Are negative interest rates to be feared?

In order to stimulate economic growth, drive up inflation and weaken their exchange rates, some central banks have opted to push the limits of their key interest rates by venturing into negative territory. These decisions have pushed many other interest rates below the zero threshold, which may seem difficult to grasp. They also raise questions about the consequences that could ensue on savers and on the stability of the financial system.

Stronger impact on bond yields than on retail rates

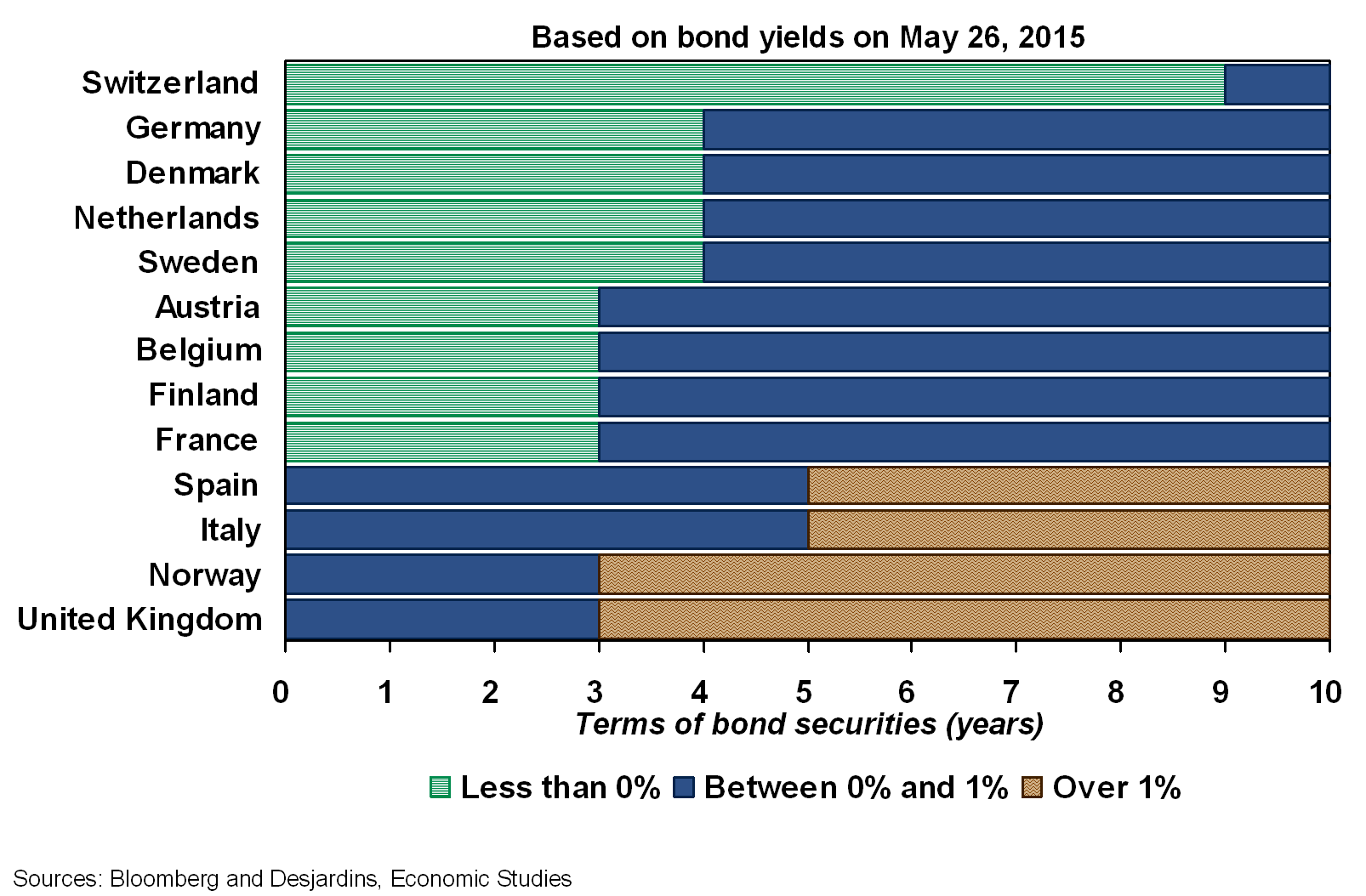

Negative key rates push financial institutions to find an alternative for their central bank deposits. To avoid paying interest, they can increase their volume of loans or turn to other assets such as government bonds. This results in raising demand for these securities to the extent that their yields occasionally become negative. The effect is especially clear in Switzerland where there is the greatest number of bond maturities with a negative yield (chart 1).

This situation has also allowed some large international corporations to issue negative yield bonds on the European market. Individuals who benefit from negative rates on their borrowings are very rare, however.

