Will Inflation Eventually Pick Up in Canada?

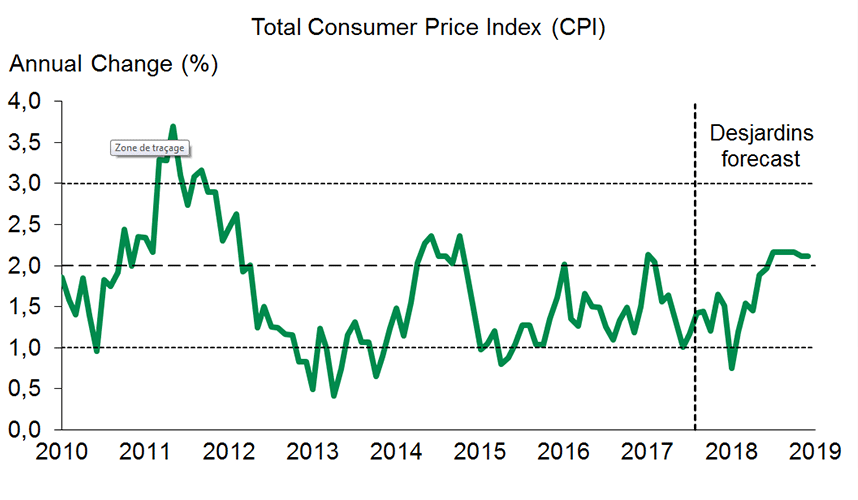

With the exception of a brief period of a few months, Canada's total annual inflation rate since spring 2012 has remained below the target median of 2% set by the central bank. At first glance, this persistently weak price growth is surprising, since the Bank of Canada (BoC) has maintained a highly expansionary monetary policy with exceptionally low interest rates since the Great Recession of 2008-2009. Therefore, there are clearly significant factors at work favouring modest price growth.

Temporary Factors Support Low Inflation

According to Statistics Canada, the annual change in the total consumer price index (CPI) was just 1.2% in July. The components that contributed most to the current low inflation rate were electricity and clothing.

Electricity prices dropped due to a change in policy in Ontario that led to reduced electricity rates in January, May and July 2017. With regard to clothing, weak price growth is nothing new. Stiff competition led retailers to resort to major markdowns. Merchants also appear to be diversifying the geographic location of their supply sources, which is helping keep costs down.

However, the effects of these factors are temporary. Their negative impact on total inflation is therefore expected to diminish in the next few months, and maybe even reverse itself. That said, temporary factors are not solely responsible for the current low total inflation rate. Structural considerations are also at play.

Certain Structural Factors Also Impact Inflation

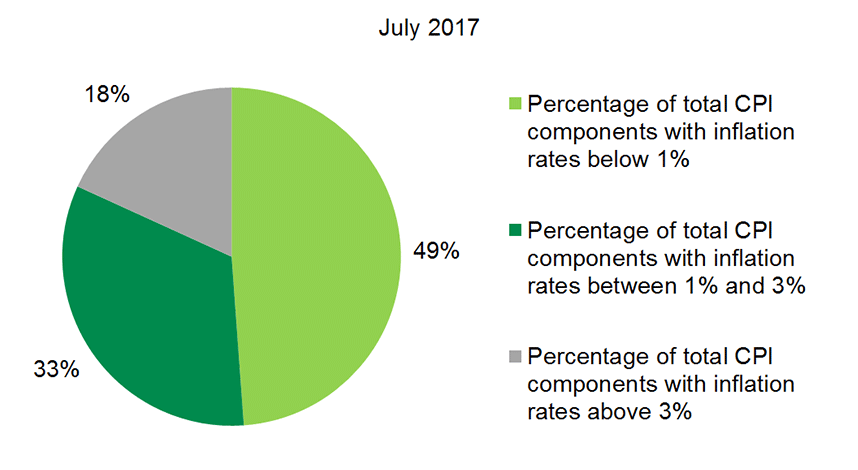

Beyond temporary factors, it should be noted that weak inflation growth is fairly widespread. In July 2017, nearly 49% of the CPI basket's components posted annual price growth below the BoC's lower target of 1% (Chart 1). In contrast, only 18% of the components posted an annual change in prices above the upper target (3%). Therefore, just 33% of components were within the target range.

Such widespread weak price growth is due in large part to excess capacity that has persisted in the Canadian economy since the Great Recession of 2008-2009. Excess capacity is measured by the output gap, which has remained in negative territory on average since late 2008.

Canada Is Not Alone

The structural problem of weak price growth is not unique to Canada. Most industrialized countries have also posted very low inflation rates, suggesting that shared factors are affecting price increases. Moreover, the Great Recession had major worldwide repercussions, leaving most industrialized countries with excess production capacity. Other theories have also been suggested to explain widespread weak price growth. The BoC recently mentioned the effects of lower inflationary expectations as households and businesses have adapted to the extended period of low price growth. Booming e-commerce worldwide, which has sharpened competition, has also been pointed to as has the impact of certain technological advances, which could improve productivity in ways that are difficult to measure. In all likelihood, these downward pressures could continue to impact price growth in most industrialized countries for some time to come. However, their true impact is difficult to assess.

Will We See Inflation Pick Up?

In light of these observations, there is reason to doubt whether inflation will eventually accelerate in Canada. It is clear that certain deflationary factors will persist in the coming months. In particular, factors affecting global inflation could very well continue to be felt for several more years. However, the gradual dissipation of excess capacity in Canada could help turn the situation around in the next few quarters while these deflationary pressures will become less and less significant.

Our economic projections also indicate that real GDP growth should continue to exceed its potential in the next few quarters. Not only could this cause excess production capacity to completely disappear, but it could even lead to some shortages. Such a situation could eventually put upside pressure on prices in Canada. In these conditions, it is reasonable to believe that in the next few quarters the annual inflation rate could accelerate (Chart 2), closing in on the BoC's target median of 2%.

* Excluding the effect of changes in indirect taxes

Sources: Statistics Canada and Desjardins, Economic Studies Sources: Statistics Canada and Desjardins, Economic Studies

Sources: Statistics Canada and Desjardins, Economic Studies