The U.S. Budget Situation: Much Worse Despite Economic Growth

Decisions by the Trump Administration and Congress Come with a Big Price Tag

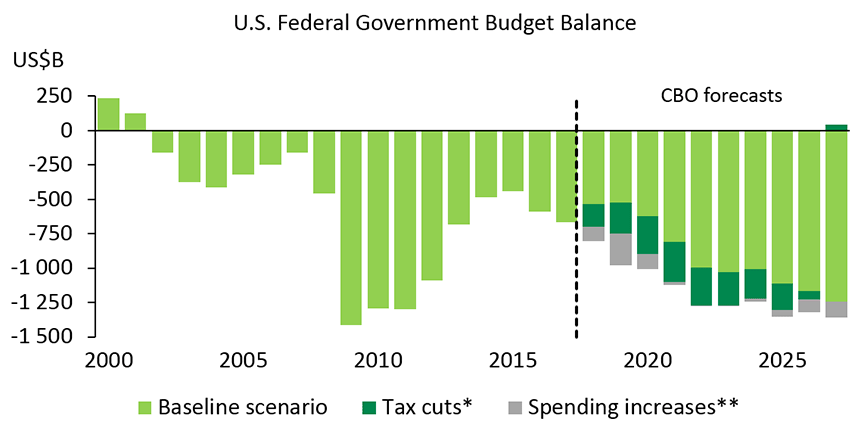

The Congressional Budget Office (CBO), a non-partisan congressional agency whose role is to assess the budget outlook and costs of various bills of the federal government, recently released its forecasts for the 2018–2028 outlook. It is clear that the recent trend of eroding public finances will persist in the coming years. The federal government's budget balance will go from -US$665.4B in 2017 to -US$804B in fiscal 2018, which will end on September 30. The deficit will keep ballooning over the next few years, and should go above US$1,000B as of fiscal 2020. The deficits also represent increases in terms of the proportion of GDP. From 3.5% in 2017, the percentage goes to 4.0% as of 2018 and keeps rising toward 4.5% in 2019. It is forecast to peak at 5.4% in 2022. It then remains relatively stable at around 5% after that.

Note that, in the CBO's projections, expenditures as a proportion of GDP go up substantially, rising from 20.8% in 2017 to 23.6% in 2028. This increase is due to the fact that expenditures for Social Security and old age pensions are expected to increase due to population ageing. There is also an increase in discretionary expenditures in 2018 and 2019, with respective annual growth of 6.6% and 6.4%. This mainly comes from the 2018 budget agreement (Bipartisan Budget Act of 2018) and the recent bill on the government's annual financing (Consolidated Appropriations Act), the fruit of negotiations between the White House and Republican and Democratic leaders of Congress. Without these legislative changes, the spending increases would be much smaller in the near term.

The other main contribution to the swelling deficit in both the short and long term is the tax cut bill that passed at the end of last year. Between 2017 and 2018, federal revenue from tax (personal income tax, payroll tax, and corporate tax) goes up a little in current dollars, rising $13.5B or 0.4%. That is small potatoes relative to the 5.2% growth by nominal GDP that the CBO is forecasting for 2018. Including the positive impact of tax relief for households and businesses on economic growth, the budget cost will be US$164B in 2018 and US$228B in 2019. Over 10 years, the total cost is US$1,854B when the positive impact predicted by the CBO is included. Note that the combination of higher expenditures and tax cuts will play a major role in the deterioration of public finances. These measures will therefore erode a budget situation that was already heading in the wrong direction (Chart 1).

