The U.S. Economic Cycle Is Aging. Should We Be Worried?

It has been eight years since the U.S. pulled itself out of the last recession. Considering that economic cycles usually last between 6 and 10 years, should we be concerned about a new recession?

Toward a Record Cycle in the United States

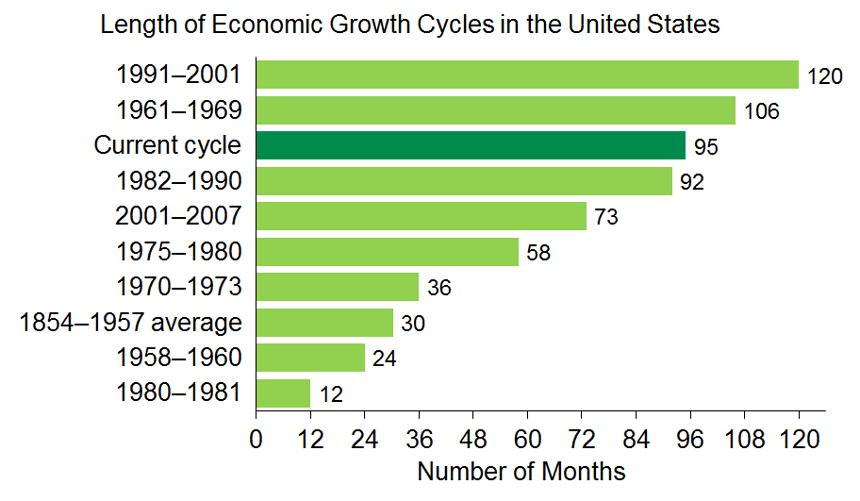

In terms of duration, the current growth cycle in the United States ranks third compared with previous cycles.

Sources: National Bureau of Economic Research and Desjardins, Economic Studies

Sources: National Bureau of Economic Research and Desjardins, Economic StudiesIf it extends for another year, it will move up to second place, held right now by the 1961-1969 period of growth. In two years, this growth period could become the longest on record in the United States, exceeding the top spot of 120 months recorded between 1991 and 2001.

A Shorter Cycle in Other Advanced Countries

Most of the other advanced countries have already reached the end of their cycle since the 2008–2009 recession. In the euro zone, financial difficulties in several governments and concerns over the banking system triggered a recession that started in 2011 and stretched until early 2013. In Japan, the sales tax increase in 2014 caused its real GDP to contract for two quarters. Here in Canada, plunging oil prices triggered two consecutive quarterly contractions in real GDP in the first half of 2015.

The Importance of the U.S. Cycle for the Global Cycle

Even if several advanced economies are recording shorter growth cycles, this does not necessarily protect them from a new shock, especially if the U.S. economy stumbles.

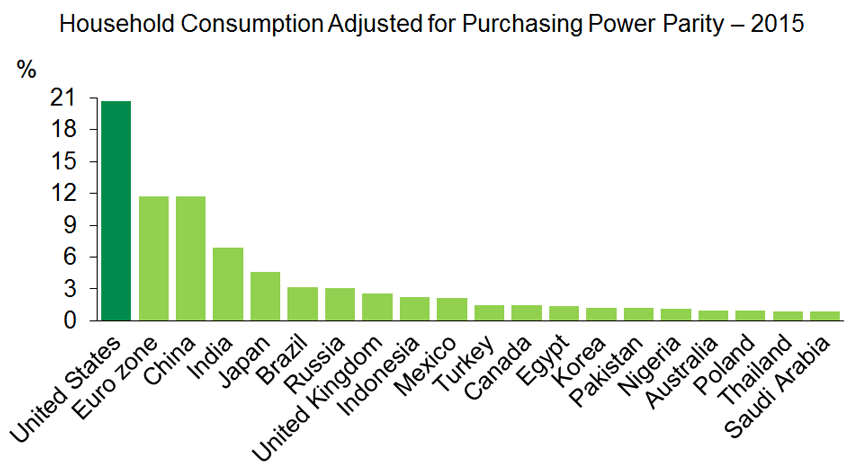

The United States represents about 16% of the world’s GDP, but slightly more than 20% of global consumption, way ahead of the euro zone and China.

Sources: World Bank and Desjardins, Economic Studies

Sources: World Bank and Desjardins, Economic StudiesIf U.S. consumption falls, the potential impact on the rest of the global economy will clearly be greater than if any other country suffers the same fate.

Time Is Not the Only Factor at Play

Given the broad differences in the lengths of economic cycles, it is difficult to accurately estimate the probability of a new recession based solely on time. Potential imbalances, like overinvestment and excess debt, must also be analysed.

