10-Year Yield Slightly Above 3% No Disaster for U.S. Stock Markets

Concerns about accelerating inflation and rising bond yields triggered a more than 10% correction on several major stock markets in early February. Things have calmed down a bit since then but several investors are still concerned by the negative impact that rising bond yields could have on the stock markets. In an environment where interest rates are expected to gradually increase, should investors get ready to deal with an imminent bear market in the United States?

The extremely low interest rates in developed countries have undoubtedly contributed to the stellar performance on stock markets in recent years. One reason is that equities and bonds represent the two biggest asset classes available to investors. Several other financial assets are available; including cash, commodities and private placements, but the biggest question most investors wrestle with is: Is this a good time to overweight equities vs. bonds?

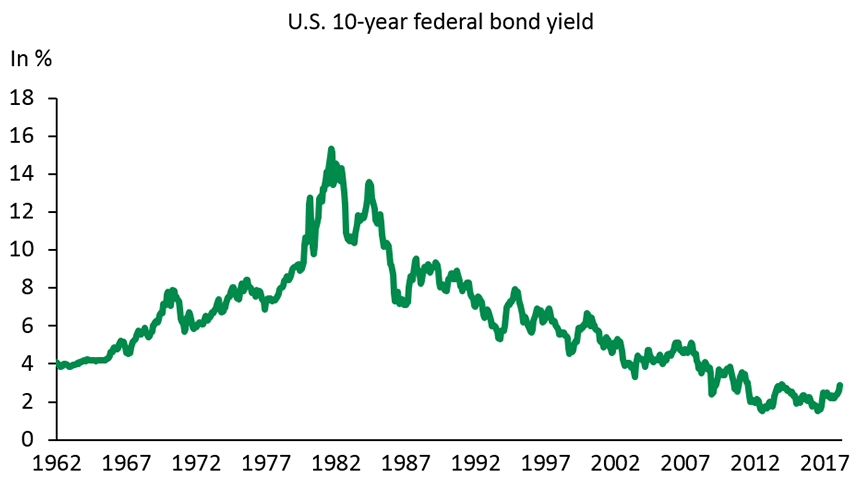

The bond and equity markets can thus be viewed as competitors, with both trying to attract investors. All things being equal, if the return outlook for bonds is getting significantly better, investors could very well sell some of their equities to buy more bonds. It is thus normal for a new and clearer uptrend in bond yields to raise concerns. At minimum, this new trend suggests that we can no longer look to the bond market to justify an unimpeded rise in price/earnings ratios. However, we doubt that the recent increase in yields will be enough to make most investors turn their backs on U.S. stock markets. A 3% yield on 10-year bonds is still extremely low, offering only a modest return to investors.

It's also possible that investors might think that the best time to overweight bonds is not when bond yields start rising. If rates continue to normalize, the bond market could deliver a negative performance in the next few quarters.

From a more fundamental perspective, the value of a share is equal to the discounted value of future cash flows to which the shareholder is entitled, i.e. dividends or capital gains. By the same token, the fundamental value of a stock index like the S&P 500 is equal to the discounted value of future earnings per share. The discount rate used in this calculation is a deciding factor. For an investor, this should represent the required return from a stock market investment, which is usually equal to a risk-free rate to which a risk premium is added. All things being equal, an interest rate increase thus reduces the value of equities by reducing the current value of future earnings.

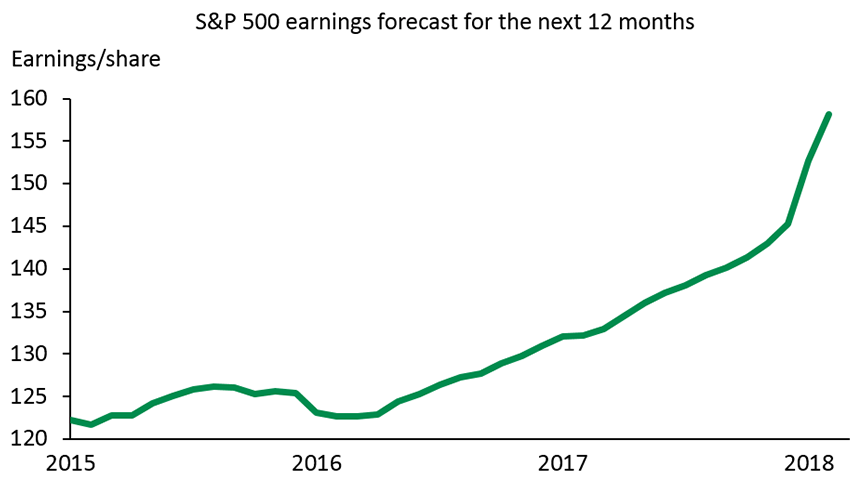

In real life, things rarely end up being equal. The recent uptrend in interest rates stems from several factors, including a marked improvement in the economic growth outlook, which the wide-ranging tax reform in Washington has magnified. In this context, analysts recently significantly upgraded their earnings growth outlook for companies making up the S&P 500 index. Faster earnings growth could very well offset the negative impact of a higher discount rate on the U.S. stock market's fundamental value.

Too Early to Sour on the U.S. Stock Market

We cannot deny that higher interest rates could put a dent in the stock market's appeal from both a relative and fundamental standpoint. That said, it would be a mistake to think that U.S. 10-year bond yields over 3% would lead to a long period of decline in the stock market. In our view, interest rate normalization would have to be much sharper to steer investors away from the U.S. stock market.

The bull market in the United States is more likely to end once the corporate earnings outlook starts to deteriorate. A spike in inflationary pressures and interest rates could contribute to such deterioration by increasing corporate costs or by curbing economic activity but right now the outlook remains very favourable. The stock markets would be in for a particularly rough ride if the United States was to slide into a recession. Investors thus need to be on the lookout for signs of a potential deterioration in economic conditions. But the U.S. stock market could keep climbing for some time before that happens.

Sources: Datastream and Desjardins Economic Studies.

Sources: Datastream and Desjardins Economic Studies. Sources: I/B/E/S, Datastream and Desjardins, Economic Studies.

Sources: I/B/E/S, Datastream and Desjardins, Economic Studies.