The Myth of Sisyphus

Awhile ago the press reported on the case of a bank that was fined nearly $100,000 by financial market regulators, because one of its representatives had traded an "inverted yield" exchange traded fund (ETF) in the portfolio of a client for an undetermined period of time. Why such a penalty?

Inverted yield ETFs aim to generate a profit when a benchmark loses value, which helps protect the value of a portfolio, since the profit generated by these ETFs compensates for a loss of value of other securities. An investor can therefore maintain their dividend income while retaining the securities they hold in their portfolio.

This strategy seems logical and excellent. However, the official website www.sedar.ca ATTENTION - Ce lien ouvrira dans un nouvel onglet., where one can find the prospectus for Canadian institutions and companies that issue financial products, indicates that some ETFs are not recommended and explains why they should not be held for longer than one trading session.

To understand this recommendation, we must take a step back. ETFs have experienced and continue to experience tremendous growth. For many investors they compete more and more with traditional investment funds. There are three main families of these funds:

- Index ETFs;

- Futures ETFs;

- Strategic ETFs.

Index ETFs are the first family of ETFs available on the market. They are the mere reproduction of a stock index and their risk is that of the index. They therefore have no manager and the annual management expense ratio is minimal (often less than one fifth of 1%). Among the most popular in Canada, in terms of volume traded on the Toronto Stock Exchange, is the XIU which replicates the Canadian S&P/TSX 60, and the XSP which tracks the US S&P500 in Canadian dollars.

ETFs in the third family vary greatly. They include "smart betas" for example, whose investment strategy differs for each ETF (which will not be discussed here).

Futures ETFs are a different family of index ETFs and replicate a futures price, which is in turn the "shadow" of a market index. For example, the futures contract on the S&P/TSX60 is called "SXF" and it is traded on the Montreal Exchange, which is the Canadian center for derivatives. A futures ETF issuer takes positions in these contracts; he "works" them and then offers them to investors, mainly labeled as (a) "double leverage" (b) "triple leverage" and (c) "inverted yield" (single, double or triple leverage) instruments.

When the issuer buys these futures, he pays nothing; they must simply post margin, a kind of guarantee required by futures exchanges, but not a cash outlay. This margin is small compared to the value of the contract. The issuer offers a product whose value is much higher than the down payment. Indeed, at the time of this writing, the SXF contract, which expires in September 2016, is at 819.40 points. Each point is worth $200 so that the contract is worth $163,880. Exchange regulations assert that the margin necessary to acquire this type of contract is only $8,000. If we divide the value of this contract by the margin, we get about 20, meaning that with a margin of only $8,000, the buyer is responsible for an amount twenty times greater. In other words, one dollar of the issuer controls $20 of futures contracts.

However, the issuer cannot offer such a product to investors, because their business is to sell ETFs, for example, with double leverage (an investor's dollar is responsible for two dollars). The issuer therefore sells products with a leverage that must correspond to what is indicated in the prospectus. Financial authorities do not allow products to be leveraged more than three times. The issuer must therefore "dilute" the leverage of the futures contract for the buyer, for example, to 1:2 for a double leverage ETF or 1:3 for a triple leverage ETF. To do this, they adopt other derivatives, which is part of the daily work of the ETF issuer's financial analysts. Once the desired ratio is achieved, the ETF goes awry. The procedure must therefore start again every day in order to set it again, just like an old coil watch that has to be adjusted every night because it runs too fast or too slow. Finally, it is as if the issuer closes their futures positions daily to immediately reopen them. This work calls to mind Sisyphus, the character in Greek mythology that Zeus condemned to forever push a rock up to a mountain top without ever succeeding, because once he reached his goal, the rock rolled down and he had to start over again. In conclusion, if an investor buys a futures ETF and holds the position from one session over to another, it will most likely not have the desired double or triple effect. In principle, they should sell the ETF late in the session and buy it again the next morning. At least that is the recommendation in the prospectus for these products.

An unintentionally negative effect of these ETFs is called "beta slippage". This refers to the conventional asymmetry between gains and losses. For example, the security of an investor with a starting price of $100 hits $90 if the value drops 10%, for a loss of $10. For the value to climb back to $100, an increase of 11% is required. If the price only goes up by 10% from $90, the investor gets $99 or one dollar less than their initial capital, despite the fact that a 10% gain looks like it cancels out a 10% loss. In the case of a double leverage ETF, if the benchmark index falls by 10%, the ETF should fall by 20% to $80. From $80 to $100, it must climb back 25%. Here we see the risk of double leverage ETF: it amplifies the effect of the natural asymmetry between gains and losses. A triple-leverage ETF further accentuates this phenomenon.