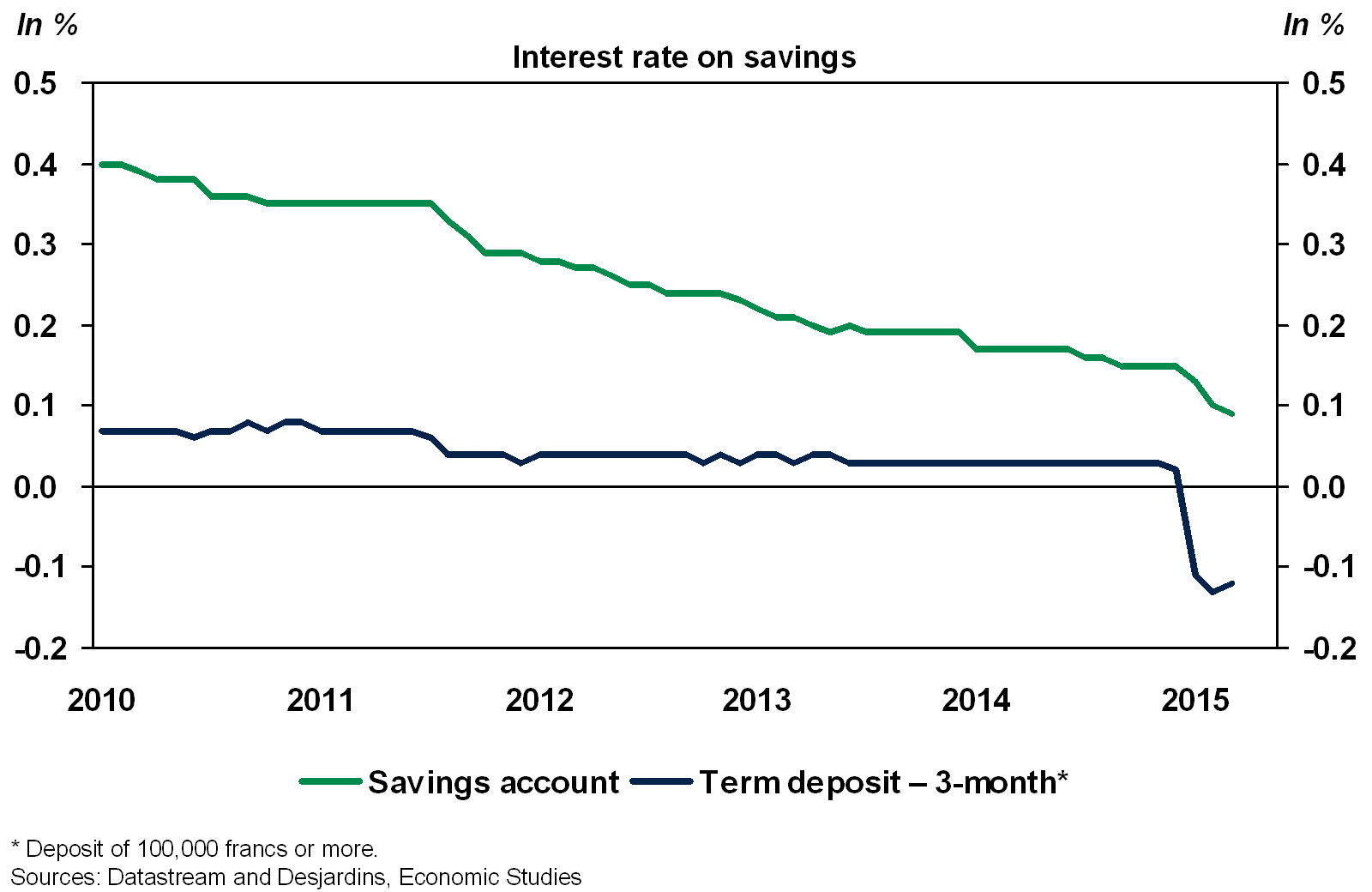

On the other hand, individuals paying interest on their savings are a little more common. Official data on the deposit rate in Switzerland clearly illustrates this new reality (chart 2). That being said, the interest rates demanded by financial institutions are not as steep as the rate paid to the central bank. The penalty mainly affects large deposits.

Why should we accept negative rates?

It may seem like an aberration to pay interest on a bond or deposit. Bonds with negative yields may turn out to be a lesser evil, especially for financial institutions, which face the alternative of making a more penalizing deposit at the central bank. We must also consider their return in real terms. If investors are worried about deflation, the returns on their investments may stay positive in real terms despite nominal negative returns. More specific to the European market, a German bond with a negative yield will remain attractive if there is fear of renewed financial tensions or of the euro zone collapsing.

Holding onto cash can still seem more advantageous in many cases. For example, even with deflation, holding cash at 0% interest would provide a real return higher than an investment with a nominal negative interest rate. But this reasoning does not take into account the cost and inconvenience of holding cash, especially in large quantities. Paper money can quickly become cumbersome and transactions can take longer. Security issues must also be considered, which can involve purchasing or renting a safe and a new insurance policy. Lastly, cash is subject to deterioration and is vulnerable to bad weather and to accidents, not to mention the danger of falling victim to counterfeiting.

Is there a limit to negative interest rates?

Technically, the limit to negative rates would be the threshold beyond which there is no difference between holding an investment with a negative return and holding cash with the entailing inconvenience and cost. This limit could vary significantly from person to person. Generally, however, the limit to interest rates is rather the threshold where the costs for the economy and financial markets become too large.