CBO: Congressional Budget Office

Sources: CBO and Desjardins, Economic Studies

CBO: Congressional Budget Office

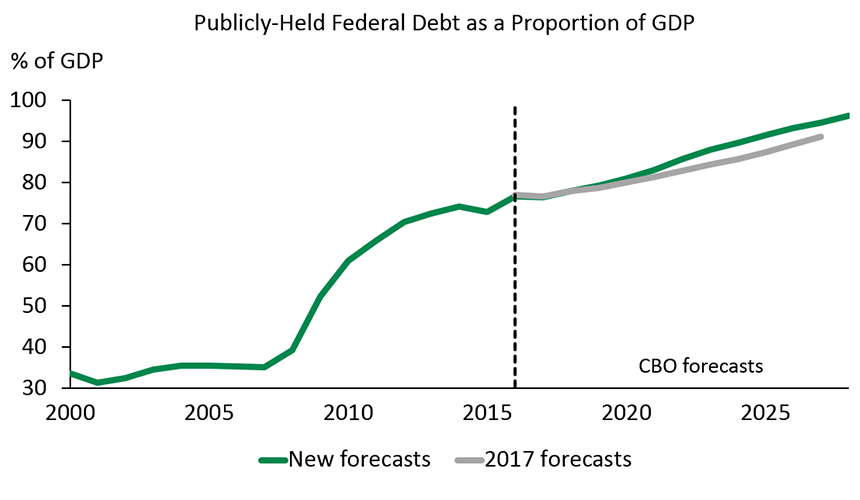

Sources: CBO and Desjardins, Economic StudiesInevitably, ballooning annual deficits will have a direct impact on U.S. federal government debt. Its gross debt exceeded US$20,000B during 2017 and stood at US$21,090B at the end of March 2018. The federal government itself holds much of this debt in various dedicated funds. It is therefore more relevant to look at publicly-held debt, which went from US$14,673B at the end of fiscal 2017 to US$15,428B at the end of March 2018.

The CBO expects publicly-held debt to rise from US$15,668B – when fiscal 2018 ends on September 30 – to US$28,671B in 2028. As a proportion of GDP, debt will thus increase from 76.5% in 2017, to 78.0% in 2018, and 79.3% in 2019, peaking at 96.2% in 2028. This is a net deterioration from what the CBO forecast last year (Chart 2).

CBO : Congressional Budget Office Sources : CBO and Desjardins, Economic Studies

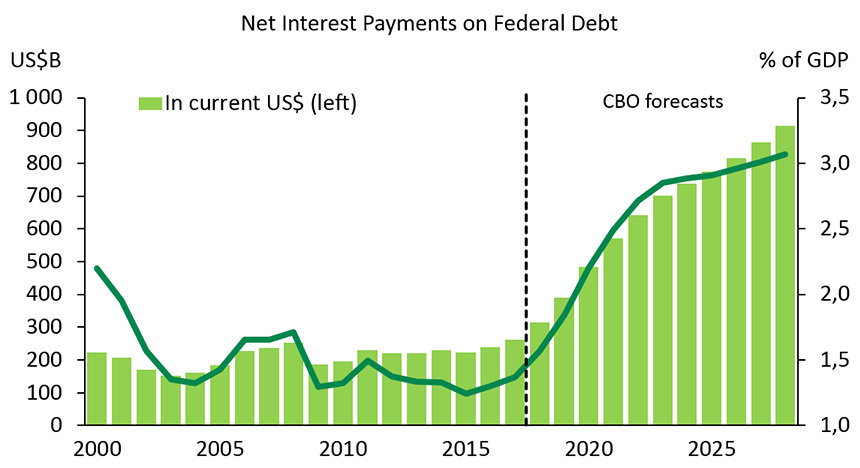

CBO : Congressional Budget Office Sources : CBO and Desjardins, Economic StudiesDespite its current and expected magnitude, the large U.S. debt does not pose a financing problem. The federal government still has a good credit rating (even though Standard & Poor downgraded it in 2011 after the debt ceiling crisis). Interest rates on bonds remain low. However, how the situation will evolve remains to be seen. Will demand for U.S. bonds be enough to meet the supply resulting from the higher debt, without bringing interest rates up sharply? The baseline scenarios are banking on some continuity with bond yields, which are primarily subject to movement by the economy and inflation. However, some pressure could eventually be felt on the cost of financing the debt. Moreover, emerging countries, particularly China, may not want to keep providing substantial financing to the U.S. government. There is also the fact that the Fed is now striving to (slowly and gradually) offload the federal bonds acquired following the financial crisis.

Note, too, that servicing the federal debt will be increasingly expensive for the government. The larger debt and higher rates mean that debt service will rise from US$263B in 2017 to US$915B in 2028, according to the CBO's forecasts. As a % of GDP, the increase goes from 1.4% to 3.1% (Chart 3).

CBO: Congressional Budget Office Sources: CBO and Desjardins, Economic Studies

CBO: Congressional Budget Office Sources: CBO and Desjardins, Economic StudiesWith its latest decisions on tax cuts and higher spending, the U.S. federal government has put itself in a situation of procyclical deterioration in public finances. The advantage is that it increases economic activity in the short term, as can be seen in the widespread increase in growth forecasts for 2018 and 2019. What remains to be seen is whether the gamble is justified, or whether the erosion of public finances will come back to haunt the economy later. At this stage in the economic cycle, the aim should be to capitalize on economic growth to decrease budgetary shortfalls to help deal with eventual cyclical shocks.