rises, the premium of $0.85 per share loses value and in addition, it decreases over time because of a factor called theta (time value), also described as the "cancer" of premiums.

Not to be stuck with these expensive drawbacks, the investor sells (selling open or short) 10 call options with a maturity of September 16, 2016, and an exercise price of $22.00. The premium received is $0.90, so for 1,000 shares, they receive $900 (less commissions).

In summary: We own the security as well as the put option with a strike price of $21.00 which expires on April 15. We also have an open short position on a call option with a strike price of $22.00 expiring on September 16. The collar is composed of the two options combined. Its advantage is that it costs virtually nothing as the sale of the calls compensates for the cost of the put options.

Advantages of this collar: if the price of XSP.to drops below $21.00 by April 15 (80 days as compared to the initial date of the strategy, January 25, 2016), the combined effect of the gain on the put options and the premium erosion of the call options will compensate 90% (the sum of the two deltas) of the loss of XSP.to and will reach 100% if the price continues falling.

Disadvantages of this collar: if the price goes higher than $22.00, the value of the call options will increase, erasing any gains made on the security. So $22.00 is the upper limit of achievable profit on the security for the 234 days remaining on the term of the call option (as compared to the original date of January 25, 2016).

Disadvantage of this specific strategy if we use it passively: the reason for choosing two different expiry dates (80 days for the put and 234 days for the call) is of course to create a collar without a debit. However, while the put option will expire in April, the call option will be open for another 154 days (the difference in days between the expiry dates in April and September). This strategy is called a "diagonal" collar, characterized by two expiry dates and two exercise prices. The collar is therefore effective until April 15, after which the position becomes a covered call option until September. Of course the investor can buy back the call option at any time, if the covered sales strategy does not suit them.

Another version of the strategy: a "vertical" collar uses the same expiry of April 15 for both options but the premium for the calls will be $0.55, generating a credit of $550 (less commission). This strategy results in a debit of $0.30 per option pair, per share ($0.55 - $0.85) for a $300 cost for 1,000 shares. The advantage of paying $300 rather than enjoying a free collar is that both options will expire on April 15 (unless the investor has liquidated the position before expiry).

Will the investor see his option exercised and sell his shares in case of a rise of the security? Yes, but only if the call options expire in the money. In this case, the investor can buy back their call options to avoid being exercised and having the collar dismantled, especially as they previously had no reason to expect the security to rise.

Finally, the collars described here use out-of-the-money (OTM) options in nearly symmetrical positions relative to the price of the security; but there are several other possible combinations. For example, using an at-the-money (ATM) call option rather than out-of-the-money. Collars can therefore be adapted to the expected change in the price of the security, and they can of course vary depending on the price that the investor is willing to pay.