The Marshmallow Test

In the late 1960s, Walter Mischel, an American psychologist at Stanford University, invented "the marshmallow test" to give to preschoolers. He proposed to them a choice: if a child wants a marshmallow, he can have it immediately but if he waits a bit (15 minutes), he will get two of them. Once they became adults, children who were able to wait generally showed a greater ability to succeed in life because they were more able to manage deferred gratification.

If, after a positive movement of the stock market, it becomes turbulent and one is undecided on what they must do, is it better to leave the market immediately (one marshmallow) or wait until the market stabilizes and to resume its climb in order to have two marshmallows later?

We know that stock market risk is always there and that we are never sure of our predictions.

Throughout the decades, we have developed techniques to try to control this uncertainty. The generic name is "portfolio insurance". Its purpose is to protect a portfolio when the market is, presumably, temporarily down. Today, there are a dozen techniques and several variants of portfolio insurance.

For example, below are three of these methods: they are albeit institutional strategies, but apart from the first and with a few adjustments, they can be used by most investors.

A. Portfolio insurance using futures.

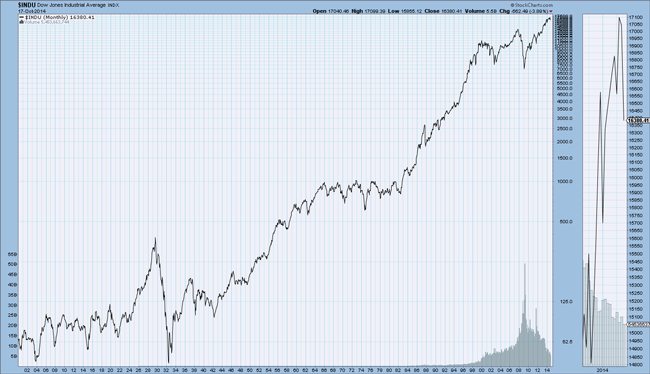

The first to propose a method of portfolio insurance was the Nobel Prize winner in Finance Mark E. Rubinstein in 1976. The strategy is to keep the portfolio as it is, but in short selling derivatives such futures contracts on stock indexes, such as the US S&P 500 (which trade on the Chicago Mercantile Exchange) or, in the case of Canadian portfolios, in the S&P/TSX60 (which trade on the Montreal Exchange). When the market goes down, the contracts generate a profit equivalent to the loss in the portfolio. When the market later goes up again, the manager buys back the futures contracts and makes a profit made on the contracts, while the portfolio goes back to its original value. This method is better managed today than in the 1980s. Historically, however, the stock market crash of Monday, October 19, 1987 (see chart) is attributed to this technique. It was one of the worst: in one day, the Dow Jones Industrials had lost almost 23%. The cause boils down to this: the fear of a falling market creates selling short futures contracts, which convinces other managers that the market is going down. These managers then sell their securities portfolios. These sales generate a market decline, causing other managers to sell short more futures in order to counter the decline, and so on. In short, the prophecy of the market decline in part caused the market decline.

Source : Stockcharts

Source : StockchartsImmediately after this crash, the securities exchanges developed regulations that temporarily suspend downside risk due to derivatives. Since then, we have seen other declines in the market, but none have been due to this portfolio insurance technique.

B. Portfolio insurance using options.

This type of portfolio insurance consists of buying put options. For example, a manager has a portfolio of high quality stocks with a price of $100 per share and wants to protect it with a put option of 150 days. The manager pays $3.11 to buy a put with a strike price of $100. To pay the premium of the put, he sells short a call option with the same maturity and exercise price as the put, the premium is also $3.11note de bas de page 1. The overall strategy costs nothing because the credit from the calls sold offsets the cost of the put that was purchased. This strategy, of which there are several variants, is called a collar. This is an excellent strategy for portfolio insurance, provided that there are options listed on the securities to protect. Otherwise, it gets more complicated: one must use index options and know the correlation between the behaviour of the stock price and the index.