The worst-case scenario is clearly a massive conversion of deposits into cash. This would translate into central banks losing the power to influence economic activity through credit. With savings fueling the financial system, it would be difficult for a company to invest and for a household to buy a home. Lastly, the collapse of the financial system would very likely push the economy into a depression.

Before arriving at such an extreme scenario, other potentially high costs may pile up. These costs often emerge even before interest rates fall into negative territory. For example, pension funds and life insurance companies have already been hard hit by weak bond yields.

One solution to low returns is taking more risk. It is still a perilous solution for the future, because if more savers acquire risky securities, more people will be penalized if the risks materialize one day.

Creating bubbles is another potential problem. For example, weak retail interest rates encourage credit and increase the risk of a real estate bubble. The situation is even more problematic when household debt levels are high, as this makes them more sensitive to an eventual price correction or a future rebound in interest rates.

Lastly, the time and capital that are wasted in analyzing the new situation and making changes to adapt to it should also be considered. Building safes to avoid deposits with negative interest rates would be a good example of wasting resources. In fact, many behaviours and ways of doing things could change, which would not be without a cost.

In conclusion, we shouldn’t stretch the elastic too far!

Up to a certain point, negative interest rates could make sense and be used to stimulate the economy. But it would be wrong to believe they can be reduced sharply without individuals, business and investors reacting, which could generate major costs for the financial system and the economy.

Rates do not necessarily need to be negative for harmful effects on the economy and financial system to become significant. The environment of weak interest rates in several areas of the world is already raising concerns for savings, pension funds and life insurance. It is also heightening the risk of bubbles, which could lay the groundwork for the next crisis. Central banks are clearly walking a tightrope.