A third aspect, which may affect profitability for this type of product if one holds it in their portfolio for more than a short period of time, is that the index future expires on a specific date and must be replaced by a contract that expires later. However, the two contracts are not the same price. This is called a "contango"; when the price of the longer contract is higher and "backwardation" when the price of the longer contract is lower. For example, the September 2016 SXF contract is at 819.40 points and that of March 2017 is at 809.20 points, so in backwardation. If the rollover from September to March SXF was done today, we would see the ETF's price drop for reasons that are not related to the performance of index. There are, of course, techniques to mitigate these price changes due to rolling, but the gap remains.

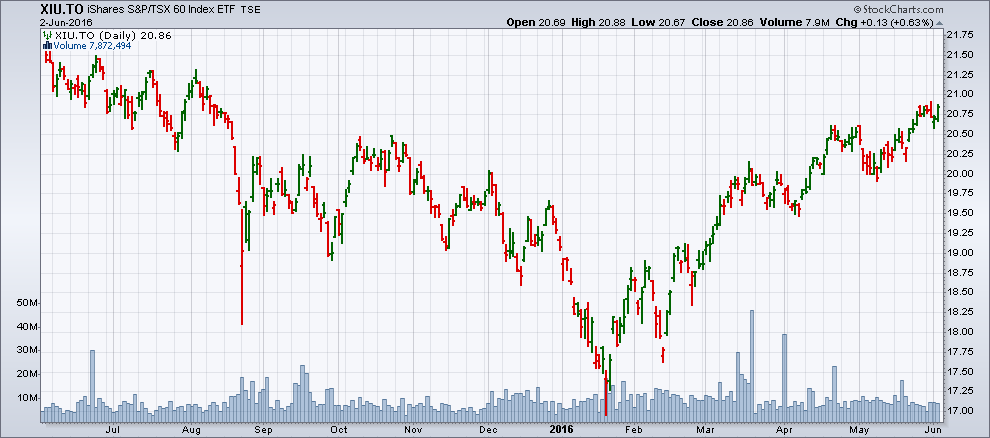

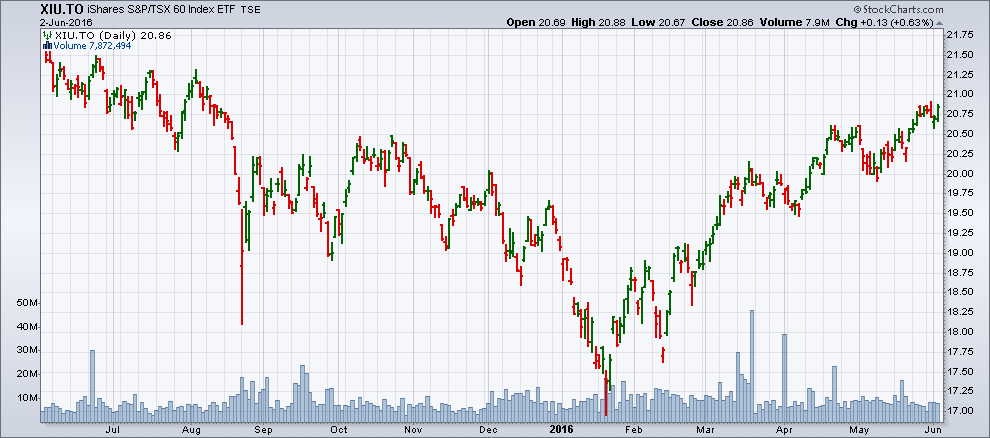

The three charts below show the XIU ETF (a traditional index ETF), the double leverage ETF for the same index (HXU) and the double leverage inverted yield ETF (HXD). The goal is to demonstrate that the performance of the latter two do not correspond to what one would expect.

Source: Stockcharts.

Source: Stockcharts. Source: Stockcharts.

Source: Stockcharts. Source: Stockcharts.

Source: Stockcharts.In the table of returns, we see that, in the case of double leverage ETFs and double leverage inverted yield ETFs, the expected returns do not correspond to what they theoretically should have been.

| Performance of the three ETFs in the charts above | June 4, 2015 | June 2, 2016 | Return (%) | Expected Return (%) |

|---|---|---|---|---|

| XIU | $21.50 | $20.67 | – 3,86 | – 3,86 |

| HXU | $29.55 | $26.39 | – 10,69 | – 7,72 |

| HXD | $9.08 | $8.80 | – 0,03 | + 7,72 |

This table represents only returns during a given period. By changing the period, the deviations may also change. Sometimes returns are correlated and sometimes they are not, depending on the volatility of price movements. The higher the volatility (market shocks), the more the asymmetry between gains and losses is reflected in the results.

In conclusion, futures ETFs should be used in the short term, mainly when technical analysis shows a change in market direction. They should not be considered the same as traditional index ETFs (like the XIU, for example).