This collar behaves the same as the portfolio to cover but with an inverse position relative to the portfolio, generating a profit equal to portfolio losses.

General considerations for methods A and B

The elegance of these methods hides some practical drawbacks: the moment when the market reverses direction is uncertain and therefore, the protection may be excessive, inadequate or even harmful if the market starts to go up instead of down. These insurance strategies are rather rigid, static. To overcome this rigidity, managers use, for example, fewer contracts than necessary, or even fewer collars. However, this may mean insufficient coverage, depending on the case.

C. Portfolio insurance without derivatives.

This method is called Constant Proportion Portfolio Insurance (CPPI). This is a technique developed after the crash of 1987. Its authors are Black and Jones. The purpose of this technique is to maintain the value of the portfolio at a given floor value, regardless of the magnitude of the market fall, while retaining a gain if the market goes up. CPPI does this without the use of derivatives such as futures or options, and it is dynamic.

Paraphrasing the example offered by Black and Jones, we must first define a floor value of the portfolio. If, for example, the present value of the total portfolio is $100 and the floor value is $80, then the $20 difference is called the "cushion". This lower boundary depends on the manager's degree of risk aversion. For example, it may represent the worst daily decline experienced in the market. The portfolio consists of two parts: a risky portion consisting of securities and a risk-free portion invested in Treasury bonds.

We label the number of dollars invested in the risky portion in portfolio with the letter "e". Again by way of example, let's say that the portion at risk is worth $50 and the portion invested in Treasury bonds is also $50.

We now calculate the "multiplier". This is the ratio between our investment in the risky portion and the cushion (the amount we agree to lose in the worst scenario). We have: $50/$20 = 2.5. This means that investing in shares (the risky portion) should be 2.5 times the maximum amount of risk. Here are two scenarios that illustrate the use of this data.

Scenario 1: Dropping market

For simplicity, we assume that the risk-free portion of the portfolio is not subject to fluctuations and that only the equity portion can change in value. We also assume that the price of securities in the risky portion is initially $100.

If the stock price drops from $100 to $90, the value of the risky portion becomes $45 (= $50 x 0.90). The total value of the portfolio is now $95 (=$45 + $50). The cushion has fallen to $15 (=$95 – $80) so the risky portion of the portfolio must be lowered to $37.50 (=$15 x 2.5). The risk-free portion becomes $57.50 (=$95 – $37.50). It is therefore necessary to reduce the risk by selling $7.50 (=$45 – $37.50) of shares and buy $7.50 of Treasuries.

Scenario 2: Rising market

If, instead of falling, the value of the shares rises to $ 110, the value of the risky portion becomes $55 ($50 x 1.10). The total value of the portfolio is now $105 (= $55 + $50). The cushion, initially at $20, is increased to $25 (=$105 – $80). By multiplying 2.5 times the new cushion, we get $62.50 (= 2.5 x 25). This new amount now becomes the risky portion, although initially it was $50 and it had risen to $ 55. The Treasury bonds portion is lowered to $42.50 (= $105 – $62.50), whereas initially it was $50. The manager must sell $7.50 (= $50 – $42.50) of Treasury bills and buy shares for $7.50 to reach the new target of $62.50 in the risky portion.

General considerations for method C

We can see from these two scenarios that if the stock rises, we increase the risky portion and we reduce the risk-free portion. Conversely, if the stock is down, the risk-free portion is increased and the risky portion is reduced.

This technique was created to gradually protect a portfolio that is declining, without allowing it to go below the established floor value, or $80 in our example. In case of rising market, this technique does not generate a profit as fully as we would by investing 100% of the portfolio in stocks.

In general, the purpose of portfolio insurance techniques is to control, as much as possible, market uncertainty without liquidating all risky part of the portfolio as the market declines. We ultimately aspire to have two marshmallows, rather than one.

Notes

- Calculated using the Montreal Exchange Covered Call Calculator: volatility 12%, short-term interest rate: zero. The zero interest rate allows for identical theoretical premiums of the two options in this article.