The Oil Market Will Continue Rebalancing Even Though Doha Failed

Oil prices have been very volatile in recent months, as have a number of other financial variables. WTI (West Texas Intermediate) prices tumbled to $26/barrel in mid-February, a 12-year low, and then rebounded to around US$40. This upswing contributed to the major gains posted by the Canadian stock market and Loonie.

Some observers chalked up much of the rebound in the price of oil to the lengthy negotiations between Russia and certain OPEC (Organization of Petroleum Exporting Countries) nations to curb production and thus help the global oil market rebalance. The negotiations were to conclude in an agreement at the April 17 meeting in Doha, Qatar. However, the eagerly awaited meeting ended in a resounding failure. With Iran absent, Saudi Arabia finally refused to commit to freezing its oil production.

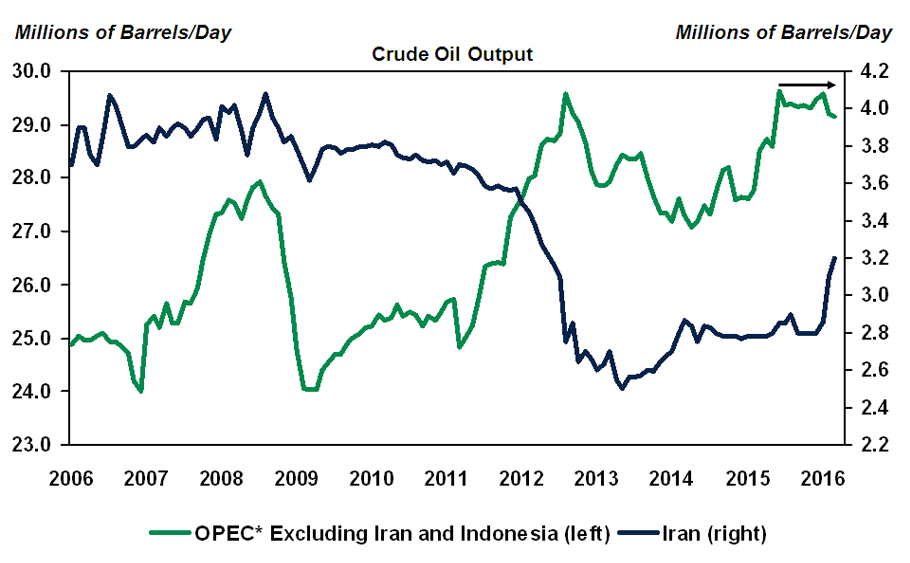

Contrary to what many feared, however, oil’s negative reaction to the news of this failure was short-lived, and WTI prices even climbed to US$44 a barrel a few days later. In fact, an agreement among the countries at Doha would have changed nothing for the world petroleum market. Neither Russia nor most OPEC nations seem to be in a position to boost their output over the coming quarters as production by OPEC nations excluding Iran has been topping out for several months now. Saudi Arabia is an exception, as it could theoretically increase its output by more than 1 mbd (million barrels per day), but nothing suggests it will decide to flood the market in the near term as things are finally starting to shift to its advantage. The news of an Iranian production freeze would have been very good for oil prices, but that was never a realistic scenario. After agreeing to limit their nuclear program last year, Iranian leaders are now determined to get the country’s oil output back up to at least where it was before international trade sanctions were levied. Iranian oil output has thus gone up by about 0.4 mbd since the start of 2016, and can be expected to show another, similar rise by year’s end.

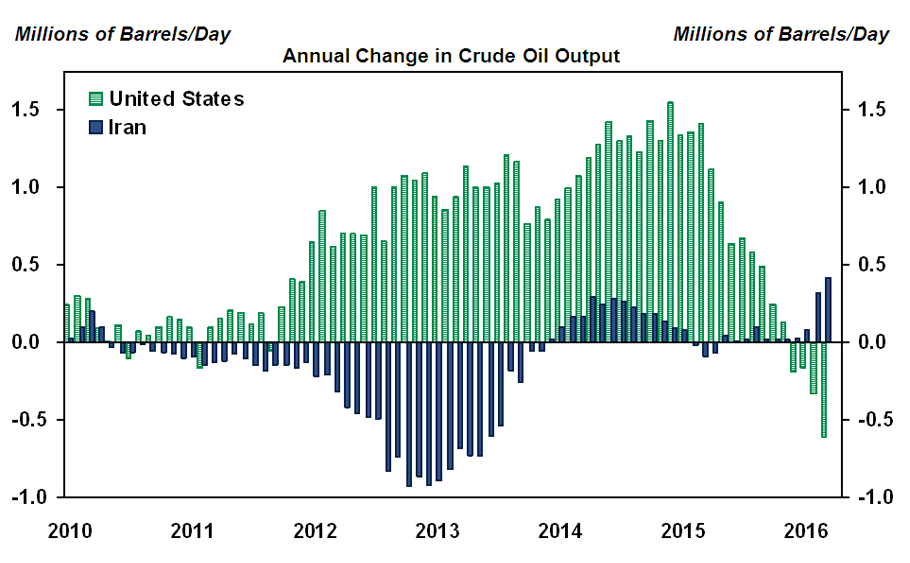

Another major oil producer – the United States – was not at Doha. In our opinion, what is now happening is much more important for crude prices. The drop in drilling and energy sector investment has not only halted the spectacular surge in U.S. production, it is now triggering a large pullback. The Energy Information Administration estimates that crude production fell to 9 mbd in March, down more than 0.6 mbd from March 2015. Everything suggests the downtrend will persist until prices have increased substantially. Output from other countries is also being reined in by low oil prices, though to a lesser extreme. The International Energy Agency thus expects that non-OPEC production will drop 1.1 mbd from the fourth quarter of 2015 to the fourth quarter of 2016. This, combined with growth of about 1.3 mbd in oil demand, should almost wipe out the surplus in the global oil market, despite the expected increase in Iran’s production.

Doha’s failure therefore doesn’t change the fact that the market is rebalancing, primarily thanks to the retreating U.S. production. Oil’s recent gains were also helped by the U.S. dollar’s weakness, however, a trend that should reverse when the Federal Reserve starts raising its key rates again. Oil prices are therefore likely to consolidate or even tick down in the near term, particularly since global oil inventories remain very high. This suggests that the Canadian dollar will edge back after the spectacular gains it has made in recent months. However, the medium-term outlook for oil is promising. WTI should end 2016 at around US$50 a barrel, as the global market is rebalanced, and continue to rise next year.

* Organization of the Petroleum Exporting Countries

Sources: Bloomberg and Desjardins, Economic Studies

Sources: Bloomberg, Energy Information Administration and Desjardins, Economic Studies