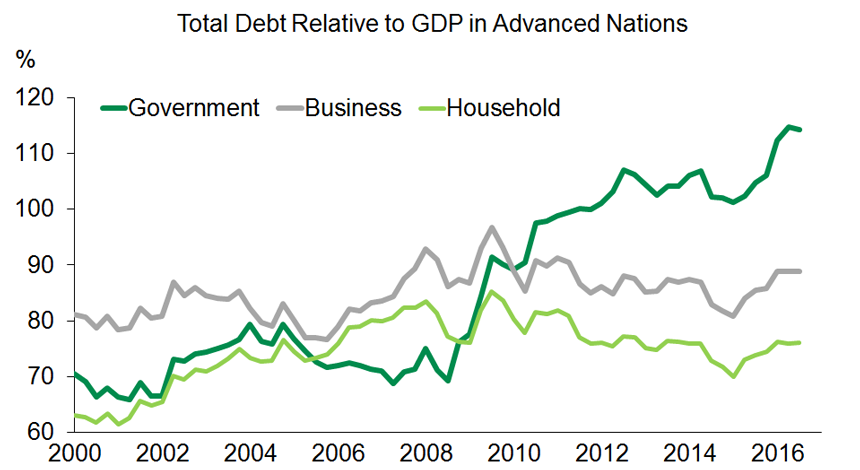

In the U.S. as in other countries, residential investments and mortgage loan debt had risen sharply prior to the recession of 2008–2009. The situation today in U.S. households is much healthier and the real estate euphoria of 10 years ago has not been revived. On the other hand, public debt has soared – a fairly widespread problem in advanced countries.

Sources: Bank for International Settlements and Desjardins, Economic Studies

Sources: Bank for International Settlements and Desjardins, Economic StudiesAll told, global debt is higher today than in 2008.

Watch Out for Rising Interest Rates

Low interest rates have certainly facilitated the rise in debt loads around the world. A return to rising interest rates, even slight, could weigh heavily on borrowers, including governments. Higher borrowing costs could force them to cut spending or raise taxes. Global demand would be penalized either way.

Investors could also be impacted. Rising bond yields would erode bond values. The race to achieve returns in recent years may have skewed the assessment of some risk premiums. Rising interest rates could trigger sharper movements in riskier bonds and companies that resorted to bond financing could have trouble refinancing.

Donald Trump’s Promises Are Fuelling Recession Risks

Donald Trump has promised to kick-start the U.S. economy by cutting taxes and increasing infrastructure spending. The problem is the positive impact is likely to be fleeting, which could in the end undercut household, business and investor confidence. What’s more, there is a real danger with jump-starting the U.S. economy in an already tight job market. Wages and inflation could shoot up, forcing the Federal Reserve (Fed) to ramp up its key rate increases. Not to mention the fact that Donald Trump’s promises would see the already high public debt climb even higher.

President Trump also has protectionist targets in his sights. Multiple customs tariffs in the United States would hurt trade flows and economic growth. The impact would be amplified if other countries decided to retaliate. Despite weaker growth, inflation could remain high in response to rising import prices and the difficulties of finding affordable substitutes locally. Interest rates would also go higher.

What about unexpected surprises?

Recessions can be caused by a multitude of surprise shocks. A major armed conflict could break out and affect global trade and confidence. Random acts of nature, like floods, a tsunami or a fierce storm, also have the potential to derail production. Sometimes, governments are behind the surprise, for example by making sudden changes to budget or tax policies or by voting in legislation that can undermine an economic pillar. For large corporations, scandals and financial difficulties can increase market volatility and punish economic growth in the end. Other potential threats include sudden shifts in natural resource prices.

The Cycle Is Likely to End by 2020

In closing, the duration of economic cycles varies considerably and forecasting their end is tough to do. They are not eternal, however, and many threats remain.

The end of the cycle in the United States appears likely in the next two or three years. Other countries will probably experience the same fate. By 2020, the public debt burden will be a growing problem due to expected interest rate hikes. The U.S. economy could also suffer a pullback when the impact of Trump’s stimulus measures fades. What’s more, we cannot sidestep the threat of U.S. protectionism, not to mention any unpredictable shocks that could be thrown into the mix.

On a more positive note, it would be surprising if a future economic cycle ended the same way it did in 2008–2009. The situation in U.S. households and in other countries is much stronger today than it was then; the same applies to the financial system. In this environment, it would probably be easier for a growth cycle to get off the ground. The Fed and other central banks could re-introduce expansionist monetary policies and postpone normalization of their key interest rates to a later date. However, it would be difficult to expect governments to increase debt as a result of higher spending or lower taxes.